WELCOME TO ISSUE NO #072

Consulting | Shop | Website | Newsletter | Speaking

📆 Today’s Rundown

Hey {{first_name}} 👋, hope you had a great week! In the last issue, we discussed why tracking ARR matters, and now we are moving with the next topic from Financial Metrics content.

Let’s talk about ⬇️

Burn Multiple

Most founders think burn multiple is just a finance metric.

Something investors care about.

Something you look at after things go wrong.

But after working with dozens of SaaS teams in tight markets, I can tell you this:

Burn multiple is one of the fastest ways to understand if your growth is actually healthy.

And today, I want to break it down in a way you can actually use.

Let’s dig in 👇

TL;DR

1️⃣ What burn multiple really tells you

2️⃣ Why investors care so much (right now)

3️⃣ What’s considered “good” (context matters)

4️⃣ The 3 fastest levers to improve it

5️⃣ Where finance becomes a growth weapon

1️⃣ What burn multiple really tells you

Burn multiple shows how much revenue you generate for every dollar you burn.

The formula is simple:

Burn Multiple = Net Burn / Net New ARR

That’s it.

Unlike LTV/CAC or sales efficiency, this metric captures everything:

Sales

Marketing

Product

G&A

Headcount decisions

It’s a full-business efficiency lens.

Need clarity on your financial strategy or cash flow optimization?

I'm Aleksandar, fractional CFO at Fiscallion, where we help founders like you achieve financial clarity, streamline reporting, and build investor-ready forecasts.

Ready to level up your finances?

2️⃣ Why investors care so much (right now)

In the “growth at all costs” era, burn barely mattered.

Today? Different story.

Investors want:

Efficient growth

Predictable scaling

Longer runways

A burn multiple close to 1.0 or lower signals control.

A rising multiple signals risk.

Same growth. Very different outcomes.

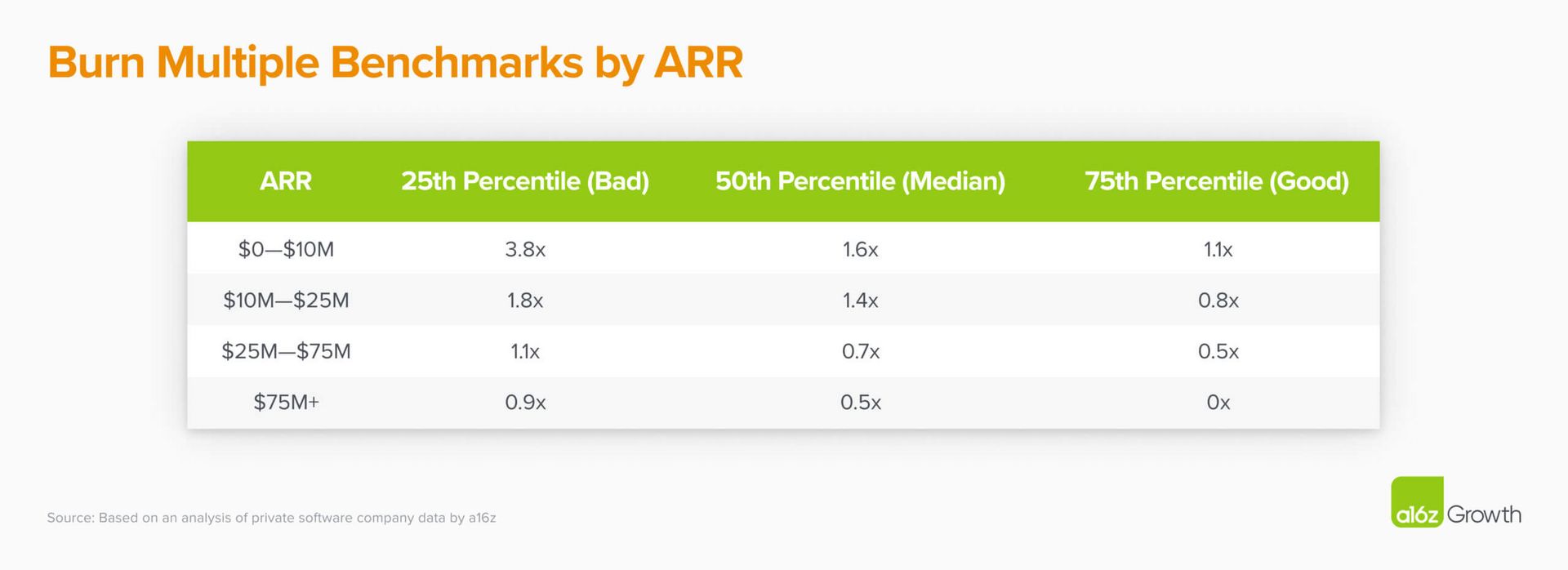

3️⃣ What’s considered “good” (context matters)

There’s no universal benchmark — stage matters.

Early-stage:

Higher burn multiples are normal while product + GTM are forming.

Series B+:

Efficiency should improve as revenue outpaces burn.

This is why benchmarks (like the a16z ARR-based ones) are so useful — they help you compare apples to apples.

4️⃣ The 3 fastest levers to improve it

If your burn multiple is too high, focus here first:

Lower CAC

Shorten sales cycles, improve rep ramp time, rebalance paid vs organic.Improve margins

Clean up COGS vs OPEX, cut unused software, fix cost misclassification.Protect ARR

Churn and downgrades quietly destroy efficiency faster than bad acquisition.

Small changes here compound fast.

5️⃣ Where finance becomes a growth weapon

This is where most teams miss the opportunity.

Burn multiple improves fastest when you:

Forecast more frequently (quarterly > annual)

Run scenario models with Sales & Marketing

Track CAC, ACV, and churn together — not in silos

Finance isn’t just reporting. It’s steering.

The bottom line

Burn multiple isn’t about spending less.

It’s about getting more from what you already spend.

And once you start managing it proactively, runway, confidence, and valuation tend to follow.

If you want, hit reply and tell me:

What’s your current burn multiple — and what’s holding it back?

Happy to take a look.

Chat soon,

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Alex Stojanovic

Chief Finance Ninja | Fiscallion

Fractional CFO & FP&A Boutique Consultancy

P.S. Whenever you’re ready, here’s how I can help:

Free Consultation: Book your strategy call.

Keynote Speaking: Schedule me for your event.

Sponsor my Newsletter: Reach 5,000+ subscribers.