Is your business making over $200K in revenue per year?

Compare 2024's top online business lenders. Secure and fast with no impact to your credit score. With over 12,000 small businesses funded, we know how to make lenders compete to give you the best offer. See your loan options in minutes, and get funding as fast as 24 hours. Strongest network coverage for those who have been in business for over 2 years with over $200K in annual revenue. Fuel your business today!

WELCOME TO ISSUE NO #025

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Hey {{first_name}} 👋, in the last issue, we discussed why tracking Billable Utilization rate matter, but now, we are proceeding with Billings & Collections and today’s topic is:

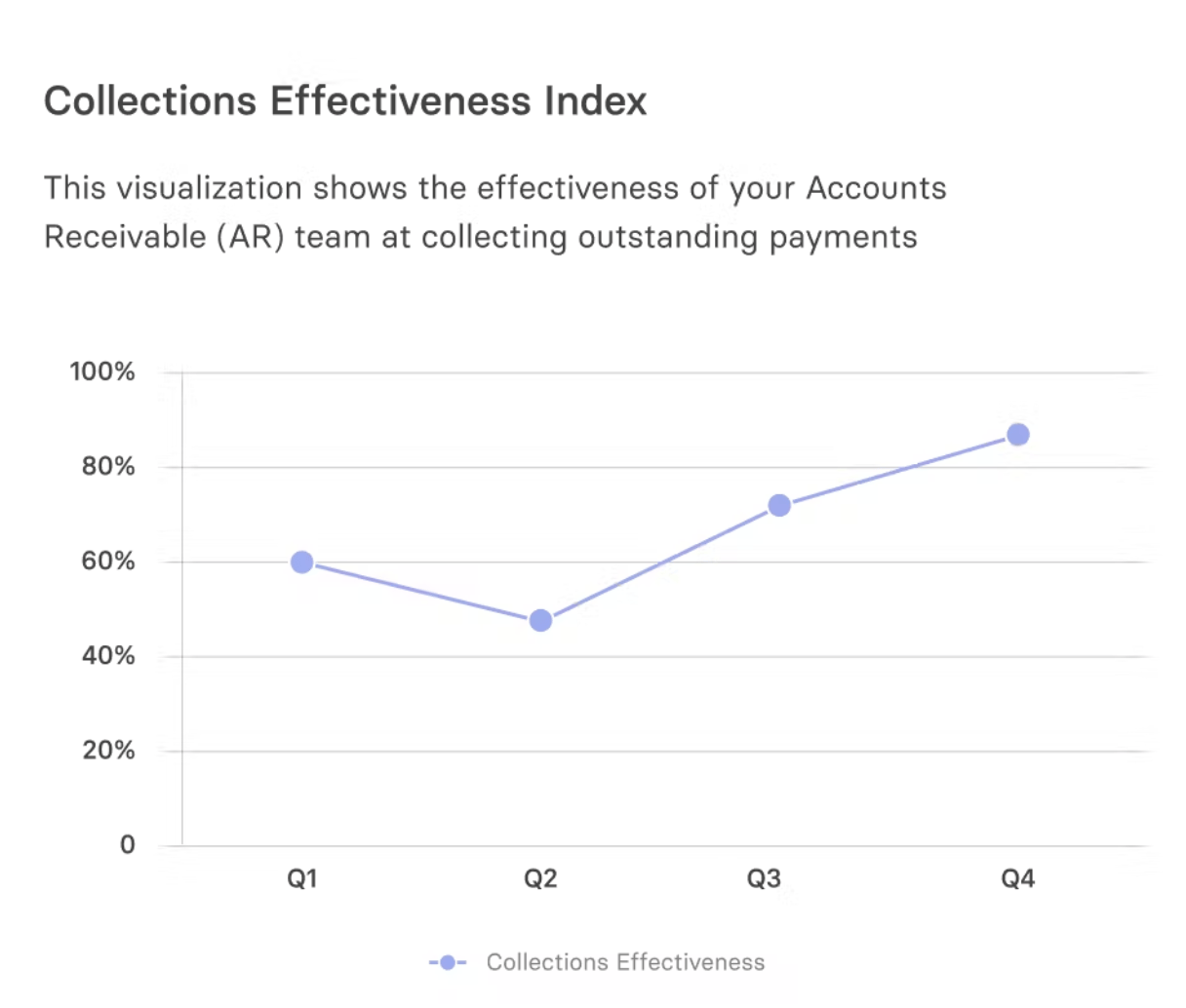

Collections Effectiveness Index

Is Your Collections Effectiveness Index on Track? How to Measure Billing Efficiency

Newsletter highlights

3 Reasons Why Tracking Collections Effectiveness Index Matters🤟

CEI Stat of the Week 🔢

My Tool of the Week 📊

Latest Week Content Update 🆓

3 Reasons Why Tracking Collections Effectiveness Index Matters

It Measures Your Company's Financial Health

The Collections Effectiveness Index (CEI) evaluates how efficiently your accounts receivable team collects outstanding payments.

A higher CEI indicates better performance, directly impacting your company's ability to maintain steady cash flow and sustain operations—crucial for SaaS businesses relying on subscription models.

It Identifies Billing Process Inefficiencies

Monitoring your CEI can uncover issues like inaccurate invoicing, poor communication with customers, or ineffective follow-up strategies.

