In partnership with

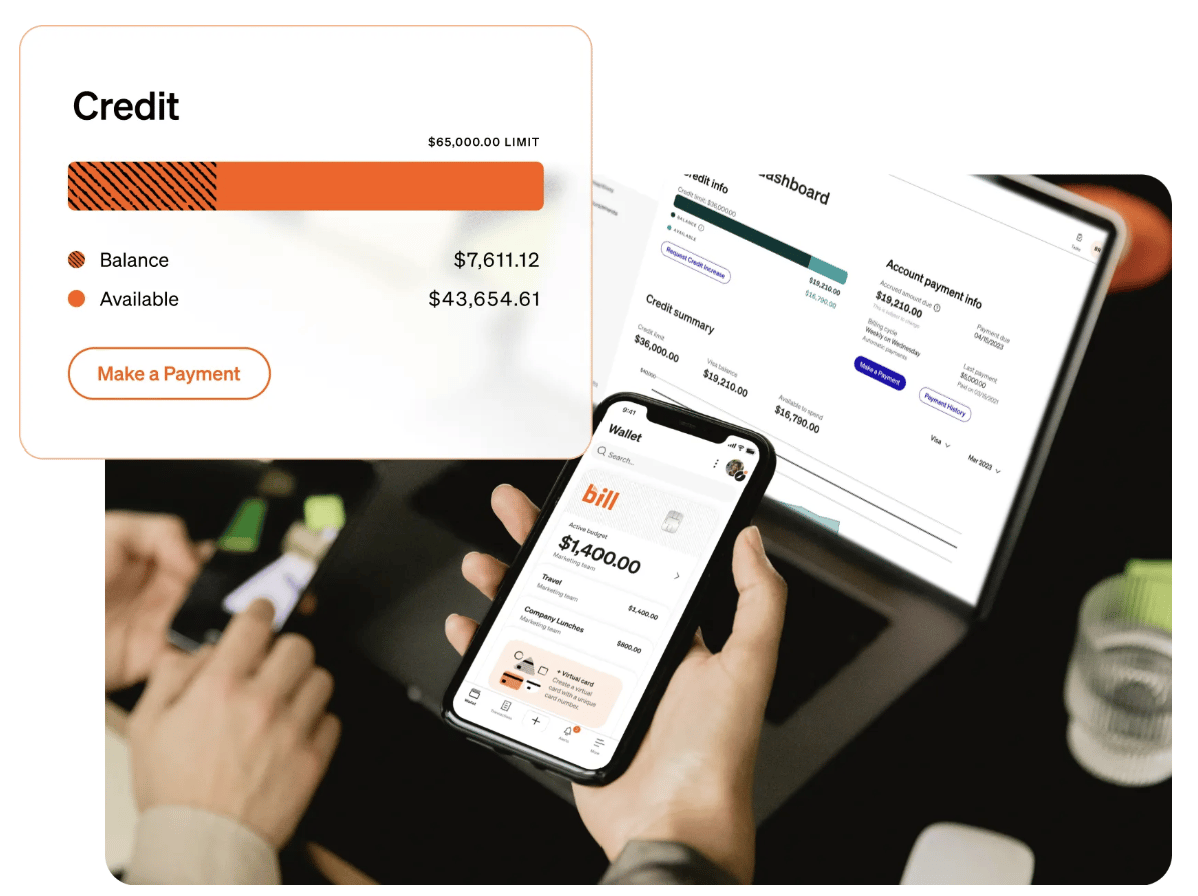

Smarter AP automation, from startup to scale

Bill.com is the accounts payable automation platform with everything you need to eliminate manual processes and scale your finance operations. Set up in minutes and enjoy streamlined workflows, real-time visibility, and enterprise-grade controls – all with reduced processing time, fewer errors, and better cash flow management.

Two powerful automation solutions, one integrated platform.

Financial automation services provided by Bill.com, LLC. Member AICPA SOC certified. Bill.com integrates with leading accounting platforms including QuickBooks, Xero, NetSuite, and Sage. All processing services provided through secure, encrypted connections. Bill.com is trusted by over 100,000 businesses to automate their financial operations and improve cash flow visibility.

