How do you stay up-to-date with the insane pace of AI? Join The Rundown – the world’s fastest-growing AI newsletter with over 500,000+ readers learning how to become more productive using AI every morning.

1. Our team spends all day researching and talking with industry experts.

2. We send you updates on the latest AI news and how to apply it in 5 minutes a day.

3. You learn how to become 2x more productive by leveraging AI.

WELCOME TO ISSUE NO #02

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Happy Saturday! This week I’ve compiled some amazing resources that will definitely impress you.

Let’s break it down in this week’s issue.

⌚ CLV: Customer life time value

🧐 1, 2 or 3: Bootstrapping vs. Angel Investor vs. Fundraising

📊 Excel: XLOOKUP vs. VLOOKUP

The FP&A and BI Guide Easter sale is now on. As the Finance Startup subscriber you can save an additional 40% off the regular price. Details below.

I’ve partnered with Wall Street Prep and Wharton Online to bring you an incredible opportunity to save hundreds of dollars and build your FP&A career. Check out this a one-of-a-kind, theory-meets-practice, FP&A certificate program. Details below.

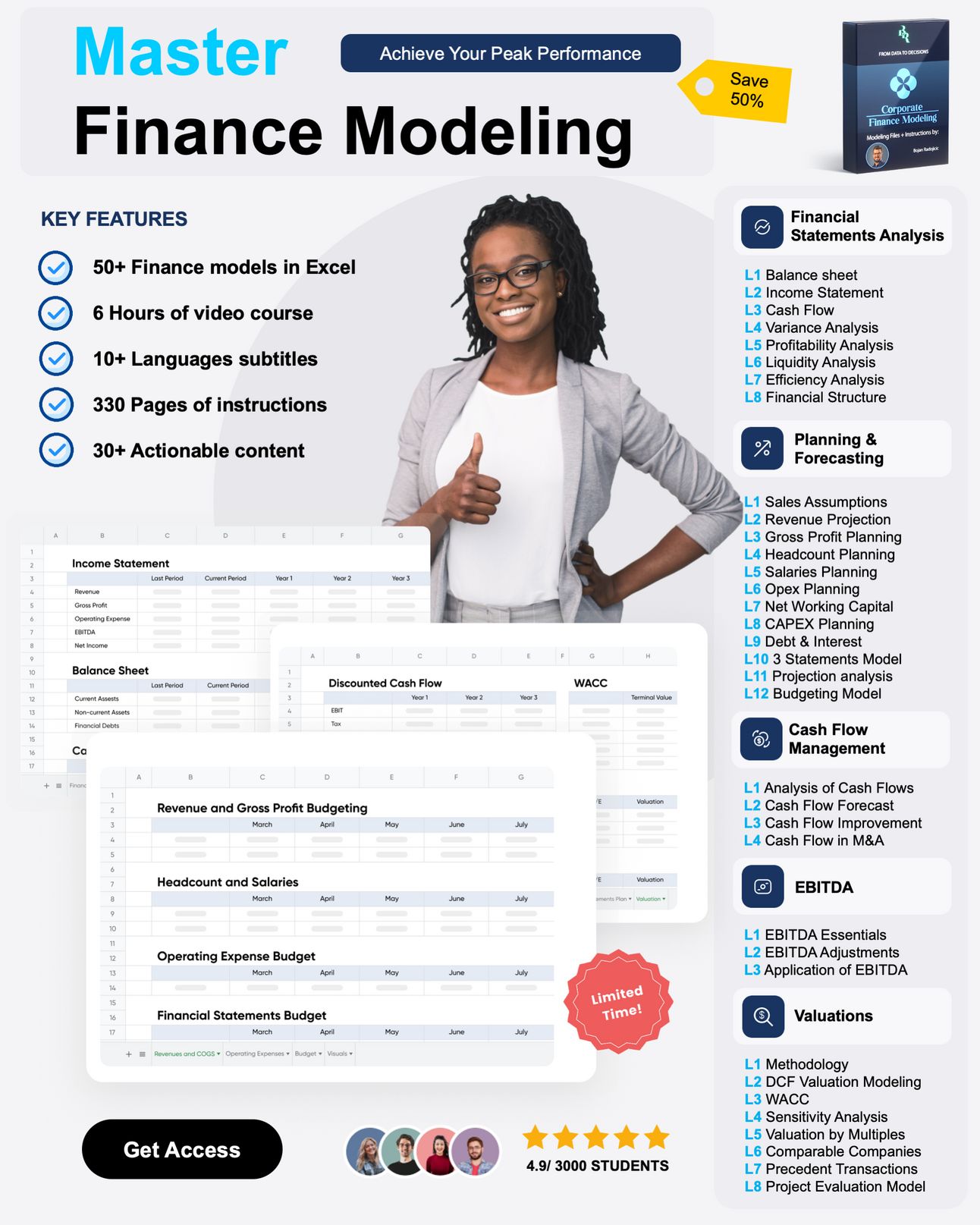

My friend Bojan Radojicic launched a value-packed Financial Modeling Course and his students are loving it. I’ve also secured an exclusive 50% off coupon just for the Startup Finance subscribers, so if you’re looking to elevate your career, check it out below.

