DeFi: Shaping the Future of Finance

Explore how DeFi Technologies Inc. (CAD: DEFI & US: DEFTF) bridges traditional finance and the $3T digital asset market. With innovative strategies and global expansion, DeFi is redefining the investment landscape. Gain exposure to Bitcoin, Web3, and beyond with regulated, secure solutions.

WELCOME TO ISSUE NO #036

Consulting | Shop | Website | Newsletter | Speaking

📆 Today’s Rundown

Hey {{first_name}} 👋, hope you had a great week! In the last issue, we discussed why tracking Customer Count matters, and now we are moving with the next topic from Bookings & Customers content, and today’s topic is:

Customer Lifetime Value (CLV or LTV)

Is Your LTV Strategy Unlocking Long-Term Growth?

Newsletter highlights

3 Big Reasons Why Tracking LTV Matters 🤟

LTV Stat of the Week 🔢

My Tool of the Week 📊

Latest Content Update 🆓

3 Reasons Why Tracking LTV Matters

It shows the true worth of your customers

Customer Lifetime Value (LTV) reveals the long-term financial impact of each customer relationship.

By calculating LTV, you can understand how much revenue an average customer brings to your business over time and identify areas to improve.

It helps shape retention and pricing strategies

By analyzing LTV by customer segment, you can see which initiatives, like loyalty programs or price adjustments, provide the greatest ROI.

Additionally, integrating LTV with churn metrics helps you assess the real cost of losing a customer.

It empowers future planning

LTV offers critical insights into the sustainability of your growth model.

A strong LTV helps you allocate resources strategically, forecast revenue, and plan for smart, scalable growth.

