Take on 2025 with $10,000

You’ve got big goals for 2025. And HoneyBook has the tools, resources, and bonus prizes to take you there. Join HoneyBook in January for a chance to win.

WELCOME TO ISSUE NO #027

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Hey {{first_name}} 👋, in the last issue, we discussed why tracking Collections matter, but now, we are proceeding with Billings & Collections and today’s topic is:

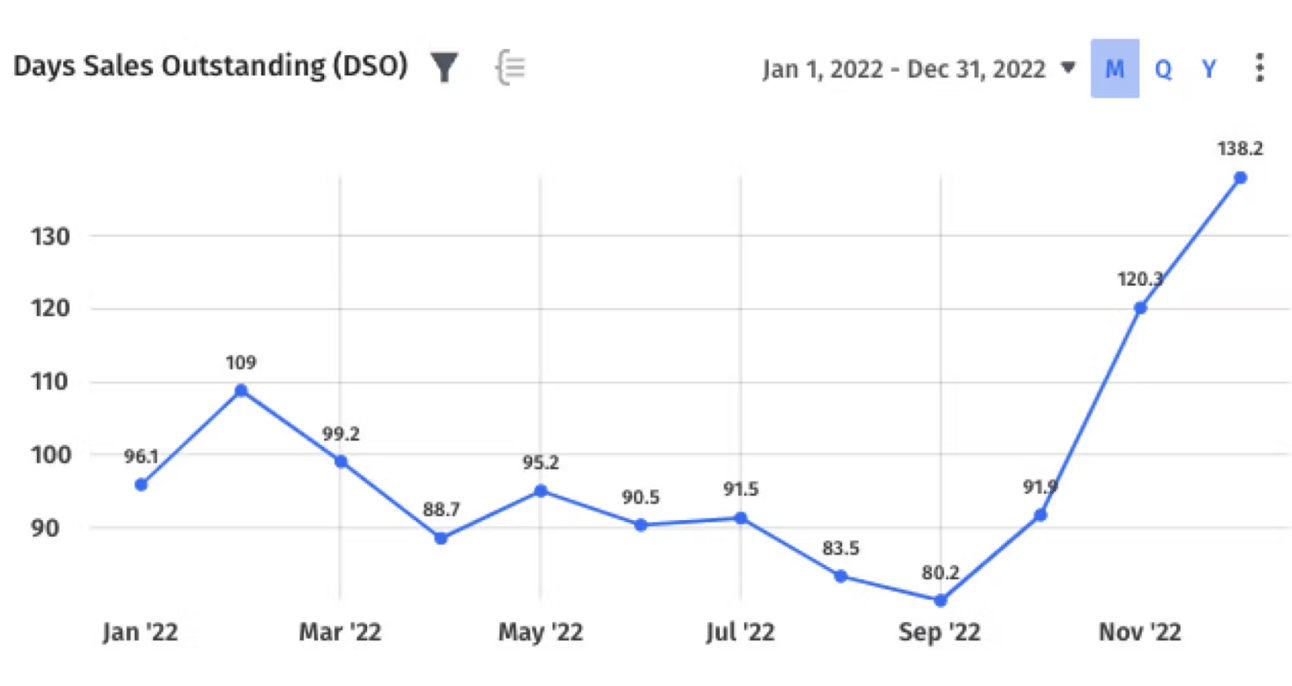

Day Sales Outstanding (DSO)

Is Your DSO Where It Should Be? How to Measure and Improve Collection Efficiency.

Newsletter highlights

3 reasons why tracking Days Sales Outstanding (DSO) matters.🤟

DSO Stat of the Week. 🔢

My Tool of the Week 📊

Latest Week Content Update 🆓

3 Reasons Why Tracking Days Sales Outstanding Matters

It improves cash flow management

Tracking DSO allows you to understand how quickly you collect payments, directly affecting your cash flow.

A lower DSO indicates efficient collections, freeing up cash to reinvest in growth and cover operational expenses.

It assesses customer credit risks

Analyzing DSO trends helps you identify potential customer credit risks.

If DSO is rising, it could indicate issues with customer payments or inefficiencies in your collections process, prompting timely corrective actions.

It optimizes billing and collection processes

Monitoring DSO regularly provides insights into how efficient your billing and collections processes are.

It helps identify bottlenecks or opportunities for improvement, leading to faster payment cycles and better financial health.

This week’s shameless plug…

Hey {{first_name}}, in case you missed it, 3 days ago I announced new flash sale.

I’ve partnered with Bojan and secured only for you a 50%+ discount on his DIY Valuation [Tutorial + Excel models] course!

Don’t miss out.

You can grab it and save 50%+ - limited time valid only:

Discount will be applied automatically on the checkout.

Happy growing!

DSO Stat of the Week

55 Days

If your DSO is around 55 days and your payment terms are net 60, you're on track. But if your terms are net 30, it’s time to evaluate your collections process..

