Better business banking, from idea to IPO

Rho is the business banking platform with everything you need to manage your company cash and scale your business. Apply in minutes and enjoy 24/7 customer support plus enterprise-grade spend management – all with zero monthly, wire, or ACH fees.

Two business bank account options, one powerful platform.

Operate with stress-free banking, $0 ACH and wire fees.

Getup to $75M in FDIC deposit insurance to secure non-operating cash while earning yield.

Banking services provided and cards issued by Webster Bank, N.A., Member FDIC. International and foreign currency payments services provided by Wise US, Inc. Treasury Management services provided by American Deposit Management, LLC. All Rights reserved. © 2019-2024 Under Technologies, Inc. DBA Rho Technologies. Rho is a trademark of Under Technologies, Inc. Rho is a fintech company, not a bank. Rho partners with FDIC-insured banks to offer banking products and services.

👋 Welcome to the 102 new Founders & Finance Pro’s who joined us since last Saturday. If you haven’t subscribed, join 5,000 people getting smarter.

WELCOME TO ISSUE NO #016

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Happy Saturday! This week I’ve prepared a one big TOPIC and one freebie just for you.

TL;DR

Structure: GPs (fund managers) raise money from LPs (investors).

Capital: Funds are committed and drawn as needed.

Metrics:

DPI: Cash returned

TVPI: Total value, including unrealized gains.

Fees: "2-20" model (2% management fee, 20% profit share above 8%).

Profit Sharing: Full catch-up means GPs get 20% of total returns above the hurdle.

I’ve partnered with my friend Tariq Munir to bring you an incredible opportunity to excel your career & your business with AI. More details below.

👇 Watch: Learn how to create a PivotTable Profit & Loss by Josh

Just a heads-up - this email’s sprinkled with affiliate links. If you fancy exploring them, it’s a great way to back this newsletter!

I’m excited to create some valuable courses just for you!

Last week, I only received a few responses to my poll about course topics, and I really want your input to make sure I’m meeting your needs.

Your feedback is incredibly important to me, and it will help shape the content that can best support your goals.

Could you take a moment to share your thoughts by participating in the poll below?

It only takes a minute, and your voice matters!

Thank you so much for your help!

Which course would you like me to create for you?

Partnering with the us enables you to avoid surprises, provide financial and strategic context and ensure that the company is on the right track.

