You can be part of a life-saving mission.

Invest in Cizzle Biotech’s groundbreaking early-detection blood test, designed to catch lung cancer before symptoms appear. With over 95% accuracy and strong backing from partners like Bio-Techne and Moffitt Cancer Center, our innovation has the potential to save millions of lives and transform healthcare. Join us in making early detection accessible—and take part in reshaping the future of medical diagnostics.

Read the Offering information carefully before investing. It contains details of the issuer’s business, risks, charges, expenses, and other information, which should be considered before investing. Obtain a Form C and Offering Memorandum at invest.cizzlebio.com

WELCOME TO ISSUE NO #031

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Hey {{first_name}} 👋, in the latest issue, we discussed why tracking Average Sales Price matters, and now we are moving with the next topic from Bookings & Customers content, and today’s topic is:

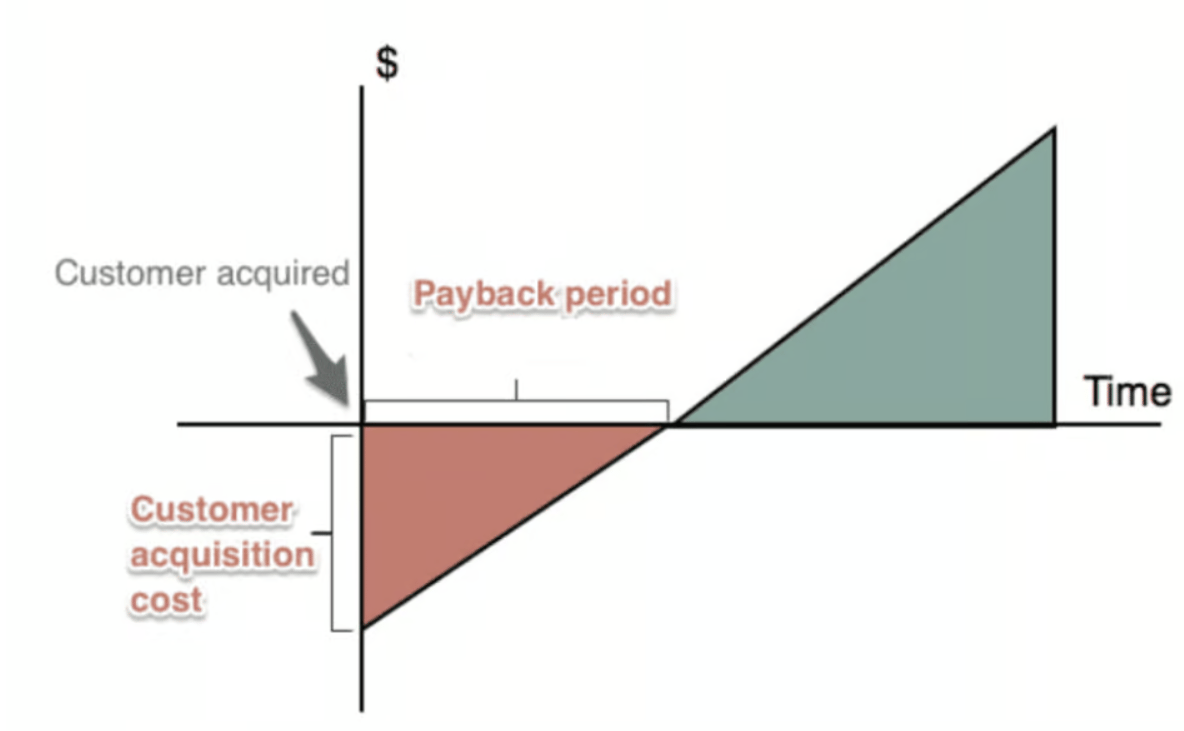

CAC Payback Period

Is Your CAC Payback Period On Track? Let’s Talk About Customer Acquisition Cost.

