The gold standard of business news

Morning Brew is transforming the way working professionals consume business news.

They skip the jargon and lengthy stories, and instead serve up the news impacting your life and career with a hint of wit and humor. This way, you’ll actually enjoy reading the news—and the information sticks.

Best part? Morning Brew’s newsletter is completely free. Sign up in just 10 seconds and if you realize that you prefer long, dense, and boring business news—you can always go back to it.

WELCOME TO ISSUE NO #039

Consulting | Shop | Website | Newsletter | Speaking

📆 Today’s Rundown

Hey {{first_name}} 👋, hope you had a great week! In the last issue, we discussed why tracking Net Negative Churn matters, and now we are moving with the next topic from Bookings & Customers content, and today’s topic is:

LTV/CAC Ratio

Are You Wasting Money on Customer Acquisition? Let’s Talk LTV/CAC.

Newsletter highlights

3 Brutal Truths About LTV/CAC 🤟

LTV/CAC Stat of the Week 🔢

My Tool of the Week 📊

Latest Content Update 🆓

3 Brutal Truths About LTV/CAC

It Exposes Profitability—or Lack of It.

The LTV/CAC ratio isn’t just a vanity metric.

It tells you if you’re actually making money or just setting it on fire.

A strong 3:1 ratio? You’re golden.

Below that? Time to fix your acquisition and retention game.

It Determines If You Can Afford to Scale.

You can’t just throw money at ads and hope for the best.

If your LTV/CAC ratio is weak, scaling will only burn through cash faster.

Get your ratio right before you crank up the growth machine.

Investors Care More About This Than Your Logo.

Venture capitalists don’t fund good ideas—they fund businesses that can efficiently acquire and retain customers.

A solid LTV/CAC ratio tells them your SaaS model is sustainable, and that’s what opens doors.