My Tool of the Week

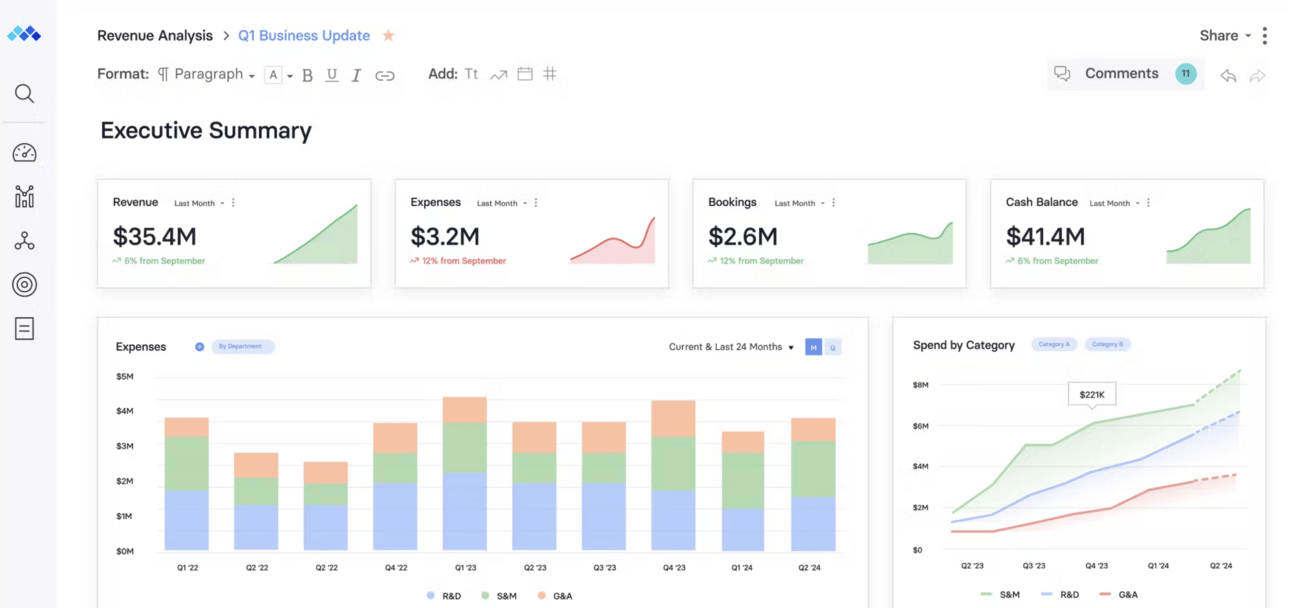

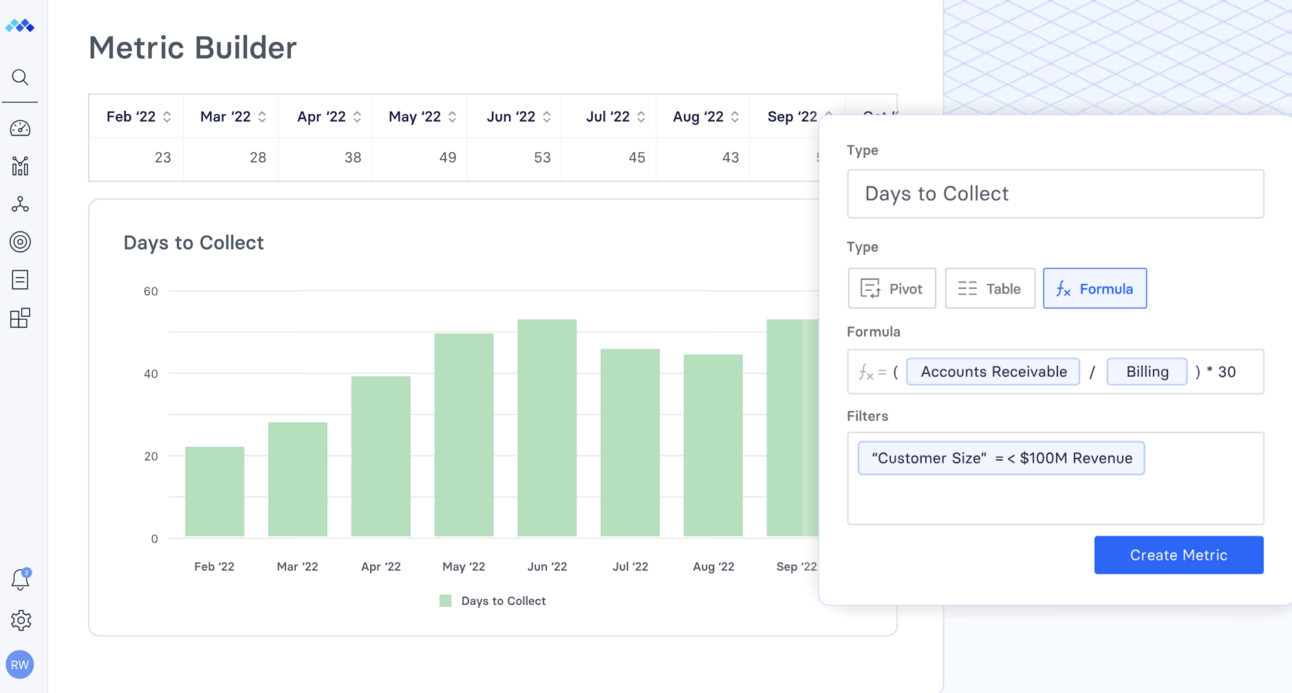

Mosaic is an FP&A platform which is designed to help companies efficiently track and reduce DSO.

It offers:

Automated Collections Tracking: Track outstanding invoices and overdue payments in real-time to reduce DSO and improve cash flow.

Granular Analytics: Dive into customer payment history and trends, enabling you to proactively address late payments and assess credit risk.

Customizable Dashboards: Monitor DSO alongside other key collections and cash flow metrics, providing clear insights to streamline the collections process.

What I like most about Mosaic is its ability to provide actionable insights that drive efficiency in managing cash flow, making it easier to track and improve DSO without manual calculations.

Latest week content update

Here is the latest week content which

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Here are 3 ways I can help you:

Free Consultation: Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Promote yourself to 5,000+ subscribers by sponsoring my newsletter. Apply here.

Catch you in the next issue.

— Aleksandar Stojanovic