WELCOME TO ISSUE NO #04

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Happy Saturday! This week I’ve compiled some amazing resources that will definitely impress you.

Let’s break it down in this week’s issue.

💰 How'd you come up with my quota? This one’s for Sales pro’s

👉 12 hard truths every SaaS founder and CFO should read

🧐 Discover: 30 Top Finance & Accounting LinkedIn Creators

I’ve partnered with Wall Street Prep and Wharton Online to bring you an incredible opportunity to save hundreds of dollars and build your FP&A career. Check out this a one-of-a-kind, theory-meets-practice, FP&A certificate program. Details below.

My friend Bojan Radojicic launched a value-packed Financial Modeling Course and his students are loving it. So if you’re looking to elevate your career, check it out below.

I’d love to get your thoughts on this week’s poll. Share your thoughts below!

👇 Watch: 5 Interesting Learnings from DropBox at $2.5 Billion in ARR by Jason

Just a heads-up - this email’s sprinkled with affiliate links. If you fancy exploring them, it’s a great way to back this newsletter!

Bonus Story

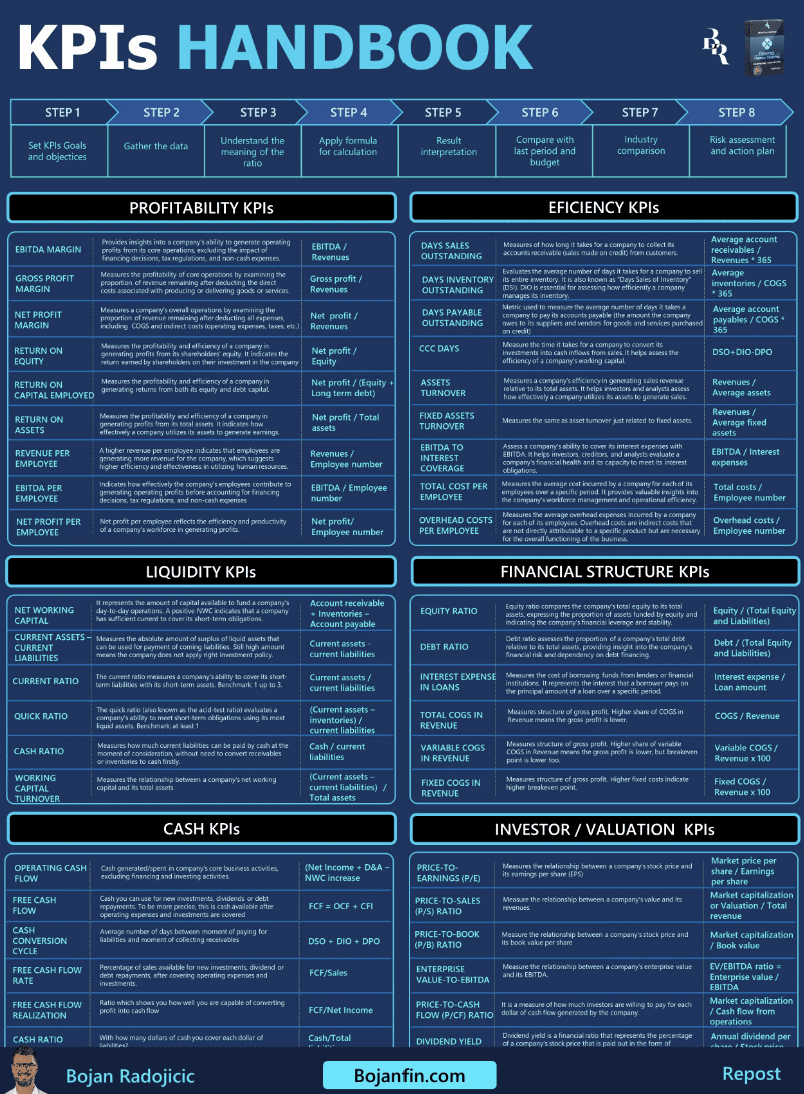

Mega KPIs & Metrics Bundle of Resources

This is a goldmine of KPI resources.

Bojan created this for us and offers it for FREE.