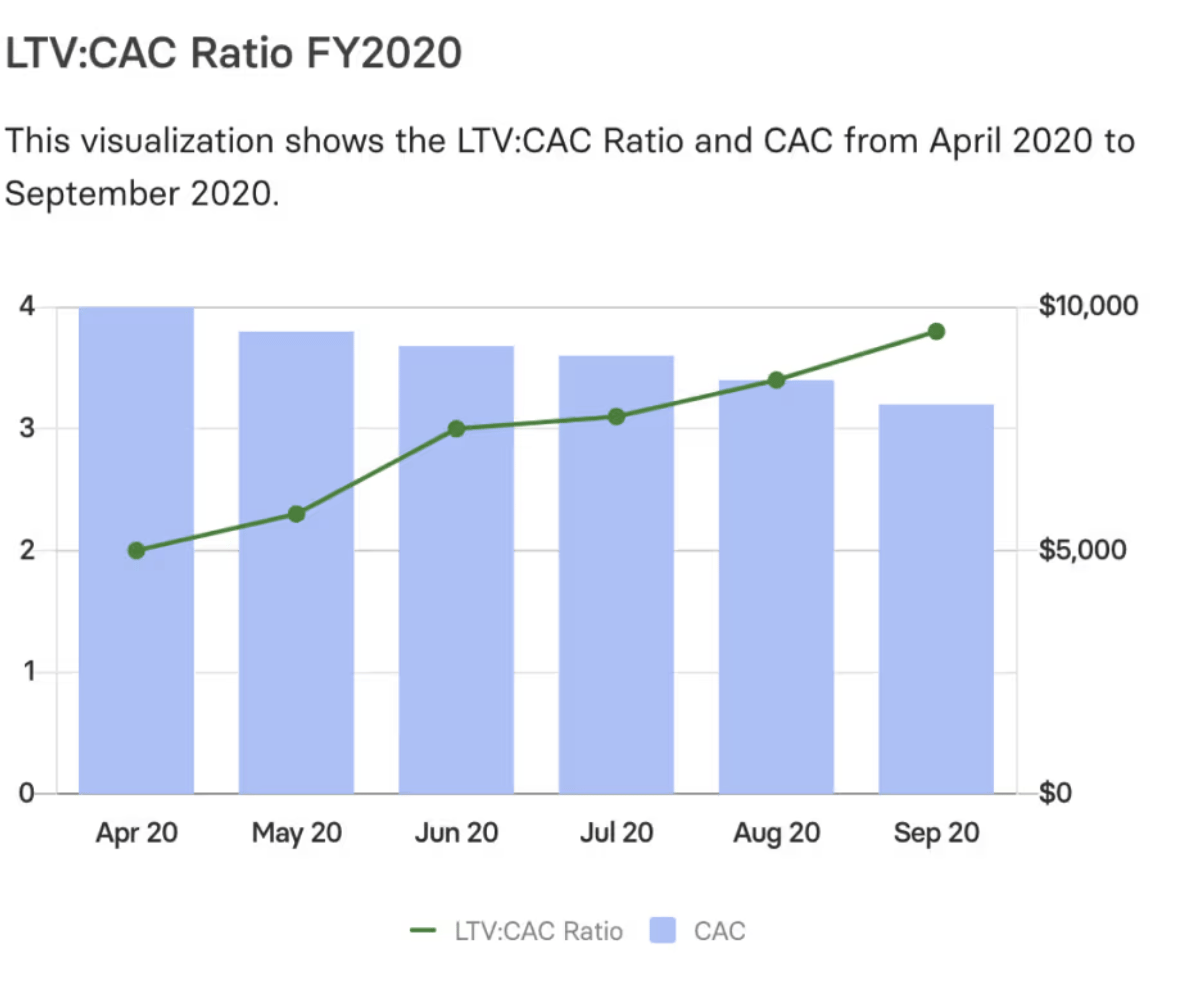

LTV/CAC Stat of the Week

3:1

That’s the SaaS gold standard for LTV/CAC. If you’re hitting it, you’ve got an efficient growth engine. If not, it’s time to tweak your acquisition costs or retention efforts.

My Tool of the Week

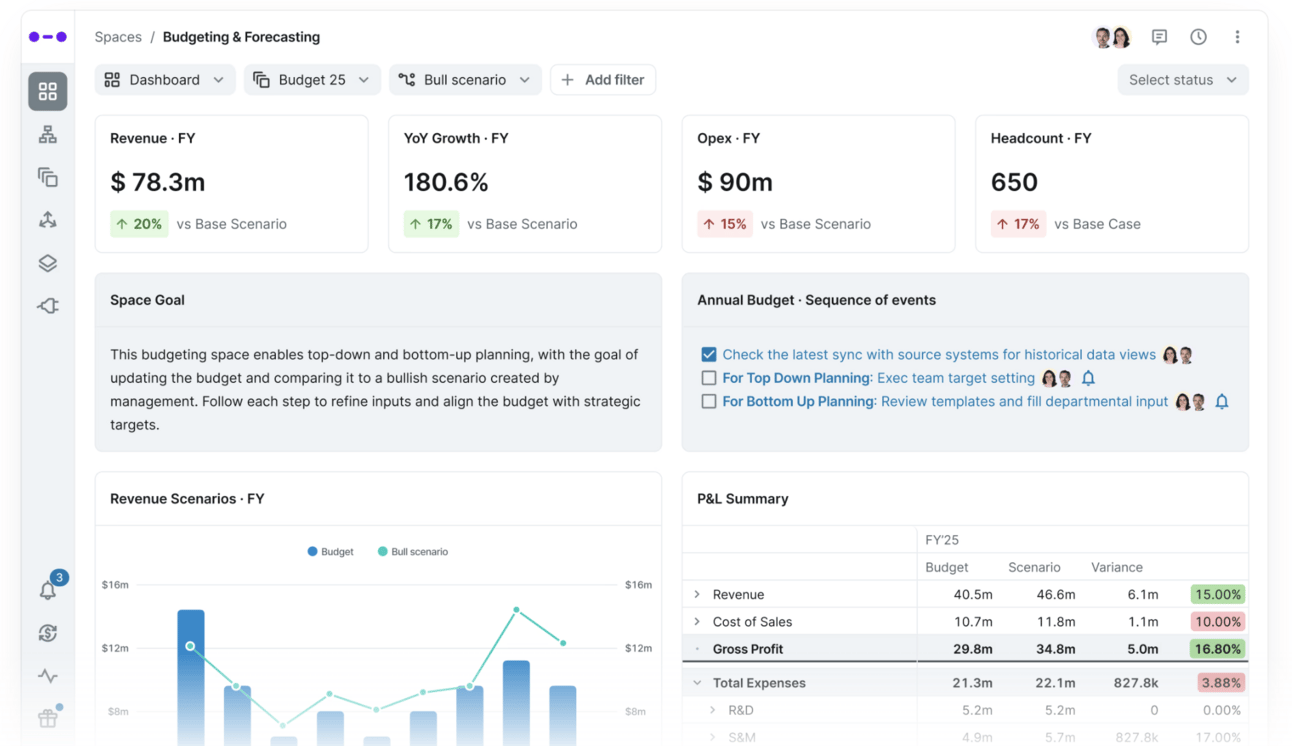

If you’re serious about tracking, optimizing, and forecasting your LTV/CAC ratio, Abacum is a must-have. Here’s why:

Automated FP&A Workflows – Integrate data from your CRM, billing, and financial tools to get real-time visibility into CAC, LTV, and unit economics.

Scenario Modeling – Run different acquisition and retention strategies to see how changes impact profitability before making big moves.

Collaborative Forecasting – Sync finance, marketing, and sales teams to align on acquisition costs, churn prevention, and expansion revenue strategies.

Investor-Grade Insights – Generate detailed financial reports that prove you’re not just growing—but growing efficiently.

What I love about Abacum? It bridges the gap between finance and GTM teams, ensuring every dollar spent on acquisition drives long-term customer value. No more flying blind—get the clarity you need to scale profitably.

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Aleksandar Stojanovic

Founder of Fiscallion

Fractional CFO & FP&A Boutique Consultancy

P.S. Whenever you’re ready, here’s how I can help:

Free Consultation: Book your strategy call.

Keynote Speaking: Schedule me for your event.

Sponsor my Newsletter: Reach 5,000+ subscribers.