✔ Financial Model Updates and Ongoing Maintenance

✔ Board Reporting and Investor Relations

✔ Budgeting and Scenario Planning

✔ Detailed Month-End Analysis

✔ Advanced Metric Tracking

✔ Get More Clarity

✔ Save Time

FREEBIE

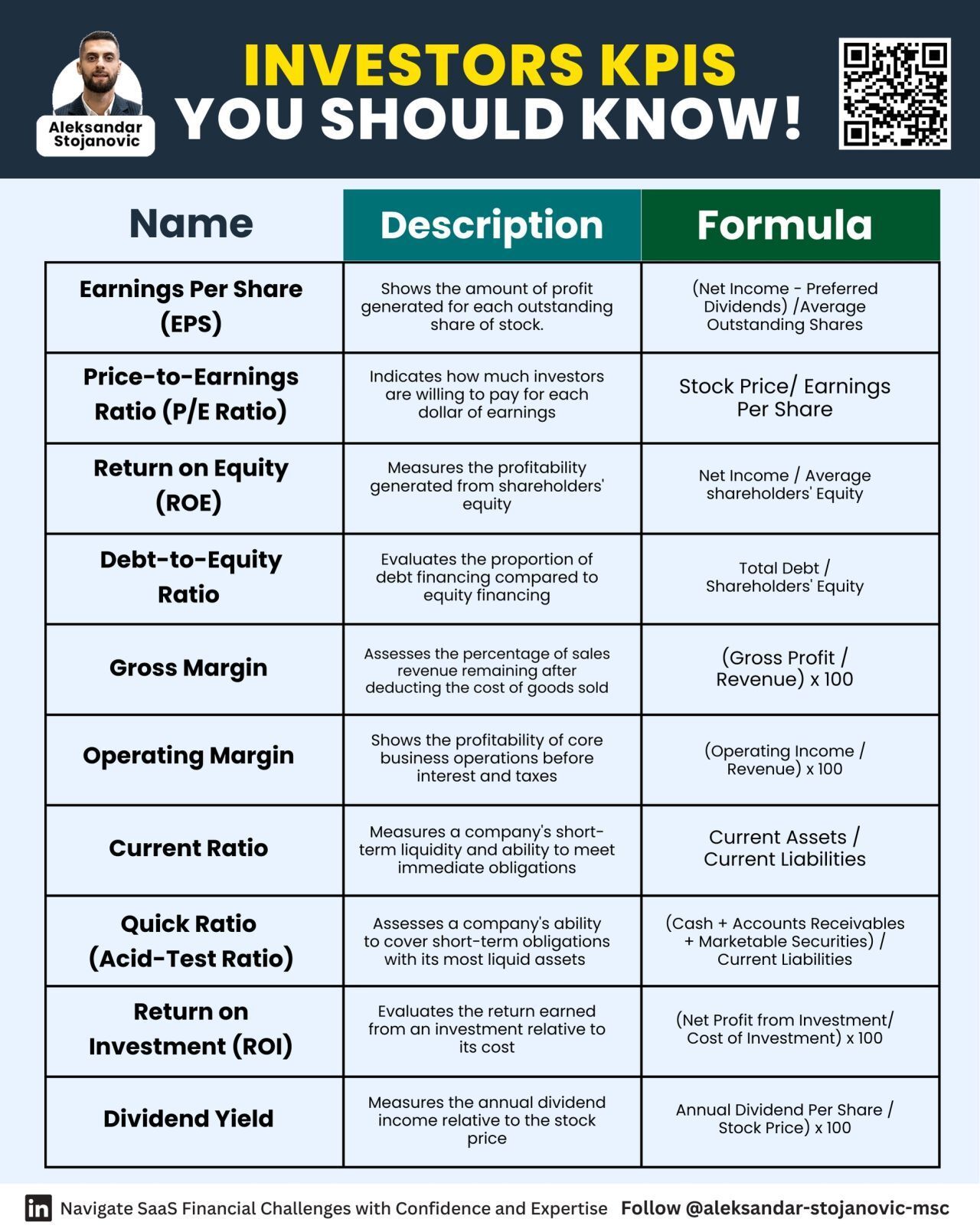

10 Investors KPIs You Should Know👇

Grab a PDF with all the information at:

Here's what you'll get....

Earnings Per Share (EPS)

Price-to-Earnings Ratio (P/E ratio)

Return on Equity (ROE)

Debt-to-Equity Ratio

Gross Margin

Operating Margin

Current Ratio

Quick Ratio

ROI

Dividend Yiel

Ever dreamt of crafting stories, sharing insights, or building a community around your passions?

Now’s the perfect time to start your own newsletter. Whether it's about tech trends, personal journeys, or niche hobbies, your voice matters.

Bring your ideas to life and join a thriving community of creators.

Who knows where your words might take you?

How do PE VC Funds work?

Disclaimer: Opinions are my own. Not investment advice. Do your own research.

How does a Private Equity / Venture Capital fund work? What are PE VC Funds?

In this issue we decode the world of PE VC funds, and the key terminologies associated with them.

First up – Why PE / VC funds are needed?

Ultra rich investors, having already invested in listed Equities and Debt markets, are looking for diversification and higher return potential.

So they turn to early stage #investing (unlisted equity)

How does the PE VC Fund work?

A PE / VC fund manager raises money, to invest in unlisted ventures (usually). They could define themes, like consumer funds, or tech funds, or could be sector agnostic

Who are General Partners / Limited Partners in PE VC Funds?

In simple terms, the Fund Manager is the General Partner (GP), and the investors are Limited Partners (LP).

Committed Capital?

The amount committed by the investor (Paid-in Capital).

Drawdown

The GP (Fund Manager) may draw capital at different points, rather than all at the beginning. This way, capital is called only when it is to be invested.

DPI and TVPI

As the exits from some of the unlisted investments happen in PE VC Funds, the GP distributes the money to LPs.

Terms like DPI (Distributions to Paid in Capital) and TVPI (Total Value to Paid in Capital) become key metrics.

Say the investor puts in $100 million. This is invested in 10 companies (INR 10 mn each).

If the first company is exited at $60 million (and this is distributed), and the value of the other 9 investments is $120 mn (these are yet to be exited)

DPI here would be 60/100 = 0.6

And TVPI would be (120+60)/100 = 1.8

What is the fee structure like for PE VC Funds?

Usually most PE VC funds operate on a 2-20 structure, with a Hurdle rate.

2-20?

So the management fee is 2%. Then there is a carry (profit sharing) of 20%, above a certain hurdle return – say 8%

If the fund return > 8%, then 20% is shared with the Fund Manager (FM).

But what is Catch Up?

20% above 8% is the profit sharing, but what about upto 8%. This is what Catch up defines.

If a fund has Full Catchup – it means that if the return crosses 8%, then the FM gets 20% on the entire return.

For example, if the fund generates 15%, then in full catch-up, the carried interest would be 20% of the entire 15%.

But in a No Catchup scenario, it would be 20% of the return above the hurdle (15%-8%)

What is a Distribution Waterfall?

This defines how the funds will be distributed. Think of a simple 1 year fund.

Suppose you invest 100 in this fund.

Till the fund value crosses 108 (8% of the Paid in capital), there is no profit sharing.

But above 108, profit sharing begins. The next 2% goes to the FM, so that by the time the return reaches 10% (up to Fund Value 110), 20% of the entire return is shared with the FM.

Returns above this are shared 80:20.

Venture Capital is a booming segment in USA. Knowing these concepts helps everyone: a founder, a financial management team as well as an investor.

WANT TO GET CLARITY ON YOUR FINANCIAL HEALTH?

I CAN HELP ⬇️

I’ve developed a top-notch assessment called the Financial Health Accelerator.

You’ll Get:

A diagnostic of your company’s performance on each of these 6 financial keys to success.

A roadmap to your personal and business goals with clear financial targets.

Specific recommendations you can take action on immediately to achieve results without guess work.

A one-hour presentation with Q&A and a 40-60 page detailed report, written in an easy-to-read format designed for “non-finance people”.

To get started, send a DM to LinkedIn or an email to [email protected] with the subject “Financial Health Accelerator”.

Earn free gifts 🎁

You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

POLL TIME

How would you rate today's newsletter?

If you have specific suggestions or feedback, simply reply to this e-mail.

How can I help you?

Book a Growth Call: Looking to scale your company? Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Dive into 1:1 Coaching: Personalized coaching can make all the difference. Let's work together to navigate the complexities of finance and set you on the path to success. Click here to start your 1:1 coaching journey.

Sponsor an Issue of the Startup Finance: Want to reach a dedicated audience of founders & finance enthusiasts? Consider sponsoring a future issue of the Startup Finance. Contact me here for sponsorship details.

Leave a Testimonial: I would appreciate if you could leave a 5-star rating for this newsletter if you enjoyed it here.

Thanks so much for reading.

Aleksandar