It includes:

𝗞𝗣𝗜𝘀 𝗵𝗮𝗻𝗱𝗯𝗼𝗼𝗸

A list of 50+ KPIs (mostly financial)

5𝟬 𝗞𝗣𝗜𝘀 𝗳𝗼𝗿 𝟭𝟬 𝗶𝗻𝗱𝘂𝘀𝘁𝗿𝗶𝗲𝘀

Selected KPIs best for each industry

𝟮𝟭 𝗜𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁 𝗶𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿

𝗠𝗲𝘁𝗿𝗶𝗰𝘀 𝗳𝗼𝗿 𝗦𝗔𝗔𝗦

𝗘𝗕𝗜𝗧𝗗𝗔 𝘃𝘀 𝗡𝗲𝘁 𝗽𝗿𝗼𝗳𝗶𝘁 𝘃𝘀 𝗙𝗿𝗲𝗲 𝗖𝗮𝘀𝗵 𝗳𝗹𝗼𝘄

𝗥𝗢𝗔 𝘃𝘀 𝗥𝗢𝗘 𝘃𝘀 𝗥𝗢𝗖𝗘 𝘃𝘀 𝗥𝗢𝗜

𝗠𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁 𝗿𝗲𝗽𝗼𝗿𝘁𝘀 𝘄𝗶𝘁𝗵 𝗞𝗣𝗜𝘀

𝗖𝘂𝘀𝘁𝗼𝗺𝗲𝗿 𝗹𝗶𝗳𝗲 𝘁𝗶𝗺𝗲 𝘃𝗮𝗹𝘂𝗲

...and more

"How'd you come up with my quota?"

Today, let’s set aside the complex algorithms and statistical models typically used to optimize sales organizations and compensation structures. Instead, I want to share three straightforward, experience-based rules of thumb for structuring your sales teams. These aren’t backed by heavy data, but they are honed by real-world application and a fair bit of gut instinct.

One-Third of Your Sales Reps Should Carry Individual Quotas

A Rep’s Quota Should Be At Least 5x Their On-Target Earnings

Plan for 80% Quota Achievement

“One-Third of Your Sales Reps Should Carry Individual Quotas”

Picture this: in a typical sales "pod," you have one quota-carrying rep. This rep is your frontline warrior, tasked with clinching new deals. Supporting this rep is a team that includes a manager, a system engineer for technical details, and a business development rep who helps generate leads. This structure scales up, with managers overseeing several reps, each supported by system engineers and SDRs, and so on up the hierarchy to the VP of Sales.

But here’s the catch: only about one-third of your sales force should actually be quota carriers. Why? Because having fewer quota carriers suggests a potentially bloated team structure where too many are feeding from the pot but not enough are contributing to filling it.

I thought you held the quota!

“A Rep’s Quota Should Be At Least 5x Their On-Target Earnings”

Let’s delve into the nitty-gritty of compensation. Say a rep is on a 50/50 plan with $100K base and $100K variable, totaling $200K in on-target earnings. At a minimum, this rep’s quota should be around $1 million. This setup ensures that their contribution margin significantly benefits the business. Problems arise when quotas are not proportionately high compared to salaries, creating a no-man's land where the business neither loses nor gains much financially. This is particularly risky when new reps are still ramping up, a process that can take months without generating immediate revenue.

“Plan for 80% Quota Achievement”

Realistically, not every target set will be hit. That’s why it’s prudent to plan for 80% achievement across your sales teams. This planning should align with three different forecasts: the internal operating plan, the board’s expectations, and, if applicable, the public street plan. Your operating plan should be the most ambitious, allowing for strategic bets and innovations, while your board plan should provide a buffer for underperformance against these high expectations.

Moreover, it's wise to slightly over-deploy quotas at each level of the sales hierarchy to accommodate factors like employee turnover, which is typically high in sales roles. Some attrition is normal, as reps might leave if they see they’re not on track to meet their targets, or management may decide to cut underperformers.

Chef’s are ruthless sales managers.

While these rules are less formal, they are practical and tested in the field. They can guide you in creating a lean, effective sales organization that not only meets its targets but also drives significant business growth.

Until next time, keep strategizing and watch your sales soar!

