Hey,

Thank you for being with me for the very first issue of "the Startup Finance," where I’ll delve into the dynamic world of finance, strategy, and tech at startups, providing valuable insights and guidance from the perspective of a fractional tech CFO. My newsletter is a vital resource for founders and finance professionals looking to thrive in the ever-evolving startup landscape.

In today’s email:

CAC Payback Period

How Startup Funding Really Works

Venture firms are calling more capital

👇 Listen: Mastering SaaS Models by Derek Baker and Paul Barnhurst.

BONUS STORY

The FP&A Market Guide

A Guide to 3rd Generation FP&A tools is finally here.

This guide is designed to help you, the buyer, understand the newest tools in the marketplace. The market can often be overwhelming, so it has been put together to help you navigate the marketplace.

The guide includes:

The core components of planning software

A vendor segmentation map

Company and product overview

Founder story

How each tool uses AI/ML

Tool Evaluation section, including strengths and opportunities

List of Native ERP, CRM, and HRIS integrations

and more

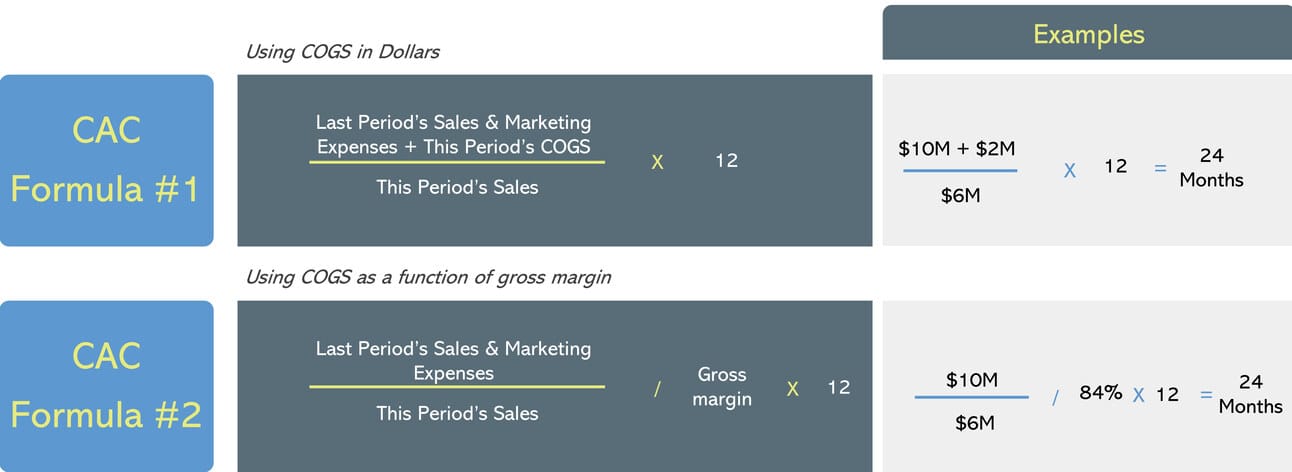

CAC Payback period

“Too many people spend money they haven't earned, to buy things they don't want, to impress people they don't like.” - Will Rogers, The Great Gatsby

She has a 1 day CAC payback period

Customer Acquisition Cost (CAC) Payback period allows you to measure the efficiency of your business’ go to market machine. It effectively tells you,

It takes me X months to break even on the Y dollars I spent to get a customer.

Can CAC Payback Be too Low?

Definitely! You know, this might mean you're not making the most of your chances and could be skimping on your go-to-market strategy. For smaller private software companies, the sweet spot is usually about 6 months, and for the public ones, it's closer to 10 months. After that, it gets tricky to tell if you're hitting the mark or just not investing enough in growth. It's a fine line, right? You want to feed the beast enough to keep it going, but not so much that it gets lazy. You want to keep it a little hungry, but not starving.

