👋 Welcome to the 92 new Founders & Finance Pro’s who joined us since last Saturday. If you haven’t subscribed, join 5,000 people getting smarter.

WELCOME TO ISSUE NO #012

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Happy Saturday! This week I’ve prepared a one big TOPIC and one freebie just for you.

TL;DR

ARPA (Average Revenue Per Account): See how much each customer brings in on average. Higher ARPA means your sales strategies are working.

MRR (Monthly Recurring Revenue): Track your predictable monthly income. Growing MRR is a good sign; shrinking MRR means trouble.

ARR (Annual Recurring Revenue): Like MRR but yearly. Great for long-term planning and impressing investors.

Net Burn Rate: Know how fast you're spending cash. Crucial for startups to ensure they don't run out of money.

Revenue Churn: Measures lost revenue from cancellations. Lower churn means happier, loyal customers.

Revenue Growth Rate: Shows how fast your revenue is increasing. Important for understanding overall growth and attracting investors.

I’ve partnered with my friend David Fortin to bring you an incredible opportunity to excel your career & your business with AI. More details below.

👇 Watch: the ULTIMATE guide to Software as a Service KPIs by Caya

Just a heads-up - this email’s sprinkled with affiliate links. If you fancy exploring them, it’s a great way to back this newsletter!

FREEBIE

The Cash Flow Statements Guide

Most people struggle with understanding cash flow statements.

But if you avoid these 5 common pitfalls,

I guarantee you'll have a clearer picture of your company's liquidity.

Neglecting Non-Cash Items.

Overlooking Working Capital Changes.

Inconsistent Accounting Policies.

Timing Differences in Revenue Recognition.

Ignoring Financing Costs.

Ever dreamt of crafting stories, sharing insights, or building a community around your passions?

Now’s the perfect time to start your own newsletter. Whether it's about tech trends, personal journeys, or niche hobbies, your voice matters.

Bring your ideas to life and join a thriving community of creators.

Who knows where your words might take you?

6 Revenue KPIs for SaaS Companies

Disclaimer: Opinions are my own. Not investment advice. Do your own research.

To establish steady growth and track your company’s financial health, you’ll want to keep a finger on your revenue KPIs pulse. Revenue KPIs are big-picture metrics that tell you how well your company is doing by tracking changes in revenue over time.

Let’s jump into the key revenue KPIs.

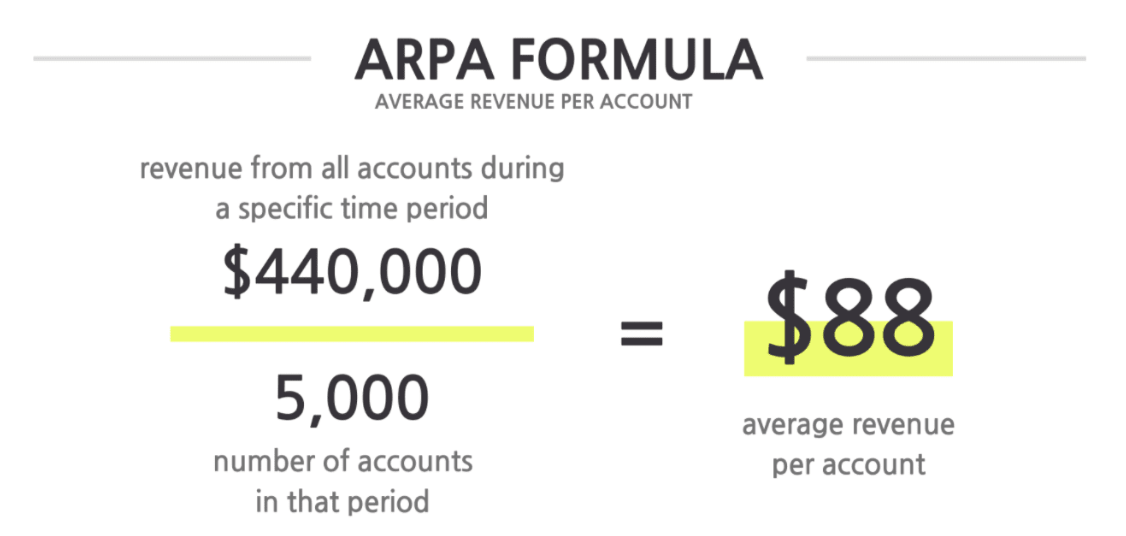

1. Average Revenue Per Account (ARPA)

When you’re operating on a subscription business model, average revenue per account (ARPA), measures the average revenue you generate from your customer accounts over a period of time.