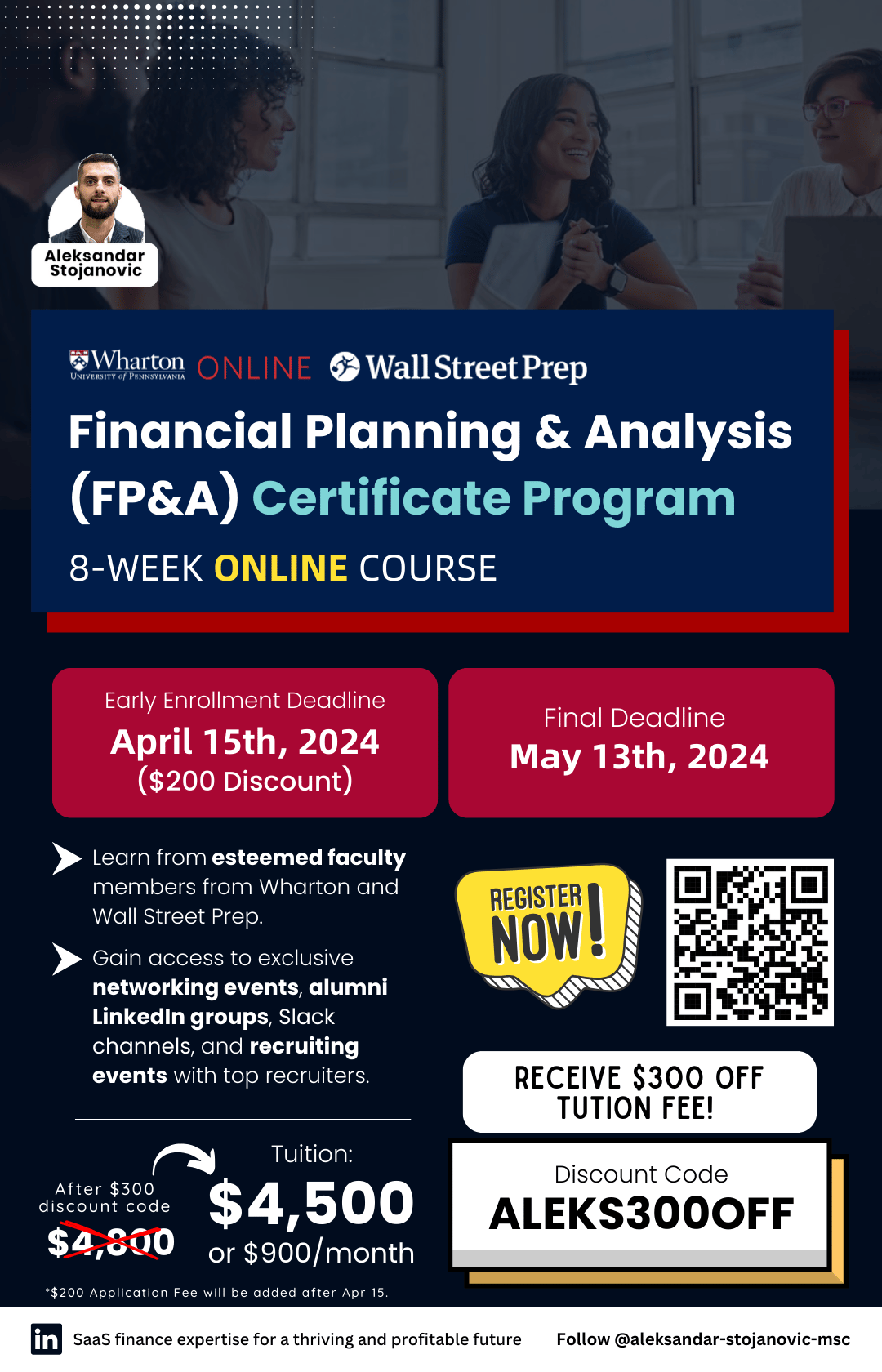

Introducing Wharton & Wall Street Prep's Exclusive FP&A Certificate Program

When: 8 Weeks May 13 - July 7, 2024 (8 weeks)

Time Commitment: 8 Hours per Week

Format: Online Self Paced with Live Office Hours

Early Registration Deadline: April 15th, 2024

Tuition: $5,000 (save $500 using my affiliate registration link)

Certificate: Issued by Wharton and Wall Street Prep

Closing Ceremony: Penn Club in NYC (Attend Live or Virtually)

Faculty: Taught jointly by Wharton & Wall Street Prep

Guest Speakers: Marcela Martin (Buzzfeed), Josette Leslie (Affinity.co), Debbie Sebastian (Eagle Family Foods Group), and more.

