Steal our best value stock ideas.

PayPal, Disney, and Nike all dropped 50-80% recently from all-time highs.

Are they undervalued? Can they turn around? What’s next? You don’t have time to track every stock, but should you be forced to miss all the best opportunities?

That’s why we scour hundreds of value stock ideas for you. Whenever we find something interesting, we send it straight to your inbox.

Subscribe free to Value Investor Daily with one click so you never miss out on our research again.

WELCOME TO ISSUE NO #021

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Hey {{first_name}} 👋, in the last issue, we discussed Why tracking AR turnover matters, but now, we are proceeding with Billings & Collections and today’s topic is:

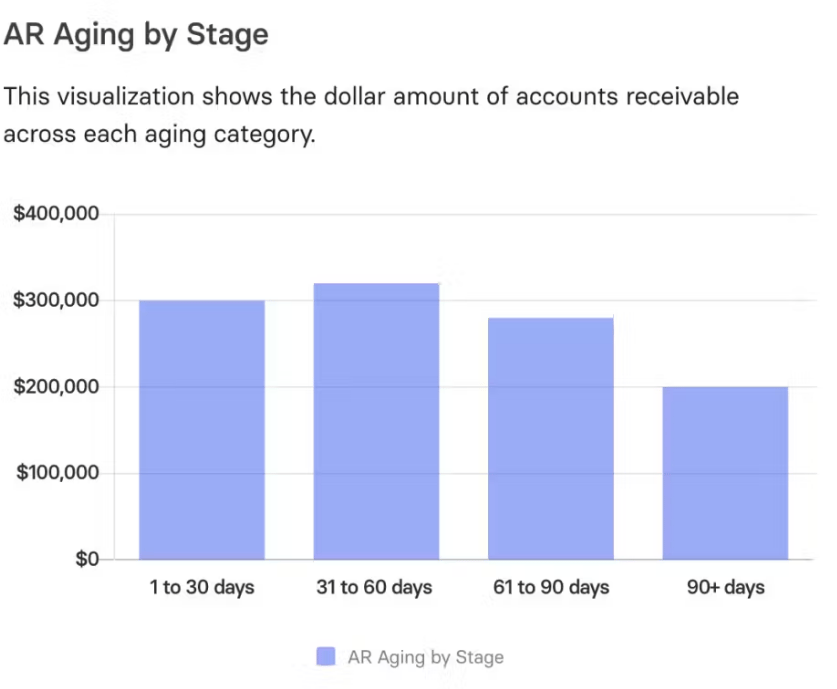

Accounts Receivable Aging

Are You Missing Critical Cash Flow Insights? Master AR Aging Reports.

Newsletter highlights

3 reasons AR aging reports are essential 🤟

AR Aging Stat of the Week 🔢

My Tool of the Week 📊

Latest Week Content Update 🆓

3 Reasons Why AR Aging Reports Are Essential

They help you identify late payments

AR aging reports organize unpaid invoices into 30-day buckets, allowing you to spot overdue accounts that may impact your cash flow.

By identifying customers who consistently pay late, you can take proactive steps to address payment delays, improving your cash inflows.

They help prevent bad debts

Tracking overdue invoices helps you avoid bad debts by alerting you to customers who may become credit risks.

By incorporating late fees and offering early payment discounts, you can incentivize timely payments and reduce the chances of uncollectible debts.

They offer insights into your company’s financial health

Regularly reviewing your AR aging report keeps you informed about the efficiency of your collections process.

This insight allows you to adjust your strategies as needed, ensuring a steady cash flow and maintaining investor confidence.

AR Aging Stat of the Week

90+Days

Invoices that remain unpaid for over 90 days are at high risk of becoming bad debts, potentially harming your company’s cash flow and financial stability.

This week’s shameless plug…

Just a couple days ago, I made a big announcement.

I launched The Financial Strategy Sessions!

What is it?

A flexible option to book a 60-minute power-hour session focused on your financial needs

A chance to dive deep into your business's financial strategy, forecasting, and planning

An opportunity to optimize your financial systems with personalized, expert advice

You can now book these sessions as standalone or as part of the 4-session CFO Program

Ready to elevate your financial strategy?

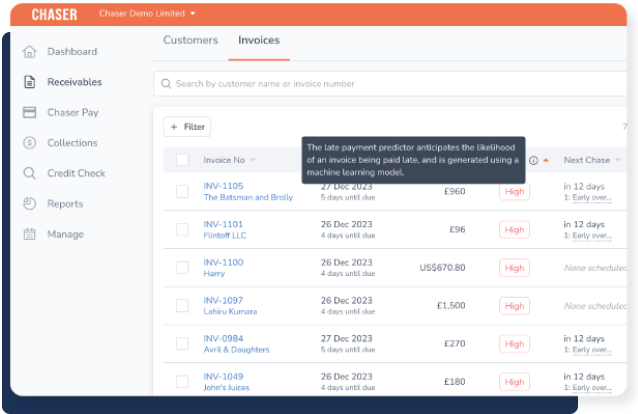

My Tool of the Week

Chaser is an accounts receivable automation tool specifically designed to improve AR aging and cash flow management.

It offers:

Automated Payment Reminders: Automate the process of sending personalized payment reminders to customers, reducing the time spent on manual follow-ups and improving payment timeliness.

Invoice Tracking: Monitor the status of all your outstanding invoices in real-time, helping you quickly identify late payments and take action.

Customizable AR Aging Reports: Generate detailed AR aging reports that can be customized to fit your specific needs, providing clear visibility into your collections process.

What I like most about Chaser is its ability to enhance the collections process through automation and personalization, making it easier to manage overdue invoices and improve your AR aging performance.

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Here are 3 ways I can help you leverage AI in your financial processes:

Free Consultation: Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Promote yourself to 5,000+ subscribers by sponsoring my newsletter. Apply here.

Catch you in the next issue.

— Aleksandar Stojanovic