Sponsored by

At Received we built the first B2B Billing & Revenue Management platform designed to help B2B scale-ups ensure smooth operations and a steady revenue flow as they grow.

Why B2B finance teams choose Received:

B2B Focus: tailored specifically for B2B companies, juggling complex Pricing Structures, Usage pricing, and bespoke Contracts.

Built for Finance: a data-rich, yet intuitive interface and Excel-based pricing configurator tailored to Finance needs.

All-in-One: a one-stop-shop for B2B revenue management, with full Customer and Contract Management, Dunning, Advanced Analytics, and more.

If you want to find out what CFOs from leading tech scale-ups have to say about how Received accelerates business growth,

WELCOME TO ISSUE NO #03

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Happy Saturday! This week I’ve compiled some amazing resources that will definitely impress you.

Let’s break it down in this week’s issue.

⌚ How does dilution work? Cap tables and pie.

🧐 How to forecast your revenue in a SaaS business

📊 6 Types of Finance Professionals

All my paid products are on a Birthday sale now. As the Finance Startup subscriber you can save an additional 80% off the regular price. Details below.

I’ve partnered with Wall Street Prep and Wharton Online to bring you an incredible opportunity to save hundreds of dollars and build your FP&A career. Check out this a one-of-a-kind, theory-meets-practice, FP&A certificate program. Details below.

My friend Bojan Radojicic launched a value-packed Financial Modeling Course and his students are loving it. So if you’re looking to elevate your career, check it out below.

I’d love to get your thoughts on this week’s poll. Share your thoughts below!

👇 Watch: Top 3 FP&A Interview Questions Answered by Asif

Just a heads-up - this email’s sprinkled with affiliate links. If you fancy exploring them, it’s a great way to back this newsletter!

Bonus Story

100 Business Frameworks

Free Ebook To download.

Nicholas spend weeks to create this 218 pages ebook.

It includes:

25 Strategic Management Frameworks

25 Project Management Frameworks

25 Process & Quality Frameworks

25 Analysis & Decision Making Frameworks

BIRTHDAY SALE ALERT

ALL MY DIGITAL PRODUCTS 🎂

80% Discount on Now for a 48 hours only.

The Finance Startup Subscribers only get this chance.

Use coupon code EQV45BR at checkout.

How does dilution work?

Today, let's slice into the concept of dilution, a term you've probably heard thrown around in the finance world. But what does it really mean?

Let's break it down using a delicious analogy: pie.

The Dive

Dilution is a lot like pie. To put it in the words of a financially minded baker:

“Imagine you're a baker, and your business is a pie. When you bring in new investors, you're essentially creating more slices of your pie. Your own slice gets smaller, but the investors have set a new, higher price for a slice of your business. So, even though your piece of the pie is smaller, the whole pie is now worth more, making you a wealthier baker than before.”