Alumni Benefits including:

Exclusive Networking Events

Invites to Alumni LinkedIn Group and Slack Channels

Exclusive Recruiting events with top Recruiters

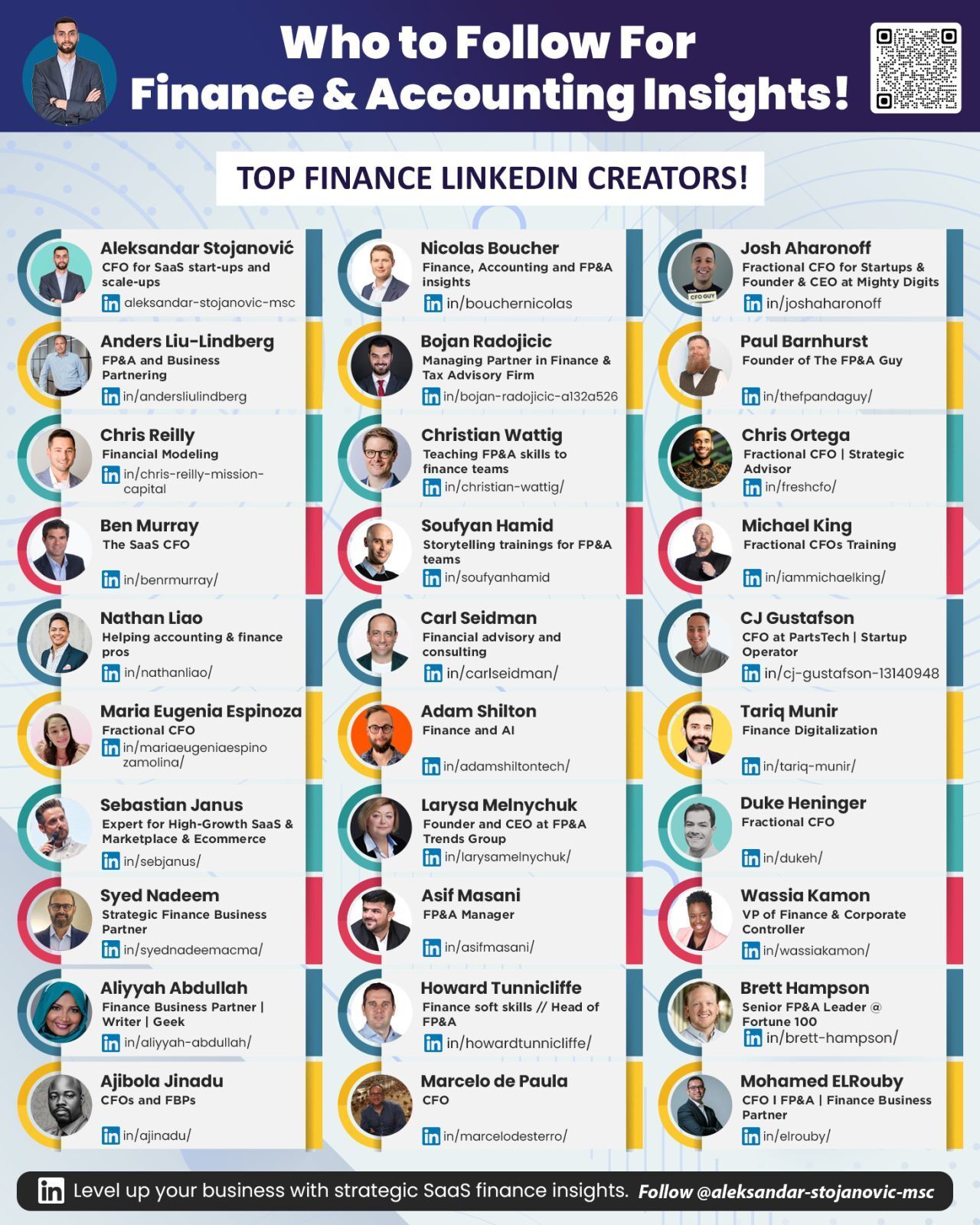

30 Top Finance & Accounting LinkedIn Creators

Ever feel like you're hitting a plateau in your Finance & Accounting career? Are you eager to learn from the industry's best and gain access to resources that could elevate your professional skills? If that sounds like you, you're in for a treat!

