Better business banking, from idea to IPO

Rho is the business banking platform with everything you need to manage your company cash and scale your business. Apply in minutes and enjoy 24/7 customer support plus enterprise-grade spend management – all with zero monthly, wire, or ACH fees.

Two business bank account options, one powerful platform.

Operate with stress-free banking, $0 ACH and wire fees.

Getup to $75M in FDIC deposit insurance to secure non-operating cash while earning yield.

Banking services provided and cards issued by Webster Bank, N.A., Member FDIC. International and foreign currency payments services provided by Wise US, Inc. Treasury Management services provided by American Deposit Management, LLC. All Rights reserved. © 2019-2024 Under Technologies, Inc. DBA Rho Technologies. Rho is a trademark of Under Technologies, Inc. Rho is a fintech company, not a bank. Rho partners with FDIC-insured banks to offer banking products and services.

👋 Welcome to the 98 new Founders & Finance Pro’s who joined us since last Saturday. If you haven’t subscribed, join 5,000 people getting smarter.

WELCOME TO ISSUE NO #015

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Happy Saturday! This week I’ve prepared a one big TOPIC and one freebie just for you.

TL;DR

Revenue: Track sales pipeline for accurate projections and growth.

Gross Profit: Optimize product/service profitability.

Net Profit: Set goals to manage expenses and increase profits.

Cash: Reserve 3 months’ operating expenses to avoid cash flow issues.

Debt: Strategically manage debt within your financial plan.

Processes: Ensure solid bookkeeping, budgeting, and cash flow management.

I’ve partnered with my friend Tariq Munir to bring you an incredible opportunity to excel your career & your business with AI. More details below.

👇 Watch: How to Live a Stress-Free Financial Life by Clint

Just a heads-up - this email’s sprinkled with affiliate links. If you fancy exploring them, it’s a great way to back this newsletter!

I’m excited to create some valuable courses just for you!

Last week, I only received a few responses to my poll about course topics, and I really want your input to make sure I’m meeting your needs.

Your feedback is incredibly important to me, and it will help shape the content that can best support your goals.

Could you take a moment to share your thoughts by participating in the poll below?

It only takes a minute, and your voice matters!

Thank you so much for your help!

Which course would you like me to create for you?

Partnering with the us enables you to avoid surprises, provide financial and strategic context and ensure that the company is on the right track.