Newsletter highlights

3 Big Reasons Why CAC Payback Matters 🤟

CAC Payback Period Stat of the Week 🔢

My Tool of the Week 📊

Latest Week Content Update 🆓

3 Reasons Why Tracking CAC Payback Matters

It reveals your SaaS profitability

CAC payback period is a crucial metric to determine how long it takes to recover the money you spend acquiring a customer.

If you have a shorter payback period, it means you’re recouping your investment faster, which is essential for efficient growth and profitability.

It helps allocate sales and marketing budgets

Understanding your CAC payback helps you fine-tune how much you’re spending to acquire customers and decide where to deploy marketing dollars most effectively.

If your CAC payback is too long, it might be time to rethink your sales and marketing tactics or target more profitable customer segments.

It demonstrates business sustainability to investors

Investors look closely at CAC payback as an indicator of how quickly your company can turn investments in customer acquisition into profit.

A shorter payback period means your company is capital efficient and on the path to sustainable growth, which is attractive to potential investors.

ASP Stat of the Week

12 months

A good CAC payback period benchmark for SaaS companies is 12 months or less. Some SaaS companies aim for as short as 5-7 months. For example, companies like HubSpot have managed to reduce their CAC payback period by optimizing ad spend and focusing on more targeted ideal customer profiles (ICPs), leading to improved customer retention and profitability.

