Get your news where Silicon Valley gets its news 📰

The best investors need the information that matters, fast.

That’s why a lot of them (including investors from a16z, Bessemer, Founders Fund, and Sequoia) trust this free newsletter.

It’s a five minute-read every morning, and it gives readers the information they need ASAP so they can spend less time scrolling and more time doing.

WELCOME TO ISSUE NO #032

Consulting | Shop | Website | Newsletter | Speaking

📆 Today’s Rundown

Hey {{first_name}} 👋, in the latest issue, we discussed why tracking CAC Payback Period matters, and now we are moving with the next topic from Bookings & Customers content, and today’s topic is:

Churn Rate

Is Your Churn Rate Costing You Growth?

Newsletter highlights

3 Big Reasons Why Churn Rate Matters 🤟

Churn Rate Stat of the Week 🔢

My Tool of the Week 📊

Latest Week Content Update 🆓

3 Reasons Why Tracking Churn Rate Matters

It reveals your customer satisfaction

Churn rate is a key metric to determine how well you’re meeting customer needs.

A high churn rate might indicate problems with product-market fit, customer support, or pricing.

Understanding churn is essential for making improvements that drive satisfaction and retention.

It helps with forecasting and revenue planning

For finance teams, churn rate is a critical indicator for accurate revenue forecasting.

Understanding churn helps you predict cash runway, renewals, and future revenue growth, allowing you to plan ahead and make informed decisions about where to allocate resources.

It highlights areas for collaboration between finance and customer success

Churn analysis often reveals actionable insights that require collaboration between teams.

By working with customer success to understand the root causes of churn, finance can help devise strategies to retain valuable customers and reduce churn rates.

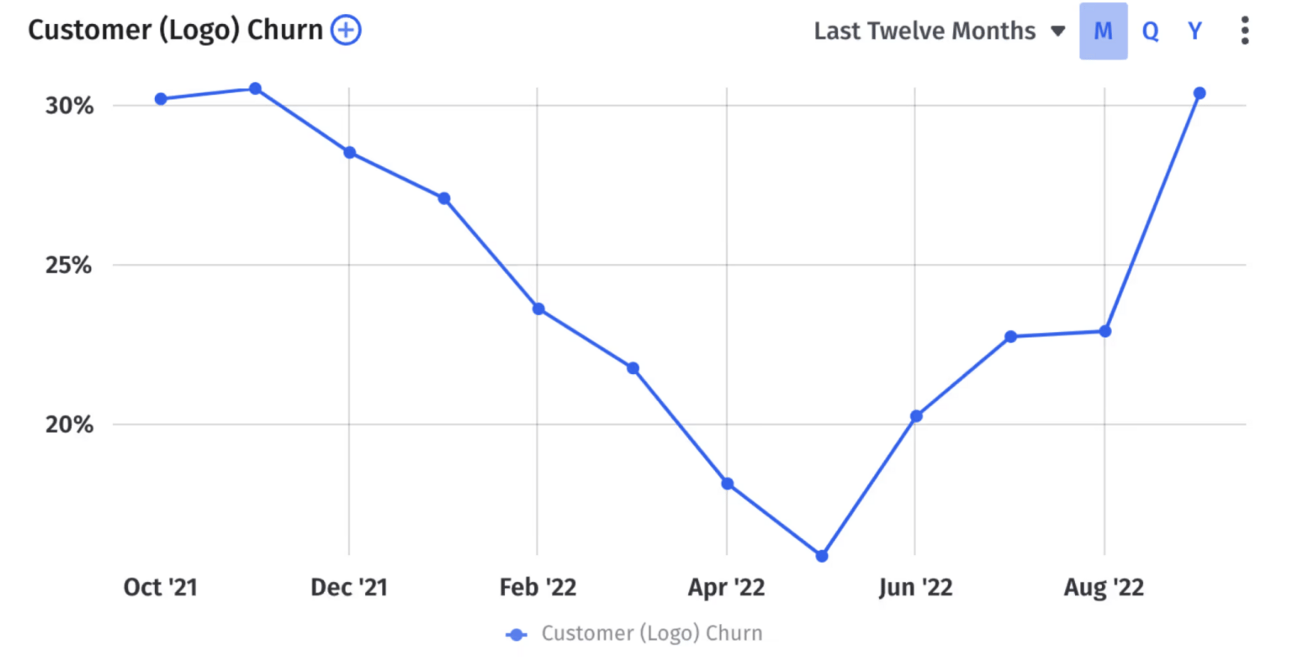

Churn Rate Stat of the Week

5%

The ideal annual churn rate for SaaS companies is between 5-7%. For example, companies that successfully segment customers and analyze churn by product line often see a drop in their churn rate to below 5%, leading to improved retention and higher net revenue retention.

