Put your money to work in a high-yield cash account with up to $2M in FDIC† insurance through program banks.

Get started today, with as little as $10.

WELCOME TO ISSUE NO #06

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Happy Saturday! This week I’ve compiled some amazing resources that will definitely impress you.

TL;DR

💰 3 mistakes you're making with financial metrics. (and how to fix them)

👉 Learn about SaaS Accounting

📃 P&L, Balance Sheet & Cash Flow Cheat Sheets

My friend Josh Aharonoff launched his new Excel Plugin - Model Wiz and finance pro’s & founders are amazed. So if you’re looking to elevate your career or business, check it out below.

I’d love to get your thoughts on this week’s poll. Share your thoughts below!

👇 Watch: Step-by-step guide for creating an engaging excel dashboard (with free template) by Josh

Just a heads-up - this email’s sprinkled with affiliate links. If you fancy exploring them, it’s a great way to back this newsletter!

Bonus Story

Unicorn list

I have spent 1000+ hours researching startup valuations so you don't have to.

Here are three key factors that will turn your startup into a successful unicorn:

1. Right Valuation

↳ You need a sustainable business model.

↳ Secondarily, you need a competitive edge.

↳ Combine both for a robust startup worth its valuation.

2. Exit Strategy

↳ It's crucial to steer clear from situations where your valuation is not reflective of potential exits.

↳ The classic example is startups that are overvalued with no demand for acquisitions or IPOs.

↳ Ensure you have a realistic exit strategy, then work diligently towards achieving it.

3. Navigating Complex Terrain

↳ The startup world is unpredictable, so navigating complex terrain is vital.

↳ Start by understanding the industry landscape, and then adapt and innovate until you attain a comfortable position.

↳ Don't rush into high valuations, but also don't underestimate your startup's potential.

Being valued over $1 billion is impressive, but ensuring your startup is worth that valuation is the real success.

It includes:

Company

Valuation ($B)

Date Joined

Country

City

Industry

Investors

3 mistakes you're making with financial metrics

(and how to fix them)

1. Mismatching revenues and costs when calculating CAC Payback Period

CAC (Customer Acquisition Cost) is what you spend in S&M (sales and marketing) to land a net new customer. And CAC Payback Period is the number of months it takes to break even on that new customer.

S&M costs should be lagged by the average sales cycle of the sales engine you’re measuring. And Customer Support costs should match the current period.

The goal is to align the dollars you spent in the past to generate the sales (ARR) you are seeing today.

Examples of lagging by segment:

Enterprise sales cycle of 180 days = 2 quarter S&M lag

Mid-Market sales cycle of 90 days = 1 quarter S&M lag

SMB sales cycle of 30 days = 0 quarter S&M lag

Mapping out the lag periods for CAC

2. Relying on Accrual Revenue when making growth decisions

Accrual Revenue isn't actually cash. It's a GAAP based accounting view of the world, looking at when revenue should be recognized for services delivered.

Accrual Revenue will almost always lag cash received from new business - cash you can use to run your business today. Common metrics Accrual Revenue lags are both ARR and Billings.

If you make hiring and spending decisions based on it, you can cap growth and leave money on the table.

3. Using nonstandard definitions for ARR (Annual Recurring Revenue)

Contrary to popular belief, not all "revenue" is created equal. Multi-year contracts with deep first-year discounting or volume ramps over time drive deltas between the first and last year's ARR.

Many companies will claim the larger, exit year Contracted ARR (CARR) as ARR. But CARR will not track to current period GAAP revenue or billings.

Using a non-standard definition of ARR can lead to unexpected mark downs by investors during financing events. Re-defining a key metric like your topline growth can cause frustration.

Arguing my CARR is really ARR

If you’re looking to elevate your career or your business, check out Excel Plugin - Model Wiz by Josh.

These are the templates that made Josh skyrocket his career & his business, too.