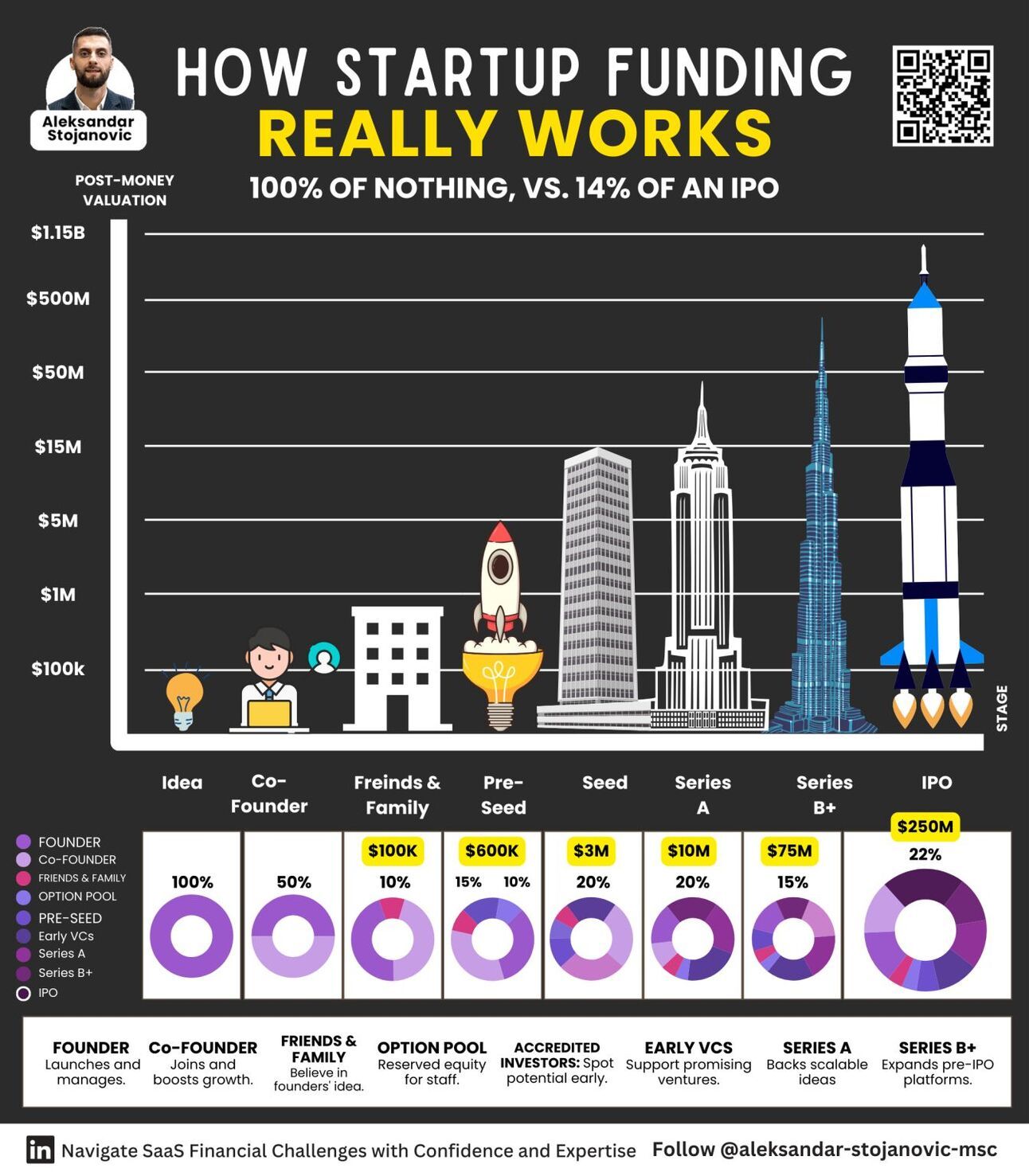

How Startup Funding Really Works

This week, I want to chat about something we all wrestle with: the tricky world of startup funding. It's like navigating a maze, isn't it? But don't worry, I've got some tips to help us find our way through.

Do's:

Kickoff with What You've Got: Putting your own money into your startup is like laying down the first brick. It shows you believe in your idea, and that's a big deal for attracting more support.

Embrace Those Early Believers: You know those first investors who see the sparkle in your startup? They're gold. Their early support can turn your dream into reality, so let's give them a warm welcome!

Grow with Grace: As our startups blossom through Series A, Series B, and beyond, let's keep our eyes on scaling up. Sure, we might have to share a bigger piece of the pie, but that pie's getting huge, and that's what counts, right?

Don'ts:

Doubt is a No-Go: If we're not sold on our own ideas, who will be? Believing in our startups is job number one.

Don't Ignore the Lifelines: Early financial backing can be the push we need to get rolling. Let's not miss out on that!

Fear of Dilution? Shake It Off: It might sting to give up some equity, but remember, we're in this for the big picture. A smaller slice of a massive pie is still pretty sweet.

Navigating from a cozy $100k idea to a whopping $1.15B IPO is a wild ride, but with the right idea, team, and support, we've got this. Here's to turning our startup dreams into reality!