We've curated a list of the top Finance & Accounting influencers on LinkedIn—professionals who are at the forefront of sharing valuable insights, practical tips, and industry best practices. Here’s your chance to dive into a wealth of knowledge on topics such as:

Accounting Standards and Principles

Financial Reporting and Auditing

Financial Modeling and Analysis

Business Valuation and M&A

Budgeting and Forecasting

Following these influencers will not only broaden your understanding but also inspire you with their personal stories of challenges and achievements. Plus, it’s a fantastic opportunity to network with them and connect with a community of like-minded professionals passionate about Finance & Accounting.

Ready to transform your professional journey?

Here’s the link to start following these amazing influencers today:

These individuals have significantly influenced my career, providing insights and guidance that have been invaluable.

I'm confident they can do the same for you.

Start following and see how far you can go!

Visit Fiscallion.io to learn more

Partnering with the us enables you to avoid surprises, provide financial and strategic context and ensure that the company is on the right track.

✔ Financial Model Updates and Ongoing Maintenance

✔ Board Reporting and Investor Relations

✔ Budgeting and Scenario Planning

✔ Detailed Month-End Analysis

✔ Advanced Metric Tracking

✔ Get More Clarity

✔ Save Time

12 hard truths every SaaS Founder and CFO should read

In the fast-paced world of SaaS, the road to success is lined with its fair share of challenges and learning curves. Today, let’s discuss some hard truths that every SaaS founder and CFO should consider—a little reality check that could guide you towards more effective and sustainable growth.

When your top performers leave, it’s a chance to introspect rather than point fingers. What can your organization improve?

It’s less about remote vs. office and more about trusting your team, regardless of their physical location.

Being resistant to feedback can cripple your ability to adapt in the ever-evolving SaaS landscape.

Ensure your financial choices mirror your company’s core values, or your team will notice the mismatch.

Diversity should be visible not only in your team but also in leadership roles and decision-making processes.

Skimping on funding crucial departments is not lean management; it’s a gamble on your startup’s future.

A negative internal culture can tarnish your product and customer relationships.

In SaaS, where service is key, happy employees lead to satisfied customers.

Micromanaging, especially in finance and product teams, can quash creativity and innovation.

Keep your best talent by ensuring their personal growth aligns with your company’s scaling journey.

Leading through intimidation can stifle creativity and problem-solving within your teams.

If you don’t compensate your team fairly, rest assured, your competitors will.

These insights serve as a reminder that placing your people first not only enhances your workplace but also propels your SaaS business towards sustainable success.

Reflect on these truths as you navigate your leadership journey. Adjusting your strategies in these areas can significantly impact your company’s morale, innovation, and overall growth.

If you’re looking to elevate your career, check out The Financial Modeling Course by Bojan.

This is the method that made Bojan and other students go from misunderstood analysts to respected finance leaders.

Earn free gifts 🎁

You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

POLL TIME

How did you enjoy this week's topics?

How would you improve the Startup Finance🚀?

Can you do me a favor? I want to know you better.

If you have specific suggestions or feedback, simply reply to this e-mail.

How can I help you?

Book a Growth Call: Looking to scale your company? Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Dive into 1:1 Coaching: Personalized coaching can make all the difference. Let's work together to navigate the complexities of finance and set you on the path to success. Click here to start your 1:1 coaching journey.

Sponsor an Issue of the Startup Finance: Want to reach a dedicated audience of founders & finance enthusiasts? Consider sponsoring a future issue of the Startup Finance. Contact me here for sponsorship details.

Leave a Testimonial: I would appreciate if you could leave a 5-star rating for this newsletter if you enjoyed it here.

Thanks so much for reading.

Aleksandar