✔ Financial Model Updates and Ongoing Maintenance

✔ Board Reporting and Investor Relations

✔ Budgeting and Scenario Planning

✔ Detailed Month-End Analysis

✔ Advanced Metric Tracking

✔ Get More Clarity

✔ Save Time

FREEBIE

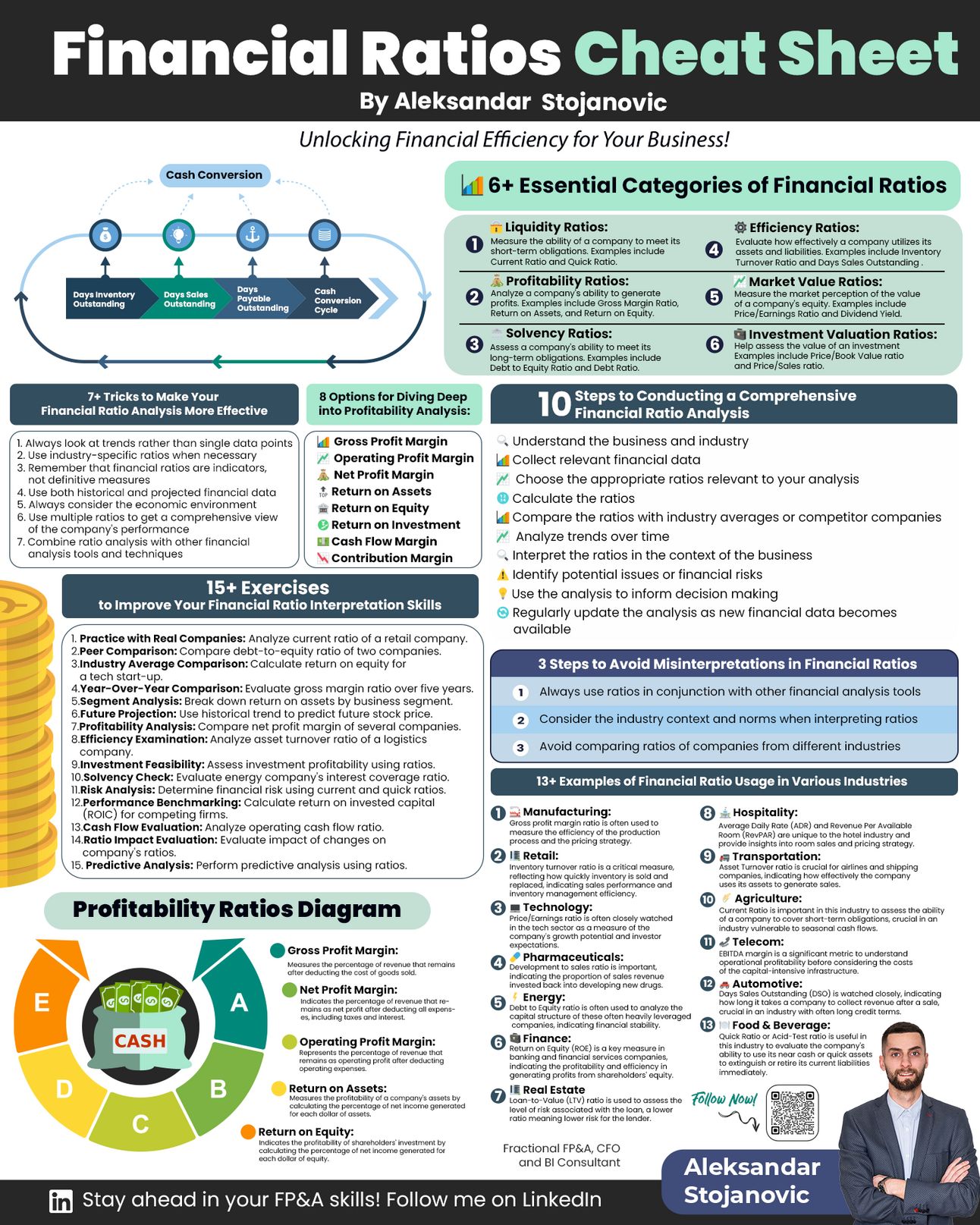

The Financial Ratios Cheat Sheet👇

Grab a PDF with all the information at:

Here's what you'll get....

6+ essential categories of financial ratios

10 steps to conducting a comprehensive financial ratio analysis

3 steps to avoid misinterpretations in financial ratios

8 options for diving deep into profitability analysis

13+ examples of financial ratio usage in various industries

15+ exercises to improve your financial ratio interpretation skills

7+ tricks to make your financial ratio analysis more effective

Ever dreamt of crafting stories, sharing insights, or building a community around your passions?

Now’s the perfect time to start your own newsletter. Whether it's about tech trends, personal journeys, or niche hobbies, your voice matters.

Bring your ideas to life and join a thriving community of creators.

Who knows where your words might take you?

6 Financial Keys to Success in Business

Disclaimer: Opinions are my own. Not investment advice. Do your own research.

1. Revenue

Projecting your company’s revenue accurately is a superpower. But since you don’t have a crystal ball, what’s the next best thing to predict revenue?

A sales pipeline.

Start tracking your lead generation activities and document the sales process so that you can project sales with a reasonable margin of error.

This will not only help you project revenue more accurately but will also reveal how to increase your revenue with more of what works and waste less time on tactics that don’t work.

2. Gross Profit

Why does gross profit matter?