A lower CEI signals that your billing and collections processes may need refinement, allowing you to address these areas and improve overall financial health.

It's a Key Indicator for Investors and Stakeholders

Investors often look at CEI to gauge a company's financial stability and operational efficiency.

A strong CEI demonstrates effective revenue collection, making your company more attractive to potential investors and stakeholders.

CEI Stat of the Week

75%

A Collections Effectiveness Index above 85% is generally considered healthy for SaaS companies. It indicates efficient receivables collection, ensuring that subscription revenues—the foundation of the SaaS business model—are secure and not at risk.

My Tool of the Week

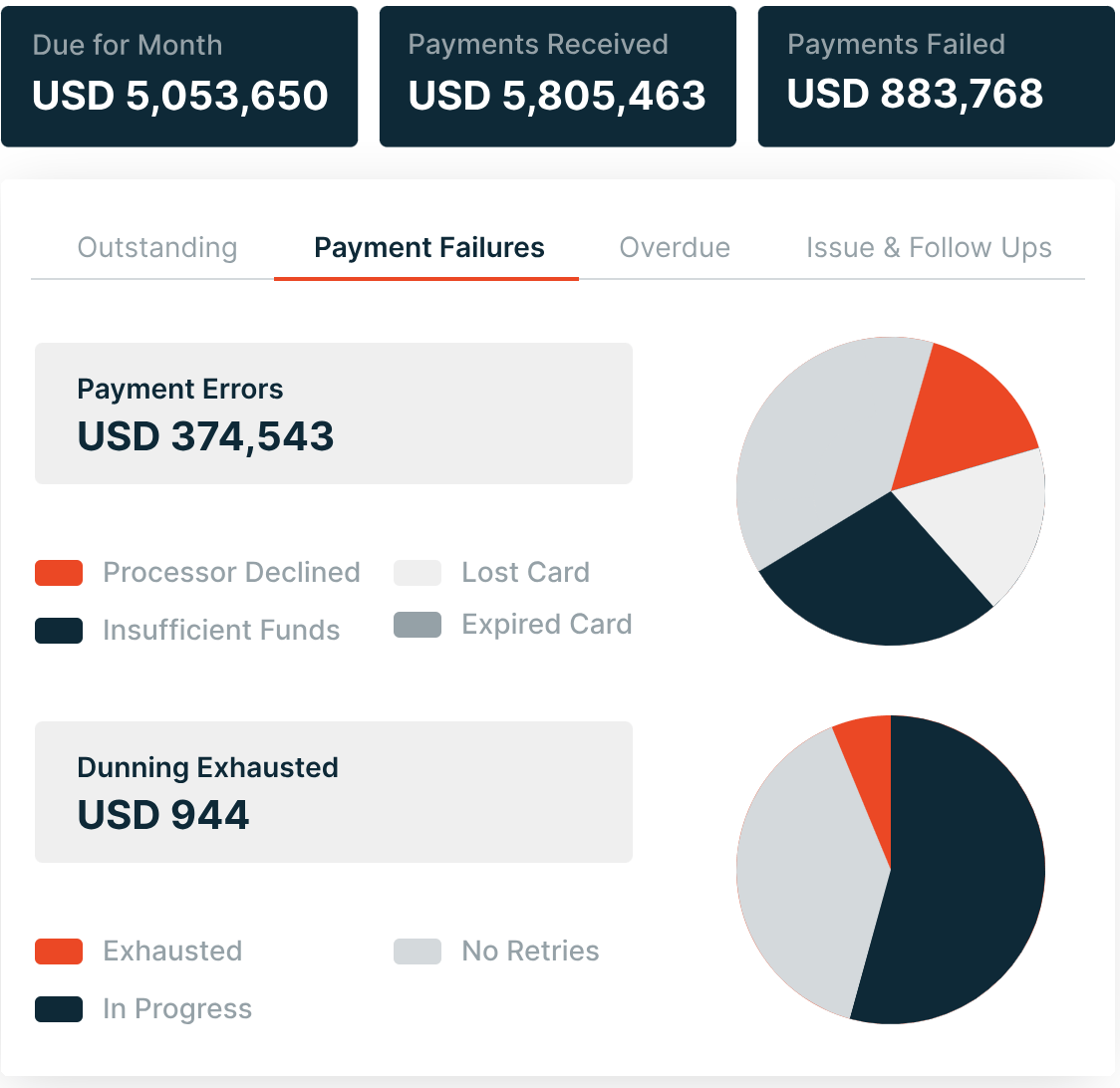

Chargebee is a subscription billing and revenue management platform designed to help SaaS companies streamline their billing processes and improve CEI.

It offers:

Automated Invoicing: Generate accurate invoices automatically, reducing errors and ensuring timely billing.

Multiple Payment Options: Accept payments through various mediums, accommodating customer preferences and reducing payment friction.

Analytics and Reporting: Gain insights into your receivables, CEI, and other key metrics to monitor and enhance collections efficiency.

What I like most about this tool is its ability to simplify complex billing operations, making it easier to manage subscriptions and improve cash flow.

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Here are 3 ways I can help you:

Free Consultation: Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Promote yourself to 5,000+ subscribers by sponsoring my newsletter. Apply here.

Catch you in the next issue.

— Aleksandar Stojanovic