SaaS Accounting

Navigating the labyrinth of SaaS accounting is not for the faint of heart. With a unique set of metrics and principles, it's a world apart from traditional accounting. But for those willing to dive deep, the rewards are substantial, offering a gateway to mastering digital-era finance.

SaaS Revenue: Subscription at its Core

At the heart of SaaS lies the subscription model—customers pay recurring fees for cloud-based software access. This continuous cash flow demands specific recognition strategies over the contract’s life, ensuring financials reflect the true value delivered.

Key Accounting Challenges in SaaS

Revenue Recognition: This cornerstone process must align revenue with the period in which services are rendered, avoiding financial discrepancies.

CAC vs. LTV: The balance between customer acquisition cost and lifetime value is crucial. Get it wrong, and your capital could evaporate.

Subscription Metrics: Metrics like Monthly Recurring Revenue (MRR) and Churn Rate are vital, each with significant implications.

Crucial Accounting Concepts

Deferred Revenue: Often received upfront, this needs careful period-over-period recognition.

Capitalizing Software Costs: Some development costs can be capitalized and amortized, adding layers of complexity.

Revenue Recognition Methods: Including event-driven, straight-line, and usage-based, each method has its implications on how revenue is recognized.

While SaaS accounting is a complex field, mastering it provides invaluable insights and prepares accountants for the nuances of the digital business landscape.

Visit Fiscallion.io to learn more

Partnering with the us enables you to avoid surprises, provide financial and strategic context and ensure that the company is on the right track.

✔ Financial Model Updates and Ongoing Maintenance

✔ Board Reporting and Investor Relations

✔ Budgeting and Scenario Planning

✔ Detailed Month-End Analysis

✔ Advanced Metric Tracking

✔ Get More Clarity

✔ Save Time

P&L, Balance Sheet & Cash Flow Cheat Sheets

Finance gurus, gather round! I’m about to make your life a whole lot easier with my ultimate Cheat Sheet Bundle, breaking down the essentials of P&L, Balance Sheets, and Cash Flow statements across various industries. Whether you're in retail, healthcare, or IT, these sheets have got your back.

P&L Statements Decoded

From retail to non-profit, we've got nine unique P&L statement layouts tailored for your industry's needs. But that's not all; we've also compiled a 10-step guide to creating an effective P&L statement—ensuring your financials are accurate and actionable.

Balance Sheet Breakthroughs

Next up, the Balance Sheet Cheat Sheet. It's like having a financial blueprint for nine different sectors, including manufacturing and banking. Plus, get insider know-how with 10 steps to crafting a comprehensive balance sheet and tips to dodge common pitfalls.

Cash Flow Clarity

Last but not least, the Cash Flow Cheat Sheet is your ticket to mastering the lifeblood of any business—cash. With nine layouts and a 10-step process for detailed statements, you’ll be optimizing your cash flows and management in no time.

Expert Insights and Exercises

Each cheat sheet comes packed with sector-specific examples, exercises to sharpen your analytical skills, and forecasting tips that will have you predicting financial trends like a pro.

With this bundle, you're not just staying ahead of the game; you're defining it. Your financial analysis is about to hit a new level of precision.