Why Should you Track Average Revenue Per Account?

This valuable metric helps you measure revenue growth and track your business’ financial health. If your ARPA is consistently increasing, it indicates that your sales and marketing efforts are attracting the right customers.

It also provides insight into what’s working and what’s not, so you can identify growth opportunities. For instance, if you have different subscription tiers, ARPA will tell you which pricing plans bring in the most revenue and which are under-performing.

How to Calculate Average Revenue Per Account

ARPA is calculated by taking your total recurring revenue for a specific period and dividing it by the total number of accounts (or paid subscriptions) in that period. It looks like this:

This calculation is usually done on a monthly, yearly, or even quarterly basis, depending on your business model. For example, if you bill your customers monthly, you would simply divide your monthly recurring revenue (MRR) by the total number of accounts.

Tips for Tracking and Driving Growth with this KPI

Correctly interpreting ARPA is important, otherwise, it can give you an inaccurate picture of your performance.

This can happen if your subscription tiers have a wide pricing range. If only a few of your customers pay significantly more than the rest, it can make your ARPA look much higher than it actually is.

You can avoid this by tracking your new and existing customers and calculating other related SaaS metrics like the MRR growth rate alongside your ARPA.

How to Interpret Average Revenue Per Account

Compare your ARPA to the industry average to get a better idea of how your business is performing against its competitors..

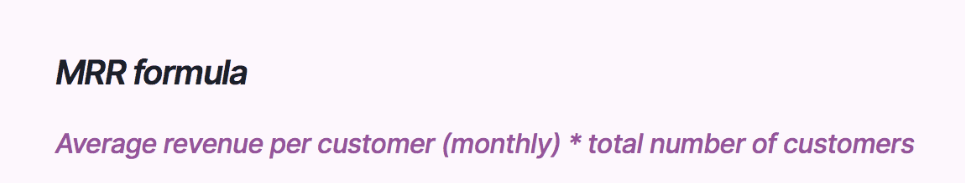

2. Monthly Recurring Revenue (MRR)

Monthly recurring revenue (MRR) calculates all the predictable and recurring revenue generated by your customers each month, like subscription fees. This means that one-time fees, free trials, or any variable fees are not included in your calculations.

Why Should you Track Monthly Recurring Revenue?

Tracking your MRR helps you easily determine the financial health of your business. An expanding MRR indicates your business is growing, while a declining MRR means your business is shrinking.

Since MRR tracks predictable revenue, it also helps you make more accurate sales projections and plan for future growth.

How to Calculate Monthly Recurring Revenue

To calculate your MRR, take the average monthly revenue from each customer and multiply it by the total number of paying customers.

For example, let’s assume you have 6 customers. Four of them are paying $50/month and the other two are paying $25/month. Your MRR will be:

MRR: (4 x $50) + (2 x $25) = $200 + $50 = $250

If all your customers are paying the same monthly fee, then your calculation will be even more simple. For example, if you have 10 customers all paying $50/month, your MRR will be 10 x $50 = $500.

Tips for Tracking and Driving Growth with this KPI

Your MRR helps you determine if your revenue is declining or growing over time. To accurately measure your business’ performance, your MRR can be broken down into subcategories: New MRR and Churn MRR.

New MRR measures how much revenue your new customers each bring in each month, while churn MRR measures how much you’ve lost from subscription cancellations.

How to Interpret Monthly Recurring Revenue

If your churn MRR exceeds your new MRR, you’re losing more customers than you’re gaining, which can spell trouble for your business.