WELCOME TO ISSUE NO #062

Consulting | Shop | Website | Newsletter | Speaking

📆 Today’s Rundown

Hey {{first_name}} 👋, hope you had a great week! In the last issue, we discussed why tracking Employee Turnover Metrics matter, and now we are moving with the next topic from Headcount content.

Let’s talk about ⬇️

Workforce Planning and Management Metrics

Most SaaS founders think you need fancy dashboards or an entire HR analytics team to manage workforce planning.

But after working with dozens of tech companies as a fractional CFO, I can tell you that’s not true.

In reality, you only need to track a few high-leverage metrics that blend finance and HR. These reveal if your team is growing efficiently — or if you’re scaling chaos.

Here are 5 workforce metrics every SaaS should track (and why they matter):

TL;DR

1️⃣ Turnover Rate

2️⃣ Ramp Rate

3️⃣ Total Headcount

4️⃣ Employee Retention Rate

5️⃣ Average Revenue per Employee (RPE)

1️⃣ Turnover Rate

Turnover = the % of employees leaving your company in a given time.

Why it matters:

High turnover kills momentum and raises costs (recruiting + onboarding).

Low turnover without fresh talent = stagnation.

Pro tip: Break it down into voluntary (they quit) and involuntary (you let them go). Voluntary turnover often signals cultural or management issues, while involuntary highlights performance misalignment.

👉 If you spot rising voluntary turnover, talk to HR early. It’s often cheaper to fix culture gaps than to rehire every 6 months.

2️⃣ Ramp Rate

Ramp rate = how long it takes a new hire to reach full productivity.

Why it matters:

In SaaS sales, misjudging ramp time destroys revenue forecasts.

If your ramp is 6 months but your model assumes 3, you’ll miss ARR targets by a mile.

Pro tip: Track ramp by role, not company-wide. Engineers, SDRs, and CSMs have very different timelines. Then reverse-engineer hiring: if you need $1M more ARR in Q4, when should you hire new reps?

3️⃣ Total Headcount

Seems basic, but it’s the foundation of workforce planning.

Why it matters:

Too few hires = bottlenecks, burnout, and missed product deadlines.

Too many = inflated burn rate and inefficient teams.

Pro tip: Don’t just track the number. Track distribution by department (engineering vs. sales vs. G&A). This shows where you’re overinvested or under-resourced.

4️⃣ Employee Retention Rate

Retention = how well you keep talent over time.

Why it matters:

Retention is cheaper than constant recruiting.

High retention usually means stronger culture, deeper product knowledge, and happier customers.

Pro tip: Layer retention with tenure distribution. If everyone leaves at year 2, you’ve likely hit a growth ceiling in career paths. Solve this with clear promotion tracks and internal mobility.

5️⃣ Average Revenue per Employee (RPE)

RPE = total revenue ÷ total full-time employees.

Why it matters:

It blends the human side with the financial side.

If RPE is falling while ARR is growing, you’re scaling inefficiency, not productivity.

Pro tip: Benchmark against your stage. A Series A SaaS may see ~$100K per employee, while post-Series C should be $200K–300K+. If you’re below peers, it’s a signal to revisit hiring pace and role ROI.

Need clarity on your financial strategy or cash flow optimization?

I'm Aleksandar, fractional CFO at Fiscallion, where we help founders like you achieve financial clarity, streamline reporting, and build investor-ready forecasts.

Ready to level up your finances?

👉 Bottom line: You don’t need 50 KPIs to manage your workforce.

But if you’re not tracking these 5, you’re scaling blind.

The good news? These are just the tip of the iceberg.

Talk soon

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Aleksandar Stojanovic

Chief Finance Ninja | Fiscallion

Fractional CFO & FP&A Boutique Consultancy

P.S. Whenever you’re ready, here’s how I can help:

Free Consultation: Book your strategy call.

Keynote Speaking: Schedule me for your event.

Sponsor my Newsletter: Reach 5,000+ subscribers.