In partnership with

Build your own tracking system

Learn how to manage your finances simple and stress-free.

WELCOME TO ISSUE NO #028

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Hey {{first_name}} 👋, in the last issue, we discussed why tracking Day Sales Outstanding (DSO) matter, but now, we are proceeding with the last topic from Billings & Collections, and today’s topic is:

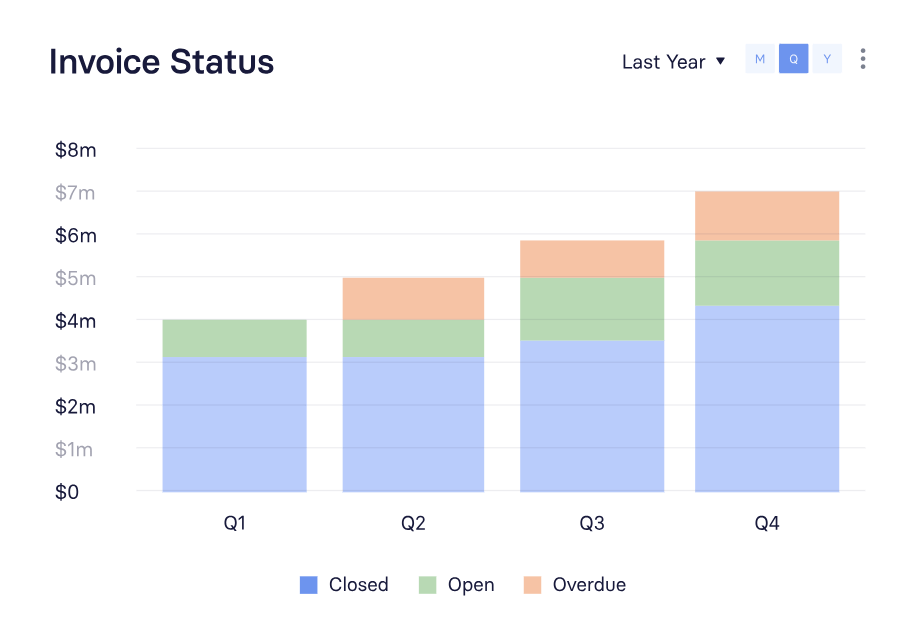

Invoice Status (Count)

Are You Effectively Tracking and Managing Your Invoice Status?

Newsletter highlights

3 Reasons Why Tracking Invoice Status Matters🤟

Invoice Management of the Week. 🔢

My Tool of the Week 📊

Latest Week Content Update 🆓

3 Reasons Why Tracking Invoice Status Matters

Tracking and managing invoice statuses is more than just billing, it provides crucial insights into your company’s financial health, operational efficiency, and customer satisfaction.

For SaaS finance teams, analyzing invoice statuses helps streamline cash flow management, allocate resources effectively, and assess customers' payment behaviors and creditworthiness.

Here are the three most common invoice statuses: overdue, open, and closed.

Overdue

Overdue invoices are those that haven’t been paid by the due date. Quickly addressing these invoices is essential to prevent cash flow problems, but it’s also important to manage follow-ups with care to maintain strong customer relationships.

In SaaS accounting, overdue invoices also impact revenue recognition, especially with the matching principle—ensuring that revenue and costs are recorded within the same period. Monitoring overdue invoices during the month-end close process is critical to maintain accuracy in financial reporting.

Open

Open invoices refer to those that are active but not yet paid, meaning payment is pending but still within the agreed terms. Open invoices are crucial for revenue forecasting, as they provide visibility into expected cash inflows. If an open invoice becomes overdue, it complicates revenue recognition, adding to the inherent complexity of SaaS accounting.

Closed

Closed invoices are those that have been fully paid and settled. Once payment is received, the status changes to “closed,” allowing the revenue to be recorded in accordance with GAAP guidelines. Closed invoices provide reliable data for revenue forecasting and strategic planning, as they represent actual, realized revenue.

This week’s shameless plug…

Hey {{first_name}}, in case you missed it, 2 days ago I send out a survey.

I want to get to know you!

First of all, thank you for being a reader of the Startup Finance Newsletter.

I’ve had a blast interacting with all of you and writing this newsletter, and in order to create the very best content going forward, I want to get to know YOU better.

Please take ~30 seconds and fill out this quick survey below:

It’s 4 questions and all I want to know is your primary role at your company and your primary skillset.

If you could take the next 30 seconds and fill it out, I’d be super grateful!

Thank you!!

Invoice Management of the Week

15%

15% of invoices in the SaaS industry are overdue on average, indicating potential cash flow risks and the need for effective follow-up processes.