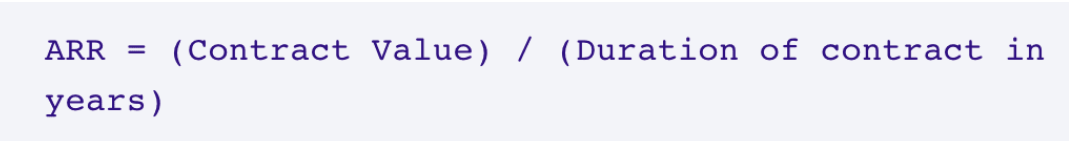

3. Annual Recurring Revenue (ARR)

Annual Recurring Revenue, or ARR, is a key metric that measures how much money you can expect to generate from your subscribers annually. To calculate ARR, your business must offer subscription contracts for at least a year or longer. You can also think of ARR as the annual version of MRR.

Why Should you Track Annual Recurring Revenue?

ARR is a valuable metric for a subscription-based business for multiple reasons:

Communicates the health of your business to investors

It’s an indicator of future growth

Tracks revenue gained from new sales and upgrades

Tracks lost revenue from customer churn and downgrades

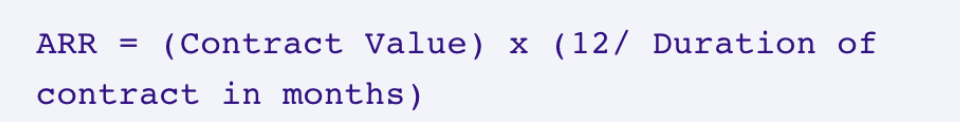

How to Calculate Annual Recurring Revenue

Similar to MRR, ARR calculations exclude any one-time fees or set-up fees and only take into account recurring revenue.

Calculating ARR is simple. If you bill customers annually, the formula to calculate ARR is:

For example, if a subscriber signs a 3-year contract at $30,000, your ARR will be:

ARR = $30,000/3= $10,000

If you bill your customers monthly, the ARR is calculated as follows:

Say your customer signs a 2-year (24-month) contract for $20,000. In this case, your ARR will be:

ARR= $20,000 X 12/24 = $10,000

Tips for Tracking and Driving Growth ARR

Here are some tips on how to use ARR to your business’ advantage:

Use ARR insights for long-term planning and future decision-making.

ARR is a forward-looking metric — it should be used to determine how much revenue you can expect in the future, not how much you’ve generated in the past year.

To get an accurate ARR, it’s important to account for any discounts or coupons given to customers when calculating it.

How to Interpret Annual Recurring Revenue

ARR gives you an overview of how well your business is performing. By tracking your growth year after year and focusing on internal benchmarks, you can see if your current strategy is resulting in progress. If not, it’s an opportunity to re-evaluate your business decisions and change your trajectory.

4. Net Burn Rate

When you’re a budding startup, monitoring your burn rate is imperative to your future growth and success.

At the beginning of your startup’s life cycle, you’ll burn through cash to reach profitability. For a while, you’ll spend more than you earn, which is normal for a startup in its early stages.

The net burn rate shows the rate at which a business is losing or “burning through” money so it can continue operating.

Why Should you Track Net Burn Rate?

Understanding how fast cash reserves are decreasing is important for both startups and mature businesses.

The net burn rate tells you how long your startup’s cash balance can cover your losses before you run out of money. This is your cash runway. Having this crucial information allows you to maintain a sustainable burn rate so you don’t deplete your cash reserves and go broke.

At the same time, mature businesses use the net burn rate as a metric to measure performance.

How to Calculate Net Burn Rate

The net burn rate is calculated by subtracting operating expenses from the revenue. In other words, it measures the difference between cash in and cash out, as follows:

As it’s typically calculated monthly, let’s look at a quick example. If your income for this month is $150k and you’re spending $250k, your monthly net burn rate is:

Net Burn Rate = $250 – $200 = $50k

What Tools Can be Used to Calculate and Track Net Burn Rate?

The best way to monitor your net burn rate is to take advantage of user-friendly online software that has a built-in calculator.

