This smart home company grew 200% month-over-month…

No, it’s not Ring or Nest—it’s RYSE, a leader in smart shade automation, and you can invest for just $1.75 per share.

RYSE’s innovative SmartShades have already transformed how people control their window coverings, bringing automation to homes without the need for expensive replacements. With 10 fully granted patents and a game-changing Amazon court judgment protecting their tech, RYSE is building a moat in a market projected to grow 23% annually.

This year alone, RYSE has seen revenue grow by 200% month-over-month and expanded into 127 Best Buy locations, with international markets on the horizon. Plus, with partnerships with major retailers like Home Depot and Lowe’s already in the works, they’re just getting started.

Now is your chance to invest in the company disrupting home automation—before they hit their next phase of explosive growth. But don’t wait; this opportunity won’t last long.

WELCOME TO ISSUE NO #034

Consulting | Shop | Website | Newsletter | Speaking

📆 Today’s Rundown

Hey {{first_name}} 👋, sorry for not being around for 2 Saturdays, but I was moving to a new apartment, onboarded bunch of new clients and needed to take care of existing ones. I hope you missed me, because this week you’re getting 2 issues, first being this one!

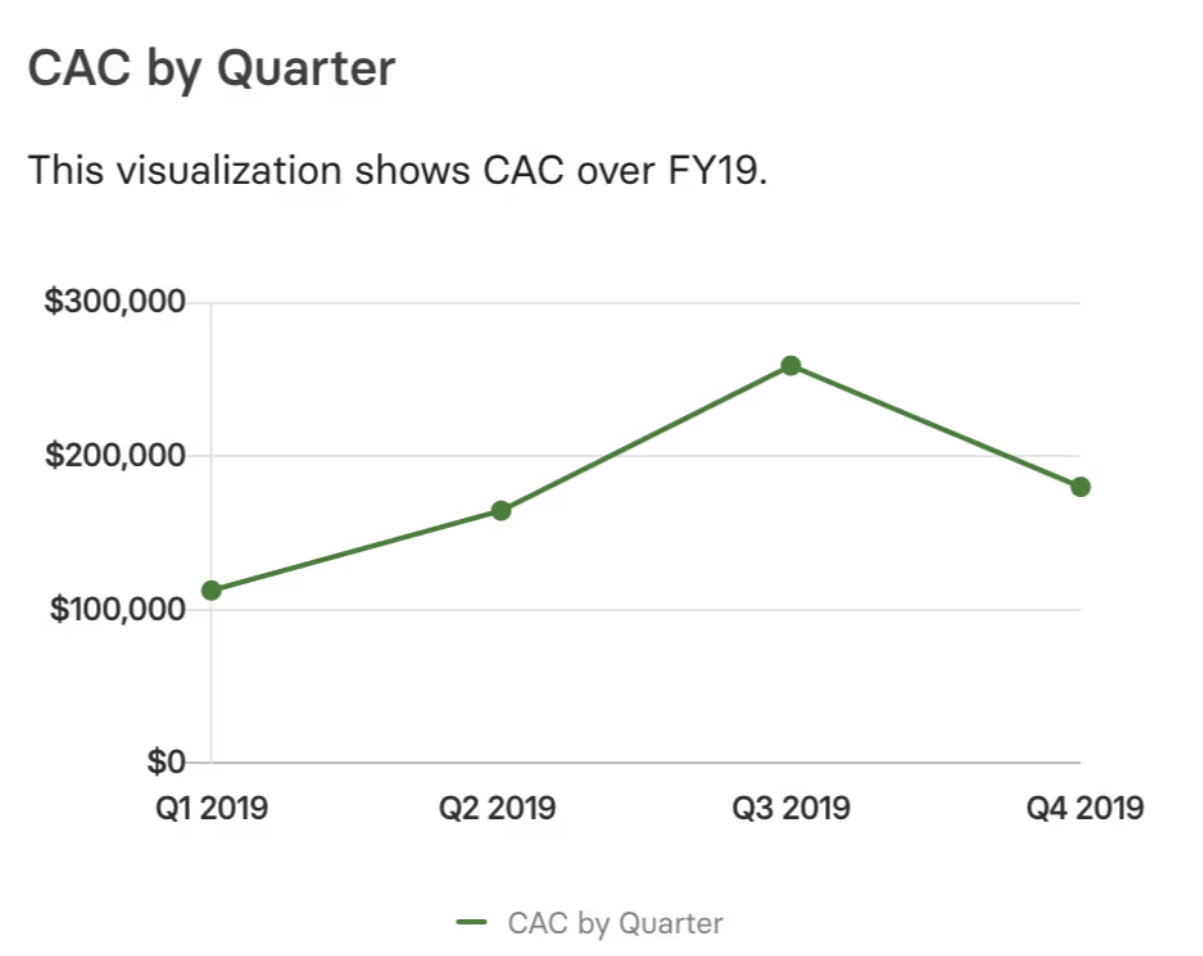

So in the last issue, we discussed why tracking Cost to Serve matters, and now we are moving with the next topic from Bookings & Customers content, and today’s topic is:

Customer Acquisition Cost (CAC)

Is Your CAC Holding Back Your Growth?

Newsletter highlights

3 Big Reasons Why CAC Matters 🤟

CAC Stat of the Week 🔢

My Tool of the Week 📊

Content Update 🆓

3 Reasons Why Tracking CAC Matters

It measures the efficiency of your growth strategy

Customer Acquisition Cost (CAC) is the cornerstone of understanding how effective your sales and marketing efforts are.

A clear view of CAC helps you evaluate whether your growth strategies are scalable and profitable.

It informs strategic decision-making

Understanding CAC in context (e.g., alongside LTV, CAC ratio, and payback period) provides insights into the sustainability of your business model.

With this data, you can make informed decisions to allocate resources more effectively.

It’s a key indicator for investors

Investors closely scrutinize CAC to assess how efficiently a company converts marketing dollars into recurring revenue.

A lower, optimized CAC signals strong growth potential and capital efficiency, making your business more attractive to potential backers.

CAC Stat of the Week

$250

That’s the average CAC for SaaS companies with high-ACV customers, according to a recent ProfitWell study. For example, Shore successfully reduced their CAC by 35%. Shore has achieved a 12X increase in leads and reduced customer acquisition costs by 35% by adapting their inbound methodology with HubSpot. Read more in this case study by HubSpot.

My Tool of the Week

Mutiny is a cutting-edge AI-driven platform designed to optimize your CAC by personalizing your website and marketing funnels. Here’s why Mutiny is an excellent choice for managing CAC:

AI Personalization: Leverage AI to create tailored experiences for website visitors based on their behavior, location, or firmographics, increasing conversion rates.

Real-Time Insights: Gain actionable insights on which strategies reduce your CAC and improve ROI across campaigns.

Seamless Integration: Mutiny integrates with your existing CRM and analytics tools to provide a unified view of customer acquisition efforts.

What I love about Mutiny is its ability to personalize at scale, allowing companies to efficiently acquire customers by targeting the right segments with the most effective messaging.

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Aleksandar Stojanovic

Founder of Fiscallion

Fractional CFO & FP&A Boutique Consultancy

P.S. Whenever you’re ready, here’s how I can help:

Free Consultation: Click here to book your free strategy call and see how we can grow your business.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Promote yourself to 5,000+ subscribers by sponsoring my newsletter. Apply here.