Because knowing your gross profit tells you if you’re making enough profit on the product or service itself, apart from any overhead expenses.

Gross profit is the profit you have after paying for direct labor and cost of materials. For instance, a bakery that charges $100 for a cake and spends $35 on labor, $25 on ingredients, and $5 on a cake box earns a gross profit of $35.

($100 - $35 - $25 - $5) = $35

The gross profit margin is the gross profit expressed as a percentage of revenue.

$35 / $100 = 35%

You need to start by identifying gross profit and gross profit margin targets to figure out where your company is losing money and how to fix it.

3. Net Profit

Net profit is the “bottom line”. It’s your company’s gross profit minus all your overhead expenses.

You need a goal for net profit to prioritize overhead expenses and identify investments versus which expenses are a waste of money.

For instance, if your revenue is $2M, gross profit is $1M and expenses are $900k, that only leaves you with $100k net profit, which is 5% of $2M of revenue. To achieve a 10% net profit margin you need another $100k in net profit either from increasing gross profit, cutting expenses, or a combination of the two.

Setting a net profit goal is essential to keeping more revenue!

4. Cash

Cash really is king when it comes to business finance.

82% of business go out of business because of cash flow problems. They simply run out of money!

Aim to save 3 months of operating expenses in cash and keep that money saved in a separate bank account.

What’s more, net profit isn’t the same cash - it doesn’t all go into your pocket. You have to pay taxes on that net profit, you probably want to pay yourself with some of that profit, and you want to be strategic about how to balance saving and reinvesting the remaining cash.

Cash flow management is often literally the difference between succeeding and failing in business.

5. Debt

Debt can be used wisely in a company, but they don’t call it a “liability” for no reason!

If you have debt, you need a plan to pay it off in balance with keeping enough cash in the business.

Sometimes you might want debt to have access to more cash or perhaps you’re seeking a loan to grow the business more quickly.

The overall principle for this: decisions about debt shouldn’t be made in a vacuum. These decisions need to be weighed carefully with the whole financial picture of the business in mind.

6. Processes

Having strong day-to-day financial processes will keep cash flowing in your business, give you control over expenses, and provide consistent clarity about your company’s financial performance.

Every business needs the following:

A bookkeeper who reconciles the books accurately each month.

A 12-month budget and review process to be intentional about spending.

A 12-month financial projection with time dedicated to reviewing and updating in order to make wise future-oriented decisions.

A cash flow forecast so you can manage your cash effectively and never worry about running out of money.

WANT TO EXCEL IN THESE 6 FINANCIAL KEYS TO SUCESS WITHOUT THE HEADACHE OF FIGURING IT OUT?

I CAN HELP ⬇️

I’ve developed a top-notch assessment called the Financial Health Accelerator.

You’ll Get:

A diagnostic of your company’s performance on each of these 6 financial keys to success.

A roadmap to your personal and business goals with clear financial targets.

Specific recommendations you can take action on immediately to achieve results without guess work.

A one-hour presentation with Q&A and a 40-60 page detailed report, written in an easy-to-read format designed for “non-finance people”.

To get started, send a DM to LinkedIn or an email to [email protected] with the subject “Financial Health Accelerator”.

Earn free gifts 🎁

You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

POLL TIME

How would you rate today's newsletter?

If you have specific suggestions or feedback, simply reply to this e-mail.

How can I help you?

Book a Growth Call: Looking to scale your company? Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Dive into 1:1 Coaching: Personalized coaching can make all the difference. Let's work together to navigate the complexities of finance and set you on the path to success. Click here to start your 1:1 coaching journey.

Sponsor an Issue of the Startup Finance: Want to reach a dedicated audience of founders & finance enthusiasts? Consider sponsoring a future issue of the Startup Finance. Contact me here for sponsorship details.

Leave a Testimonial: I would appreciate if you could leave a 5-star rating for this newsletter if you enjoyed it here.

Thanks so much for reading.

Aleksandar