Ease being the key word. With automated tools like financial forecasting and budget optimization, Fiscallion makes managing your finances easy for you, and a total grind for your money.

WELCOME TO ISSUE NO #024

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Hey {{first_name}} 👋, in the last issue, we discussed why tracking Average Collection Period matter, but now, we are proceeding with Billings & Collections and today’s topic is:

Billable Utilization Rate

Is Your Billable Utilization Rate Optimal? How to Boost Professional Service Efficiency

Newsletter highlights

3 reasons Why Tracking Billable Utilization Rate Matter 🤟

Billable Utilization Rate Stat of the Week 🔢

My Tool of the Week 📊

Latest Week Content Update 🆓

3 Reasons Why Tracking Billable Utilization Rate Matters

It Directly Impacts Revenue Generation

In professional service firms, employees' time is the main product.

Tracking billable utilization rate reveals how effectively employees are turning their work hours into revenue.

A higher rate means more hours are billed to clients, directly increasing income for the company.

It Helps Identify Operational Inefficiencies

Monitoring this metric can uncover issues such as imbalanced workloads, inefficient time management, or roles that aren't client-focused.

A low utilization rate may indicate that employees are spending too much time on non-billable tasks, which can be addressed through better resource allocation or process improvements.

It Balances Employee Well-being and Profitability

While a high billable utilization rate boosts revenue, overutilization can lead to employee burnout and turnover.

Tracking this rate helps ensure employees are not overworked, maintaining a healthy balance that supports both profitability and employee satisfaction.

Billable Utilization Rate Stat of the Week:

75%

For most companies, an ideal billable utilization rate ranges between 70% and 80%.

This means employees spend approximately 75% of their work hours on billable client tasks, striking a balance between revenue generation and sustainable workloads.

My Tool of the Week

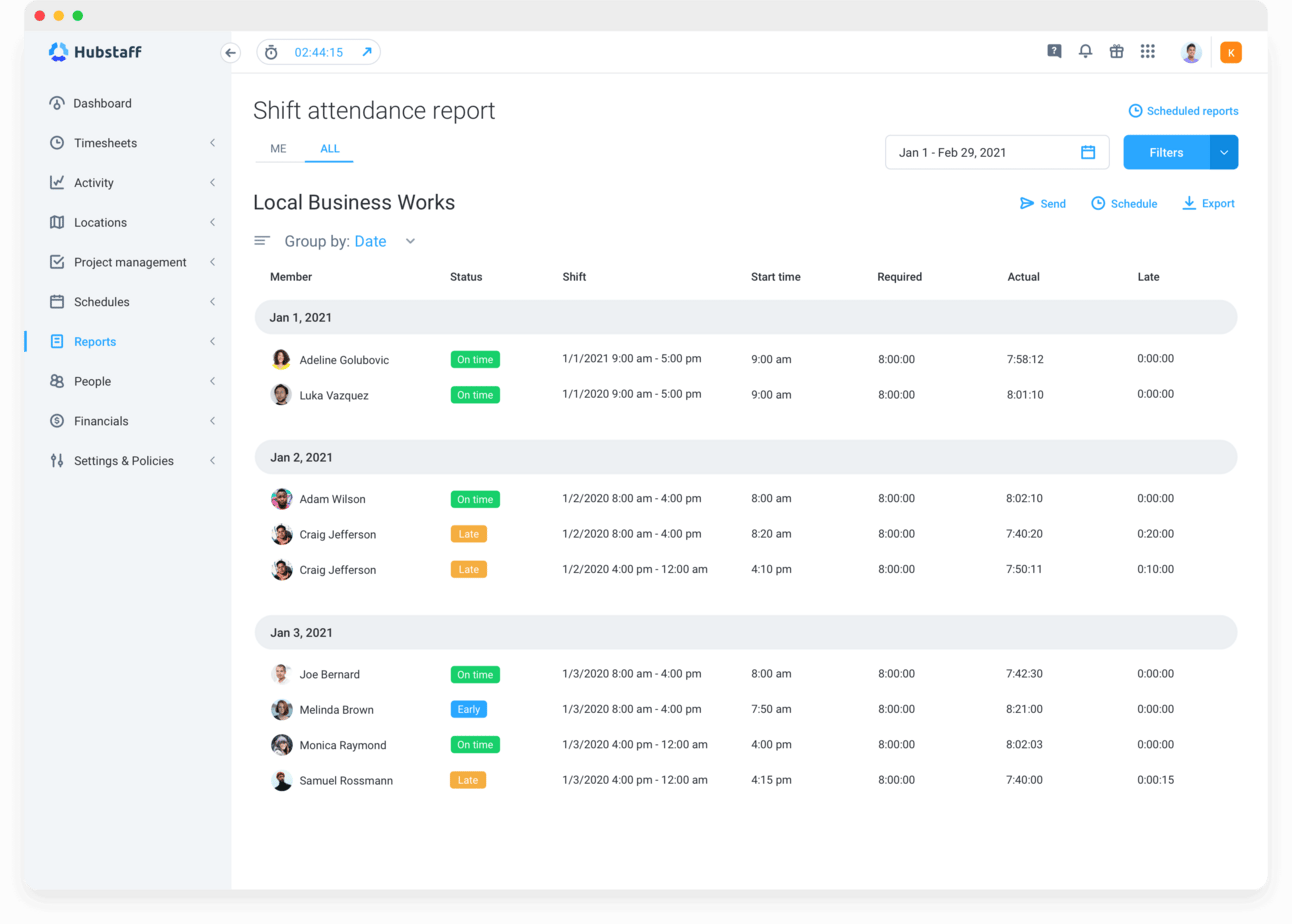

Hubstaff is a comprehensive time-tracking and productivity tool designed to help professional service companies monitor billable hours efficiently.

It offers:

Time Tracking: Simple and intuitive time entry for employees, making it easy to log billable and non-billable hours with features like automatic time capture.

Reporting: Detailed reports on billable utilization rates, productivity, and project progress, helping you understand where time is spent.

Invoicing and Payroll: Generate invoices based on tracked hours and manage payroll seamlessly, streamlining financial processes.

What I like most about this tool is its ability to provide real-time insights into billable hours and employee productivity, aiding in optimizing resource allocation and improving profitability.

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Here are 3 ways I can help you leverage AI in your financial processes:

Free Consultation: Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Promote yourself to 5,000+ subscribers by sponsoring my newsletter. Apply here.

Catch you in the next issue.

— Aleksandar Stojanovic