I’d love to get your thoughts on this week’s poll. Share your thoughts below!

👇 Watch: Learn 71 Excel Shortcuts in less than 15 minutes by Josh

Just a heads-up - this email’s sprinkled with affiliate links. If you fancy exploring them, it’s a great way to back this newsletter!

Bonus Story

Financial Modeling Handbook 3rd Edition

Learn Financial Modeling for free with this comprehensive handbook.

Discover the importance of modeling, the different types out there, and the basics of financial statements. Whether you're a founder or a finance pro, this handbook is your personal guide to navigating the world of financial modeling.

It includes:

Why is Financial Modeling Important

Types of Financial Models

Financial Statement Anatomy

Top 10 Excel Functions You Should Know in Financial Modeling

The Income Statement Guide

The Balance Sheet Guide

The Cash Flow Statement Guide

And much more

EASTER SALE ALERT

The FP&A and BI Guide 🐰

40% Discount on Now for a 96 hours only.

The Finance Startup Subscribers only get this chance.

Use coupon code 309JMWI at checkout.

Customer life time value

And this springs' hottest remix - LTV to CAC

The Dive

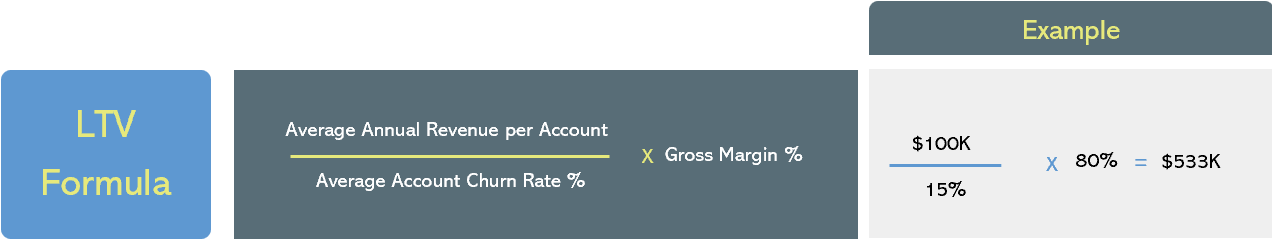

Imagine if you could predict exactly how much cash you'll pocket from a customer before they say goodbye. That's what Customer Lifetime Value (LTV) is all about. It's like peering into a crystal ball and seeing,

Ah, I'm going to make a cool [$x] from this customer before they move on.

The Math

The Nitty-Gritty

Let’s look at each component:

Average Annual Revenue per Account: This one's straightforward. It's the yearly cash flow from a customer. Subscription-based businesses have it easy here since they can expect a steady stream of income. For others, like a café or a boutique, it's a bit trickier to nail down an average, but it's still doable.

Average Account Churn Rate: Think of this as the flip side of how often customers stick around. It's easier to calculate for subscription services since you'll know when a customer bids farewell. And remember, we're talking about accounts here, not dollars. Why? Because your big fish might be balancing out the smaller ones.

Cost of Goods Sold (COGS): This covers all the expenses to keep your customer happy and engaged. Think hosting, support, and customer success. It's a reminder that even after landing a customer, there are still costs to keep them on board. And yes, I just made up a fishing analogy for this – not my finest moment!