What is a good burn rate?

Ideally, you’ll want to keep your net burn rate relatively low to ensure you’re prepared for any uncertainties. According to experts, startups should have 12-18 months’ worth of runway.

However, a temporarily high net burn rate is not necessarily a bad thing, as long as your business is consistently growing.

If your burn rate is consistently high, that’s an indication you’re bleeding money and need to curb your spending or extend your cash runway.

If you manage your burn rate wisely, you can make your business profitable and take it to the next level.

5. Revenue Churn

Another essential SaaS metric, revenue churn, measures how much recurring revenue SaaS businesses lose over time due to downgraded or canceled subscriptions.

Why Should you Track Revenue Churn?

Revenue churn is a key performance metric because it tells you how good you are at retaining revenue. The lower the revenue churn, the better. Regularly monitoring this metric allows you to take appropriate action and find ways to reduce churn.

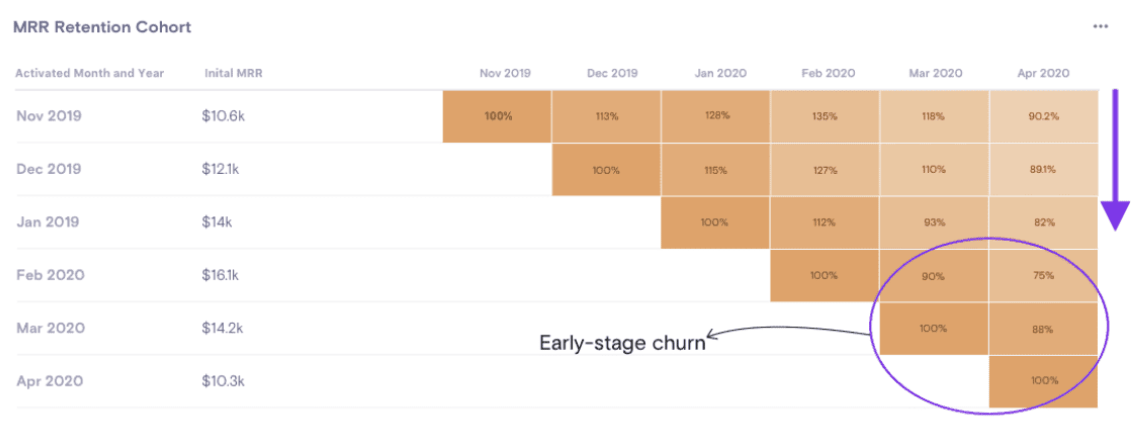

Revenue churn allows businesses to observe customer behavior, leading to actionable insights. For example, you can group all customers who canceled their subscriptions in a particular month into one cohort. This way you will be able to get valuable insights, like the fact that customers acquired in recent months have churned more than older customers.

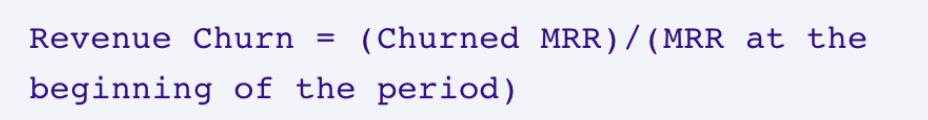

How to Calculate Revenue Churn

To find out your revenue churn, you’ll need to know the revenue lost through cancellations in a given period (churned MRR) and the revenue available at the start of that period.

For example, if you have $200,000 MRR at the beginning of this month and lose $10,000 from customer cancellations and downgrades, your revenue churn for the month will be:

Revenue churn = 10,000/200,000 = 5%

What is a good revenue churn rate?

According to a 2023 SaaS report by KeyBanc Capital Markets, the median annual revenue churn benchmark was 12%. However, an acceptable churn rate can vary from one company to the next and depends on factors like your industry, economy, the type of customers you serve, and pricing plans.

Ideally, a company should strive to get to the 5-7% range and consistently push to reduce churn.