My Tool of the Week

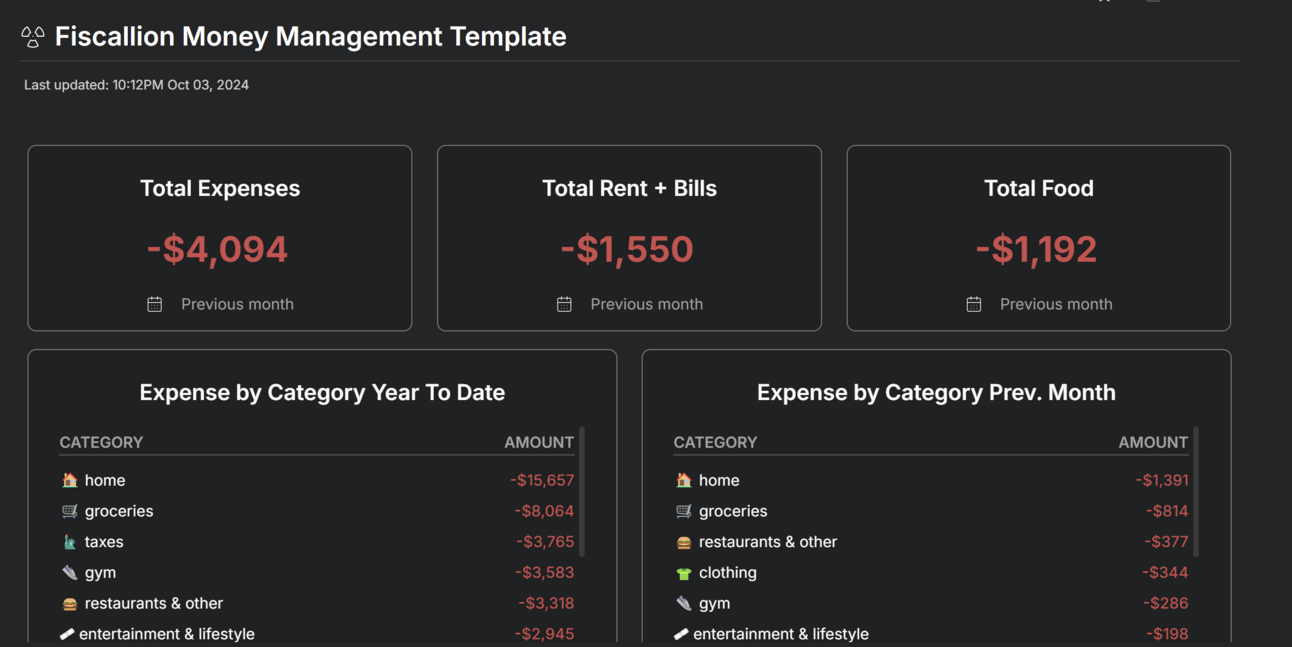

Fina is a powerful financial platform designed to help you effortlessly manage your finances, both personal and business. It offers a flexible and customizable approach that’s often compared to "Notion for Finance."

Fina provides:

Dynamic Budgeting: Unlike other tools that force you into rigid structures, Fina allows you to adjust your budgets in real-time, making financial management adaptable to your changing needs.

Customizable Dashboards: Create and view your financial data the way you want. Track everything from expense categories to business performance with personalized dashboards.

Seamless Integrations: Connect Fina with your existing financial tools and even import/export data to keep all your financial information in one place.

What makes Fina different is its balance between flexibility and ease of use. Where other platforms like Mint or YNAB fall short in customization, Fina excels, making it the go-to for those who want full control without the headache of managing multiple spreadsheets.

What I love most about Fina is how it brings clarity and ease to financial management, turning what can be an overwhelming process into a streamlined, stress-free experience.

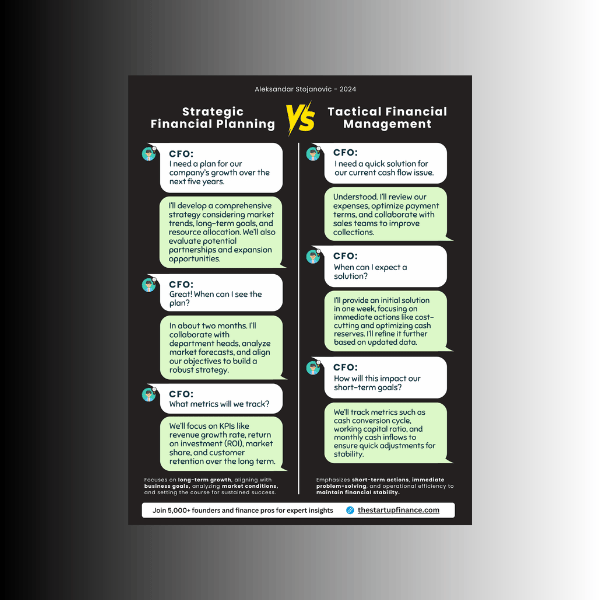

Latest week content update

Here is the latest week content which

+

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Aleksandar Stojanovic

Founder of Fiscallion

Fractional CFO & FP&A Boutique Consultancy

P.S. Whenever you’re ready, here’s how I can help:

Free Consultation: Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Promote yourself to 5,000+ subscribers by sponsoring my newsletter. Apply here.