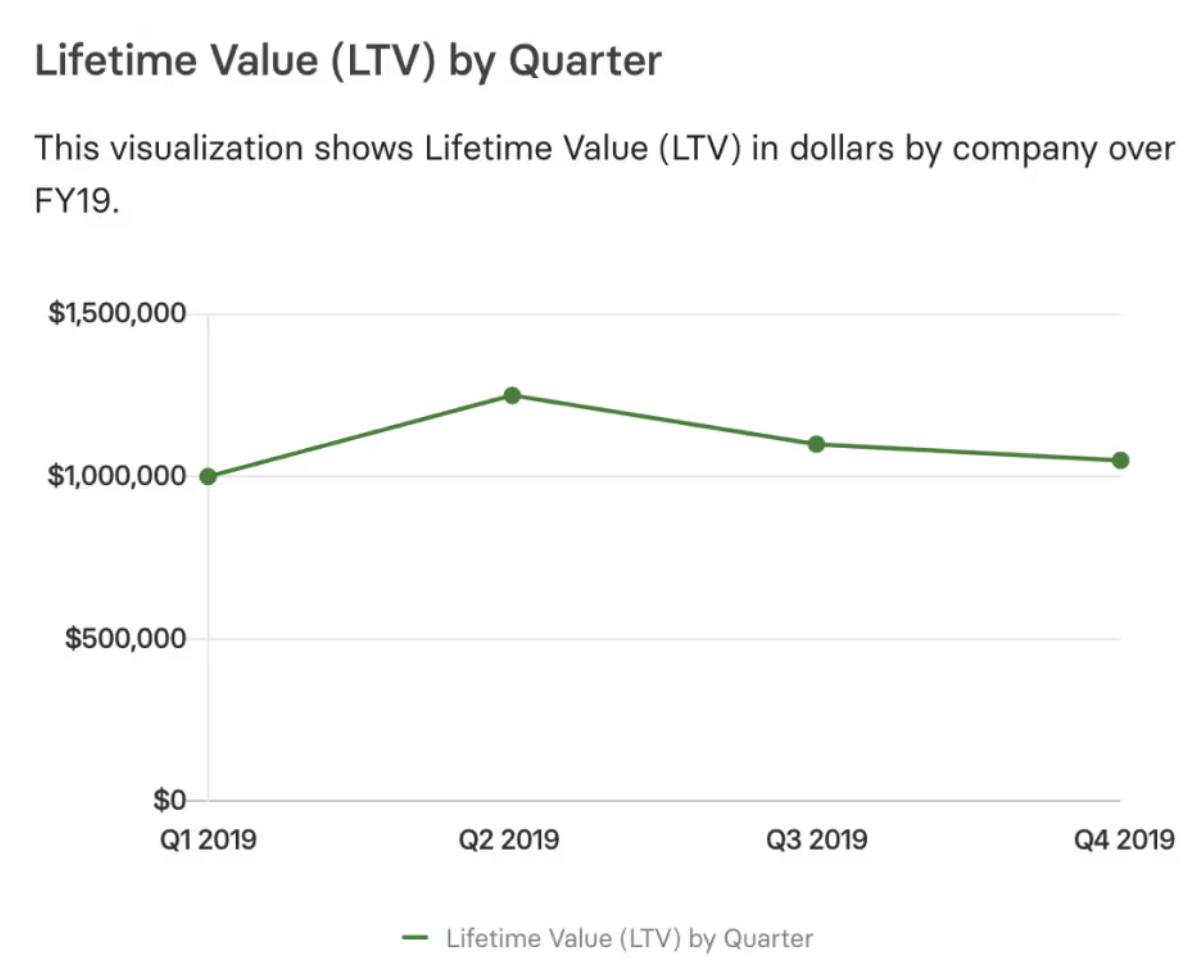

LTV Stat of the Week

$1,920

For a service with an ARPU of $120, an 80% gross margin, and a churn rate of 5%, the calculated customer lifetime value is $1,920. This showcases the significant impact that retention and pricing strategies have on long-term profitability.

This week’s shameless plug…

Over 50 founders have enrolled in Val’s Optimal Numbers: DTC Operators' Financial Program since its launch.

It’s a self-study program designed to help DTC operators master the financial side of their businesses with confidence!

Every module is packed with actionable frameworks, real-life case studies, and optional 1:1 personalized guidance to help you optimize cash flow, scale profitably, and make smarter financial decisions.

Check out the program and take control of your financial success!

My Tool of the Week

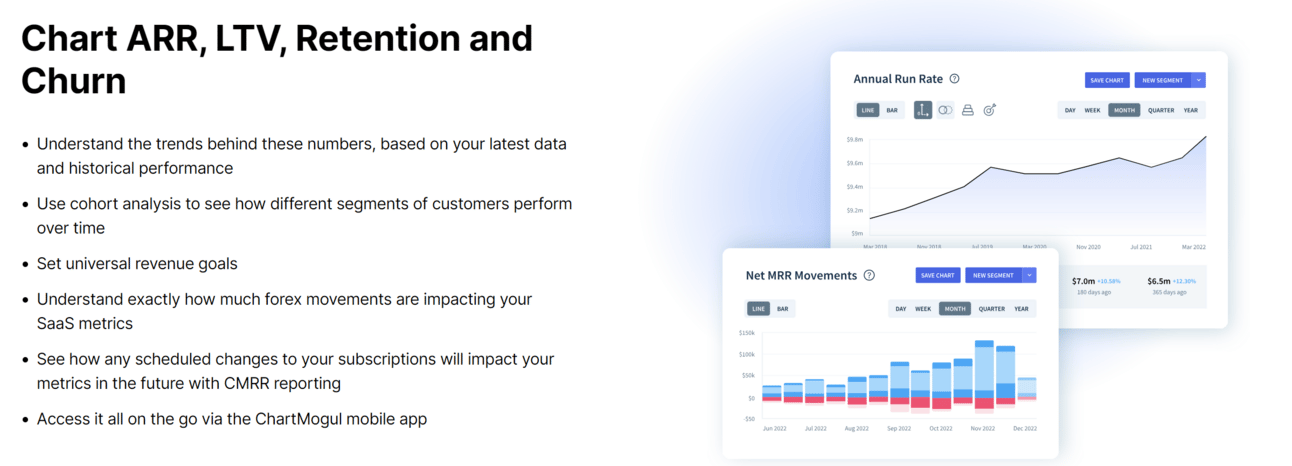

ChartMogul is an excellent solution for SaaS companies looking to track and analyze customer lifetime value (CLV) and other subscription metrics effectively.

Here’s why ChartMogul stands out:

Integrated Subscription and CLV Analytics: Seamlessly combine customer lifetime value metrics with subscription data to gain a holistic view of customer profitability.

Customizable Dashboards: Tailor dashboards to track CLV, churn, net revenue retention (NRR), and segment-specific trends in real-time.

Cohort Analysis and Segmentation: Analyze customer cohorts and segment data to identify the most valuable customer groups and optimize strategies.

ChartMogul empowers SaaS companies by linking customer lifetime value insights directly with subscription and operational metrics, enabling smarter decisions for sustainable growth.

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Aleksandar Stojanovic

Founder of Fiscallion

Fractional CFO & FP&A Boutique Consultancy

P.S. Whenever you’re ready, here’s how I can help:

Free Consultation: Book your strategy call.

Keynote Speaking: Schedule me for your event.

Sponsor my Newsletter: Reach 5,000+ subscribers.