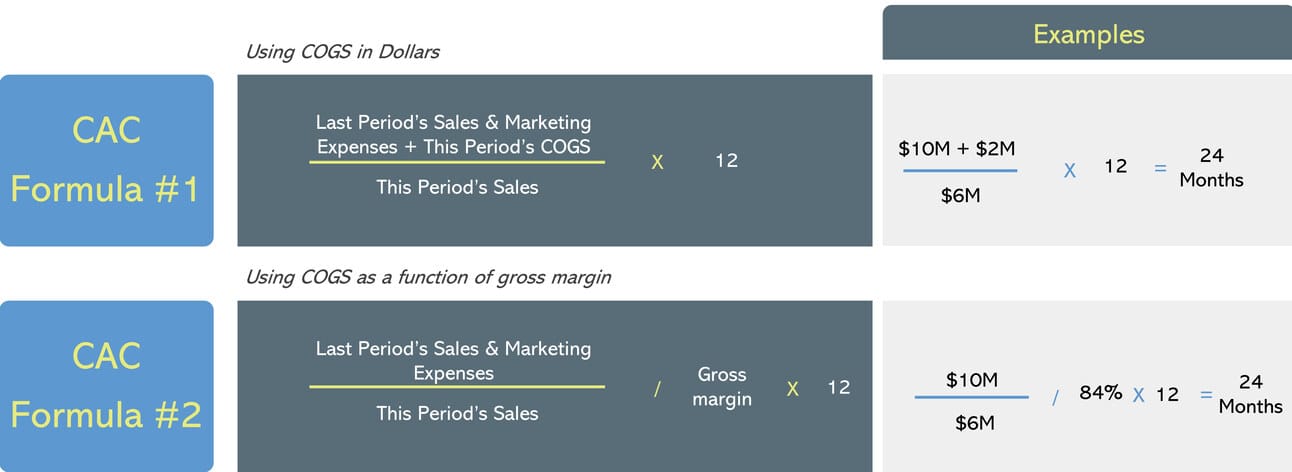

Now, how do you know if your LTV is in the sweet spot? A good rule of thumb is to aim for an LTV that's 3x to 5x your Customer Acquisition Cost (CAC). This ratio, called LTV to CAC, is a key indicator of whether you're on the right track or just burning cash.

LTV to CAC below 3x

If you want a refresher on CAC, check out this amazing piece here.

Can LTV to CAC Be too High?

Controversial take alert: Yes, it can.

If your LTV to CAC ratio is sky-high, it might mean you're playing it too safe. You could be missing out on growth opportunities by not investing enough in sales and marketing. Remember, in the business world, growth often drives valuation. So, by not chasing new customers aggressively, you might be giving your competitors an easy ride and potentially limiting your company's value.

In summary, LTV is a powerful metric that can guide your strategies and investment decisions. Keep an eye on it, tweak your approach as needed, and watch your business thrive!