How to Interpret Revenue Churn

A low revenue churn indicates you’re good at retaining customers while a high revenue churn is a signal that your business is in poor health. It may be time to pause, reevaluate your product, target users, competitors, or onboarding processes.

6. Revenue Growth Rate

Revenue growth rate shows a company’s increase in revenue over a period of time, indicating how quickly it’s growing.

Why Should you Track Revenue Growth Rate?

Tracking revenue growth momentum reveals how profitable a company is and whether its growth is sustainable in the long term. Investors look at this metric to determine whether a startup is worth investing in or not.

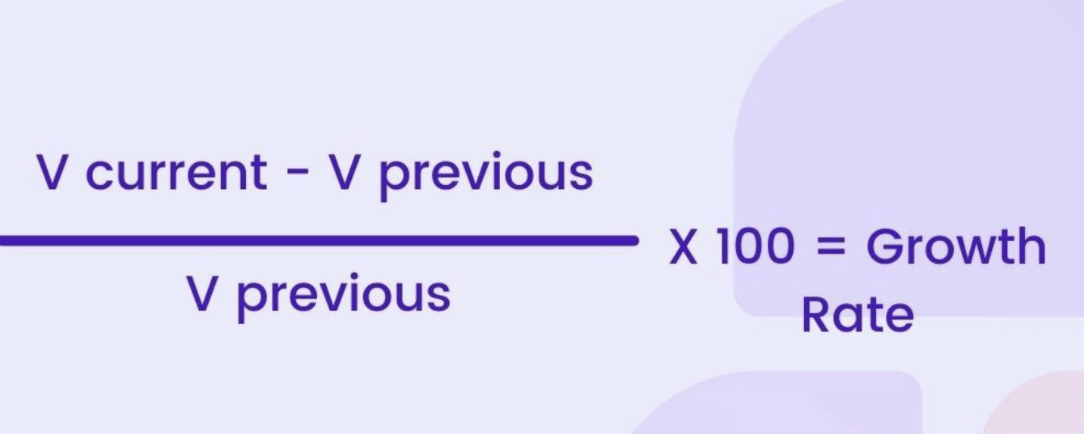

How to Calculate Revenue Growth Rate

Revenue growth rate is usually expressed as a percentage. The basic formula to calculate it is:

Let’s look at a simple example: If your total revenue for April is $10,000 and your March revenue is $8,000, then your revenue grew by 25% from March to April.

What Tools Can be Used to Calculate and Track Revenue Growth Rate?

There’s no shortage of revenue tracking software that calculates and keeps track of revenue growth. The right software will not only track, but also provide you with reports full of insights into your revenue.

Tips for Tracking and Driving Growth with this KPI

Benchmarking your revenue growth rate against similar competitors (think similar size, age, funding type, etc.) will tell you if your growth is sustainable.

Growth rate benchmarks depend on different factors like what stage your company is currently at. For example, older companies experience a slower growth rate than startups. That’s why it’s important to measure against organizations that are similar to yours.

According to the Rule of 40, a popular metric in the SaaS industry, a company’s growth rate when combined with its profit margin should exceed 40%.

Unlock Your Potential: Master Microsoft Copilot Today!

Enhance Your Skills. The course that helps business professionals go from AI beginners to AI proficient so they can enhance their productivity.

Discover tips, tricks and features you didn't even know existed. This course is designed to help complete ai rookie save hours in their professional tasks.

Earn free gifts 🎁

You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

FEEDBACK

How would you rate today's newsletter?

If you have specific suggestions or feedback, simply reply to this e-mail.

How can I help you?

Book a Growth Call: Looking to scale your company? Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Dive into 1:1 Coaching: Personalized coaching can make all the difference. Let's work together to navigate the complexities of finance and set you on the path to success. Click here to start your 1:1 coaching journey.

Sponsor an Issue of the Startup Finance: Want to reach a dedicated audience of founders & finance enthusiasts? Consider sponsoring a future issue of the Startup Finance. Contact me here for sponsorship details.

Leave a Testimonial: I would appreciate if you could leave a 5-star rating for this newsletter if you enjoyed it here.

Thanks so much for reading.

Aleksandar