My Tool of the Week

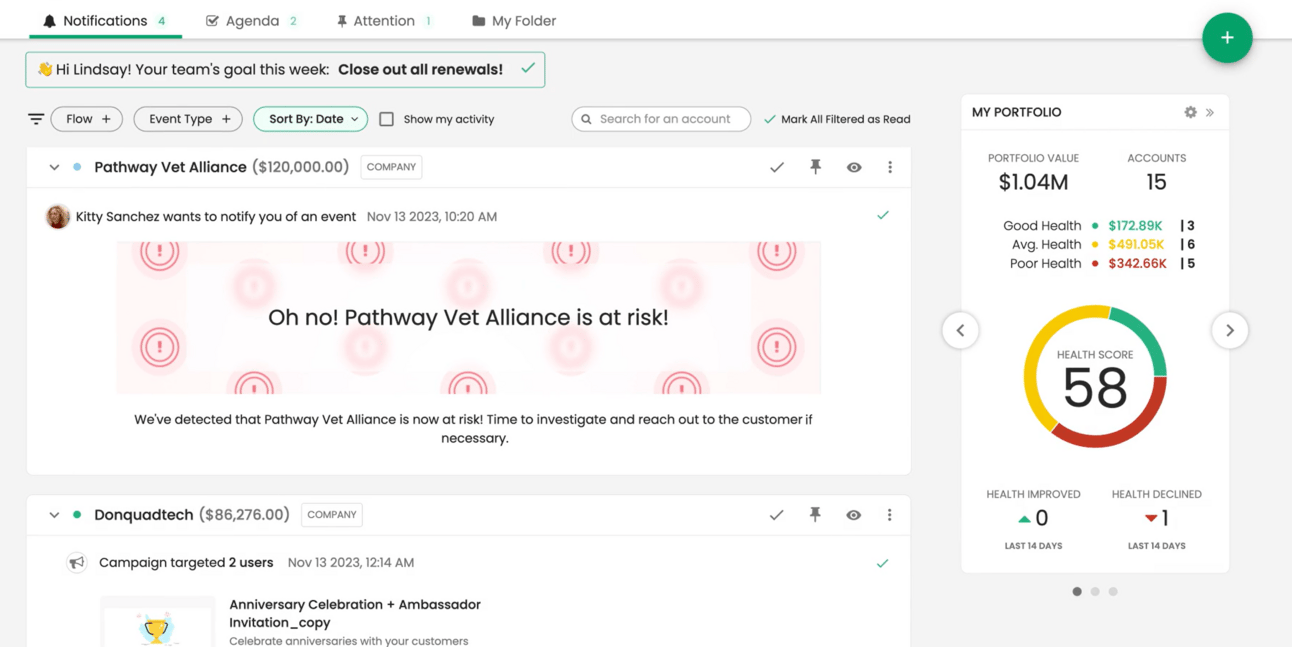

Totango is a fantastic tool for managing customer churn and improving customer retention. Here’s why Totango stands out:

Customer Health Monitoring: Totango provides customer health scores to help you identify at-risk customers and take action before they churn.

Customer Success Playbooks: Totango offers pre-built playbooks that guide customer success teams on how to reduce churn and boost retention.

Automated Alerts: Set up automated alerts to notify your team when a customer’s health score drops, allowing for quick intervention and increased retention.

What I love about Totango is how it helps finance and customer success teams work together seamlessly, providing clear insights that make reducing churn a proactive effort.

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Aleksandar Stojanovic

Founder of Fiscallion

Fractional CFO & FP&A Boutique Consultancy

P.S. Whenever you’re ready, here’s how I can help:

Free Consultation: Click here to book your free strategy call and see how we can grow your business.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Promote yourself to 5,000+ subscribers by sponsoring my newsletter. Apply here.