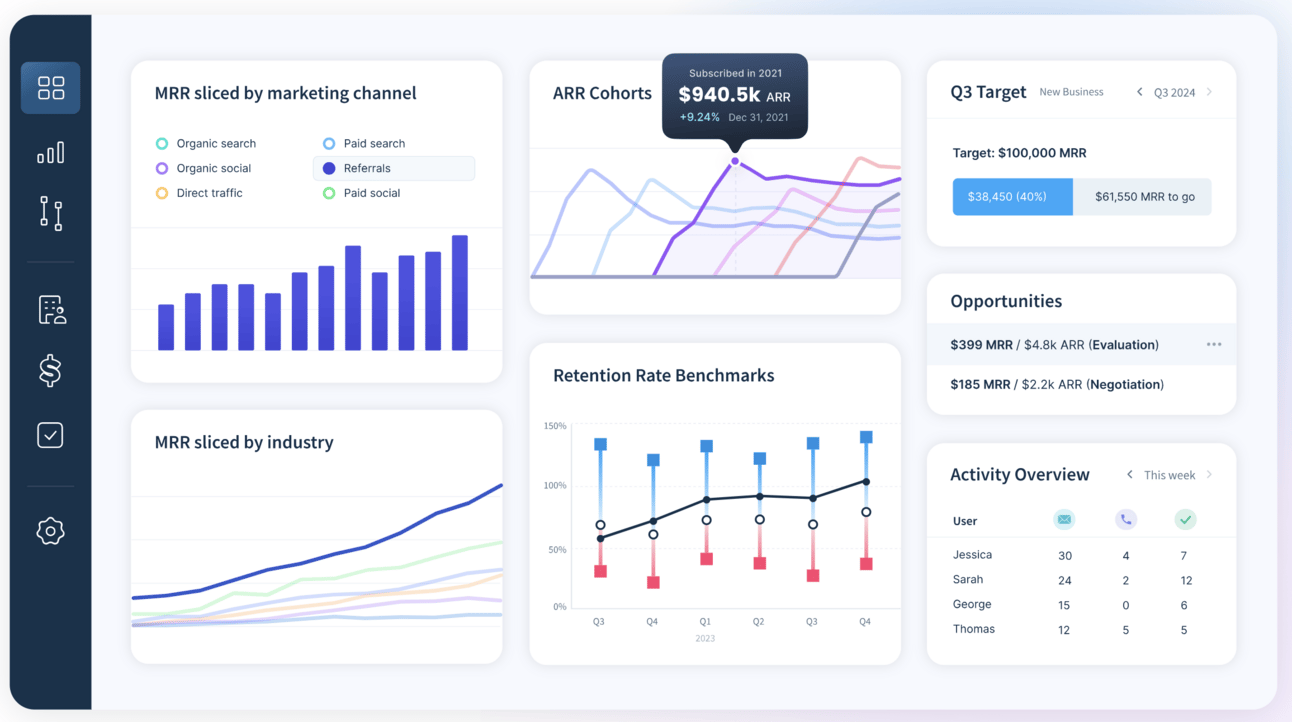

My Tool of the Week

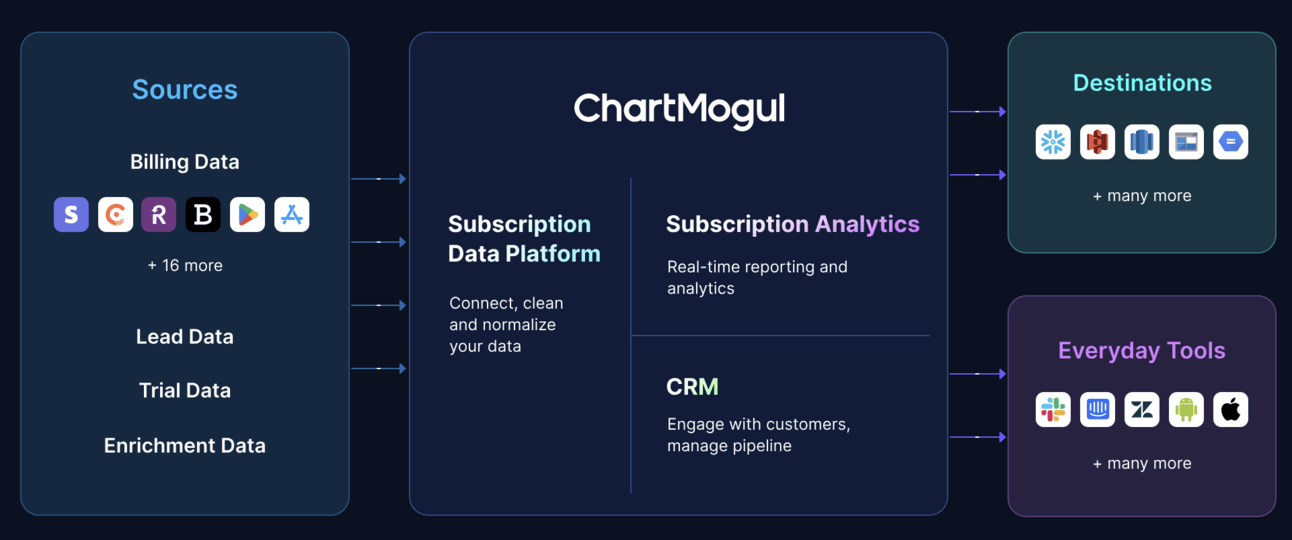

ChartMogul is an excellent tool for managing CAC payback periods effectively.

Here’s why ChartMogul stands out:

Subscription Analytics: ChartMogul offers detailed subscription analytics to help you track customer acquisition costs and understand how they affect your recurring revenue.

Customer Segmentation: Use segmentation tools to dive deeper into how different customer groups perform, giving insights into how to reduce your CAC payback period.

Revenue Recovery Insights: ChartMogul also provides insights into revenue recovery, helping you identify the best strategies for reducing payback periods and improving profitability.

What I love about ChartMogul is how it offers clear, actionable insights into your subscription metrics, making it easier to optimize CAC payback periods and drive smarter growth.

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Aleksandar Stojanovic

Founder of Fiscallion

Fractional CFO & FP&A Boutique Consultancy

P.S. Whenever you’re ready, here’s how I can help:

Free Consultation: Click here to book your free strategy call and see how we can grow your business.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Promote yourself to 5,000+ subscribers by sponsoring my newsletter. Apply here.