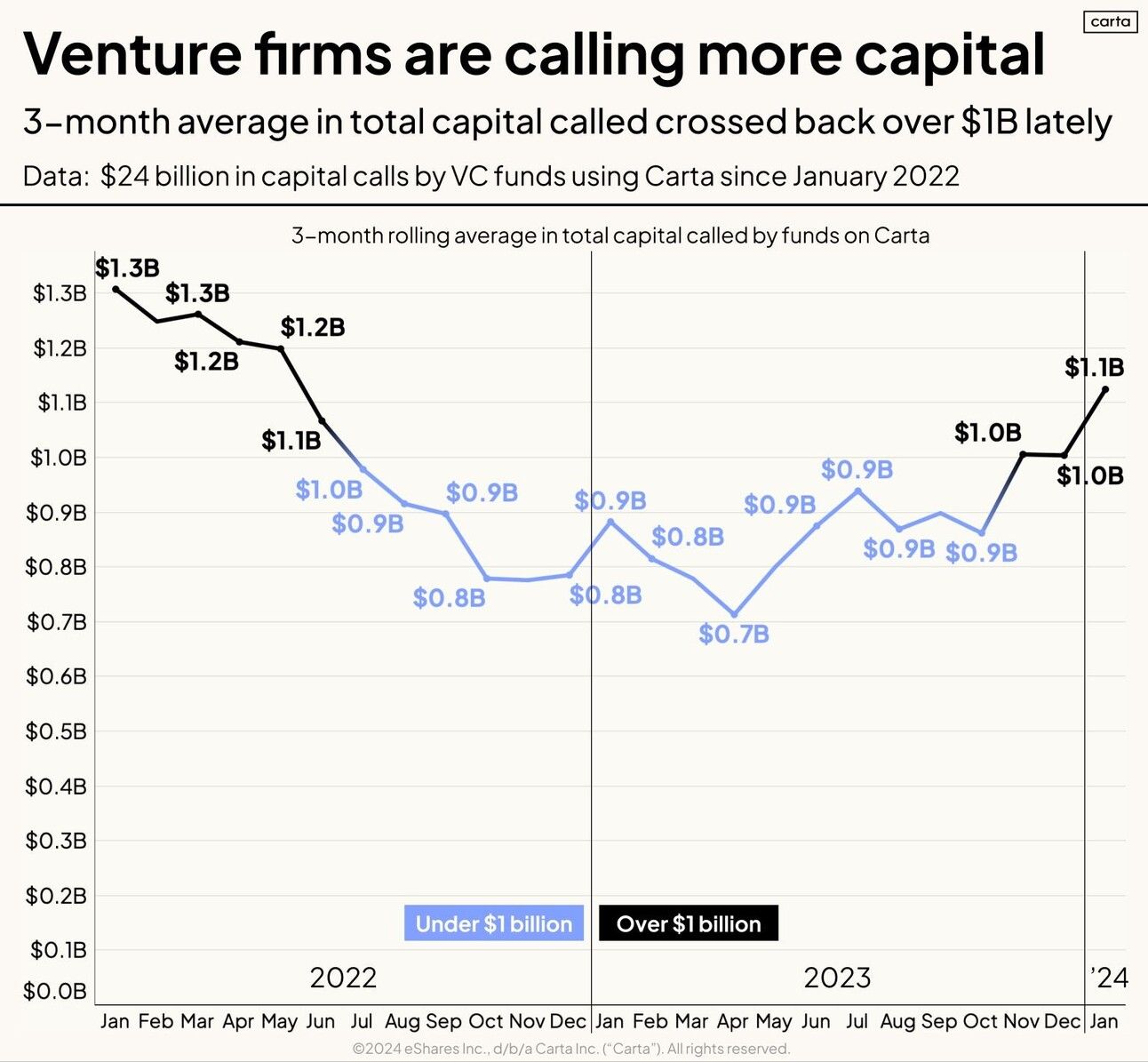

Venture firms are calling more capital

I've got a little secret I want to share with you, but let's keep it between us for now. Word on the street is that funding for VC-backed startups might be on the upswing soon. Exciting, right?

Here's the scoop: VC funds on Carta reported a significant increase in capital calls in January 2024. In fact, it's the highest amount since mid-2022. Now, for those who might be scratching their heads, let me break it down for you.

When fund managers call capital, it means they're gathering funds from their investors. This capital isn't immediately invested into startups. Instead, it's like a staging area. Think of it as the backstage of a concert where the band is getting ready to rock. The General Partners (GPs) hold onto this capital for a bit as they prep to invest in promising companies.

Why is this a good sign? Well, more capital calls mean there's potentially more money flowing into the startup ecosystem. And with the buzz around a successful Reddit IPO, it feels like there's a wave of optimism sweeping through the investment world.

So, what does this mean for startups and investors? It could signal a shift in the funding landscape, with more opportunities for growth and innovation. For startups, it's a reminder to stay ready and keep your pitch sharp. For investors, it's a hint that there might be some exciting investment opportunities on the horizon.

As we head into this week, I'm feeling optimistic about what's to come. The winds of change are blowing, and they might just be bringing a fresh wave of funding to the startup world.

Earn free gifts 🎁

You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

POLL TIME

How did you enjoy this week's topics?

How would you improve the Startup Finance🚀?

Can you do me a favor? I want to know you better.

If you have specific suggestions or feedback, simply reply to this e-mail.

How can I help you?

Schedule a Growth Call for Tech Startups: Looking to scale your startup? Book a growth call with me and let's strategize on how to propel your tech startup to new heights. Click here to schedule your session.

Arrange Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Dive into 1:1 Coaching: Personalized coaching can make all the difference. Let's work together to navigate the complexities of finance and set you on the path to success. Click here to start your 1:1 coaching journey.

Sponsor an Issue of The Startup Finance: Want to reach a dedicated audience of finance enthusiasts? Consider sponsoring a future issue of The Startup Finance. Contact me here for sponsorship details.

Thanks so much for reading.

Aleksandar