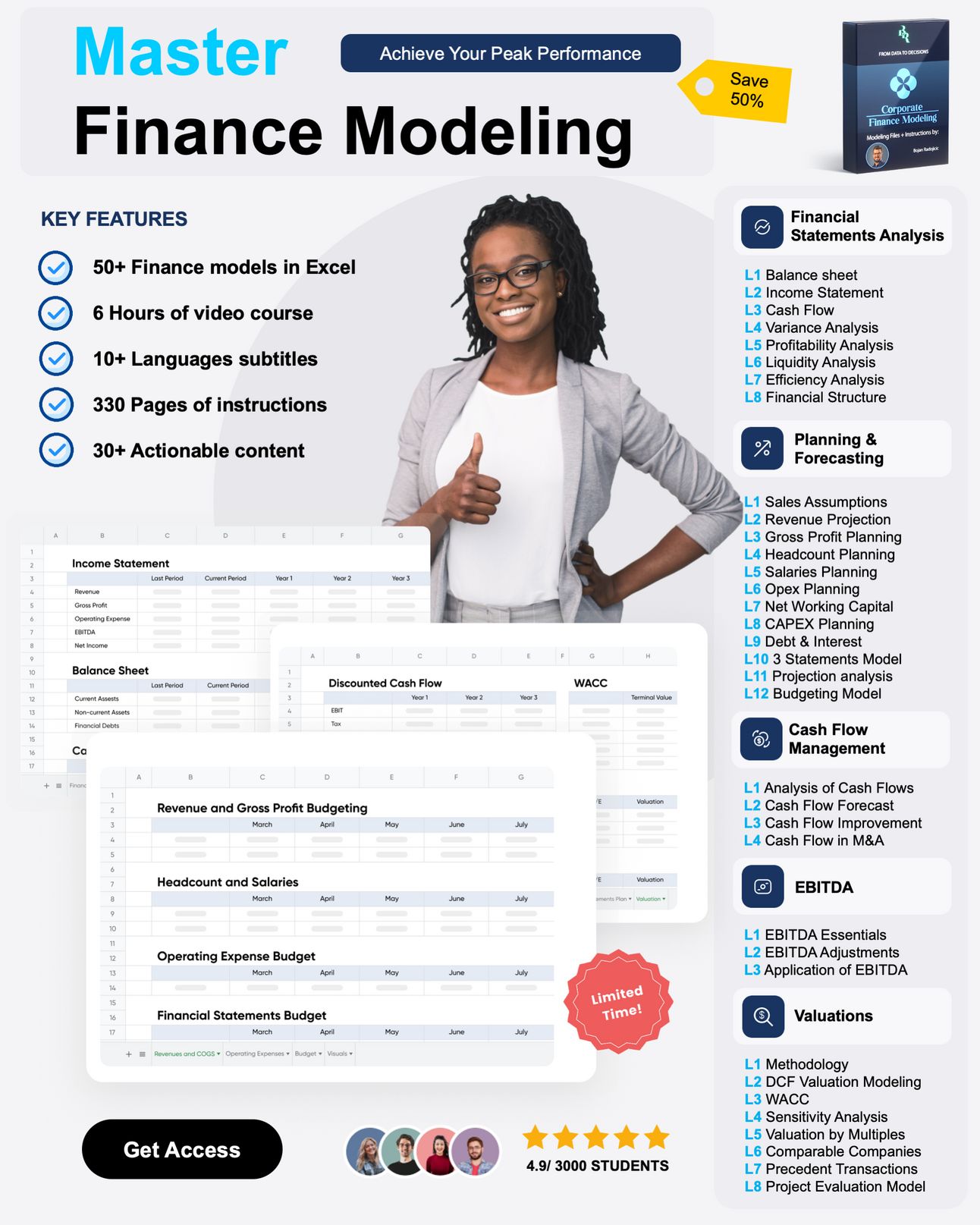

If you’re looking to elevate your career, check out The Financial Modeling Course by Bojan.

This is the method that made Bojan and other students go from misunderstood analysts to respected finance leaders.

Earn free gifts 🎁

You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

POLL TIME

How did you enjoy this week's topics?

How would you improve the Startup Finance🚀?

Can you do me a favor? I want to know you better.

If you have specific suggestions or feedback, simply reply to this e-mail.

How can I help you?

Book a Growth Call: Looking to scale your company? Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Dive into 1:1 Coaching: Personalized coaching can make all the difference. Let's work together to navigate the complexities of finance and set you on the path to success. Click here to start your 1:1 coaching journey.

Sponsor an Issue of the Startup Finance: Want to reach a dedicated audience of founders & finance enthusiasts? Consider sponsoring a future issue of the Startup Finance. Contact me here for sponsorship details.

Leave a Testimonial: I would appreciate if you could leave a 5-star rating for this newsletter if you enjoyed it here.

Thanks so much for reading.

Aleksandar