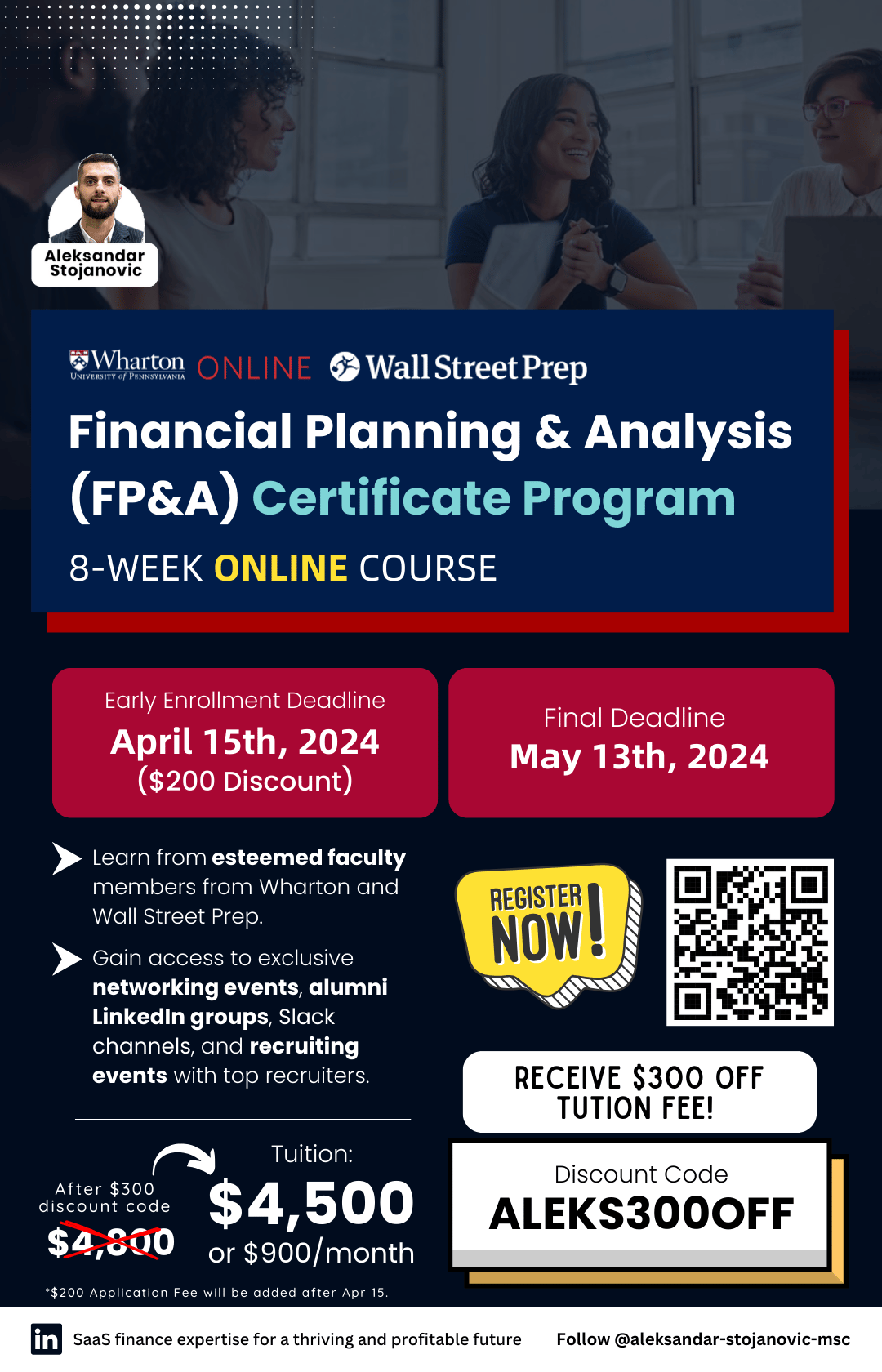

Introducing Wharton & Wall Street Prep's Exclusive FP&A Certificate Program

When: 8 Weeks May 13 - July 7, 2024 (8 weeks)

Time Commitment: 8 Hours per Week

Format: Online Self Paced with Live Office Hours

Early Registration Deadline: April 15th, 2024

Tuition: $5,000 (save $500 using my affiliate registration link)

Certificate: Issued by Wharton and Wall Street Prep

Closing Ceremony: Penn Club in NYC (Attend Live or Virtually)

Faculty: Taught jointly by Wharton & Wall Street Prep

Guest Speakers: Marcela Martin (Buzzfeed), Josette Leslie (Affinity.co), Debbie Sebastian (Eagle Family Foods Group), and more.

Alumni Benefits including:

Exclusive Networking Events

Invites to Alumni LinkedIn Group and Slack Channels

Exclusive Recruiting events with top Recruiters

XLOOKUP vs. VLOOKUP

If you're anything like me, Excel is practically your second home. And today, I want to talk about a game-changer in the Excel world: the XLOOKUP function. I used to be a die-hard fan of VLOOKUP, but not anymore. Let's dive into why.

XLOOKUP: The New Kid on the Block

XLOOKUP is like having a superpower in Excel. It lets you search through a range of data and grab values based on specific criteria. Here's a quick breakdown of its syntax:

LOOKUP_VALUE: The value you're searching for.

LOOKUP_ARRAY: The range containing the data, including where the lookup value is located.

RETURN_ARRAY: The range from which to retrieve the value.

IF_NOT_FOUND: Optional. Specifies what to do if no match is found.

MATCH_MODE: Optional. Specifies the match mode for the lookup.

SEARCH_MODE: Optional. Determines the search direction.

Why XLOOKUP Rocks:

It can look left, right, up, or down in your data.

You only need the 3 required arguments to make it work.

It uses arrays, so if data is added, XLOOKUP still works.

It can handle errors without needing IFERROR.

It can return an array, not just a single value.

It supports wildcards and reverse searches.

VLOOKUP: The Old Faithful

VLOOKUP has been a staple for Excel users for years. It's great for looking up precise values. Here's a quick syntax breakdown:

LOOKUP_VALUE: The value you're searching for in the first column of the table.

TABLE_ARRAY: The range of cells containing the data.

COL_INDEX_NUM: The column number in the table from which to retrieve the value.

RANGE_LOOKUP: Optional. TRUE for an approximate match or FALSE for an exact match.

Why You Might Still Use VLOOKUP:

It's perfect for pulling in an exact value when you don't need to sum values in a range.

The Verdict:

While VLOOKUP is still useful, XLOOKUP has definitely stolen the spotlight for me. It's flexible, powerful, and just makes life in Excel so much easier.

If you’re looking to elevate your career, check out The Financial Modeling Course by Bojan Radojicic.

This is the method that made Bojan and other students go from misunderstood analysts to respected finance leaders. Click on a link below to get an exclusive 50% discount off the course price.

Earn free gifts 🎁

You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

POLL TIME

How did you enjoy this week's topics?

How would you improve the Startup Finance🚀?

Can you do me a favor? I want to know you better.

If you have specific suggestions or feedback, simply reply to this e-mail.

How can I help you?

Book a Growth Call: Looking to scale your company? Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Dive into 1:1 Coaching: Personalized coaching can make all the difference. Let's work together to navigate the complexities of finance and set you on the path to success. Click here to start your 1:1 coaching journey.

Sponsor an Issue of the Startup Finance: Want to reach a dedicated audience of founders & finance enthusiasts? Consider sponsoring a future issue of the Startup Finance. Contact me here for sponsorship details.

Thanks so much for reading.

Aleksandar