The Math

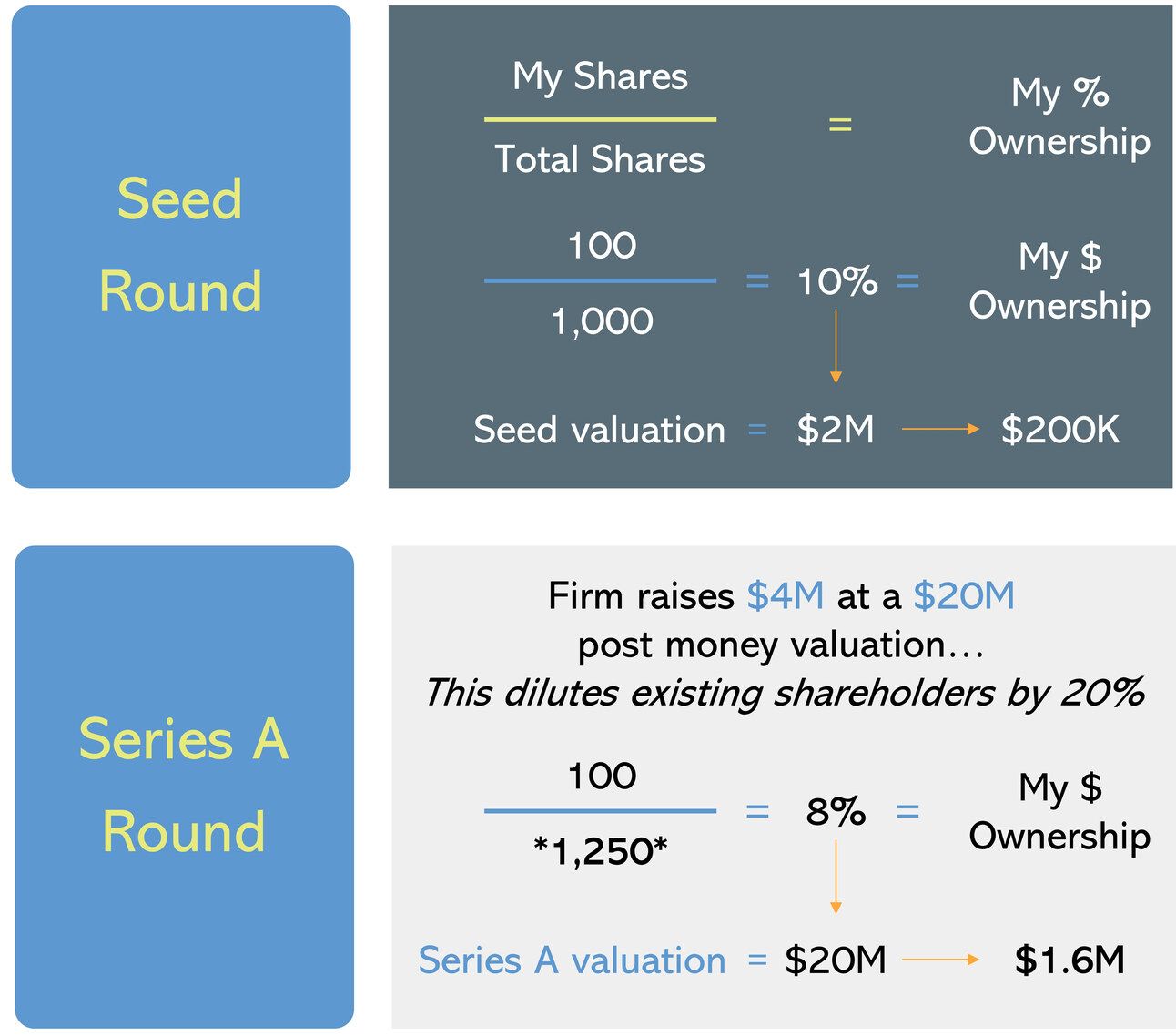

When new shares are created, the total number of shares increases, and your ownership percentage decreases. This is known as "fully diluted" ownership. However, if the company's value increases with each funding round, you won't mind the dilution because the total dollar value of your slice has gone up.

Here’s an example:

In this example, if your ownership goes from 10% to 8% due to the creation of 250 new shares, but your dollar ownership skyrockets from $200K to $1.6M, you're in a better position than before.

The Nitty-Gritty

Dilution happens when new shares are issued. Common scenarios include:

When Employees Exercise Options: More shares are created as employees convert their options into actual shares.

When Convertible Warrants or Bonds are Exercised: The conversion of debt to equity increases the number of outstanding shares.

When the Firm Completes a Fund Raise: New shares are created, increasing the total number of shares and diluting existing shareholders.

IPO: Similar to a private fundraise, an IPO can create new shares and dilute existing shareholders.

Once again, remember that it’s not necessarily a bad thing if any of these events occur in conjunction with an increased valuation. Ask yourself:

“Would I rather have 10% of a company worth $2 million, or 8% of a company worth $20 million?”

So How Much Dilution is Normal?

Early Stages: Expect higher dilution as the company goes from zero to something.

Series A: Typically, dilution is around 20% to 25%.

From Series B Onward: Dilution is usually kept to around 10% per round.

Can Dilution be Bad?

Yes, especially in a "down round" where the company's valuation decreases. This means your ownership percentage and the value of the company are both going down.

Do All Companies Get Equally Diluted?

No. Companies with higher valuations can raise more money while giving away less of the company.

In Summary…

Dilution is part of the game in the finance world. It's a trade-off you should be willing to make if your company's valuation is increasing significantly with each round.

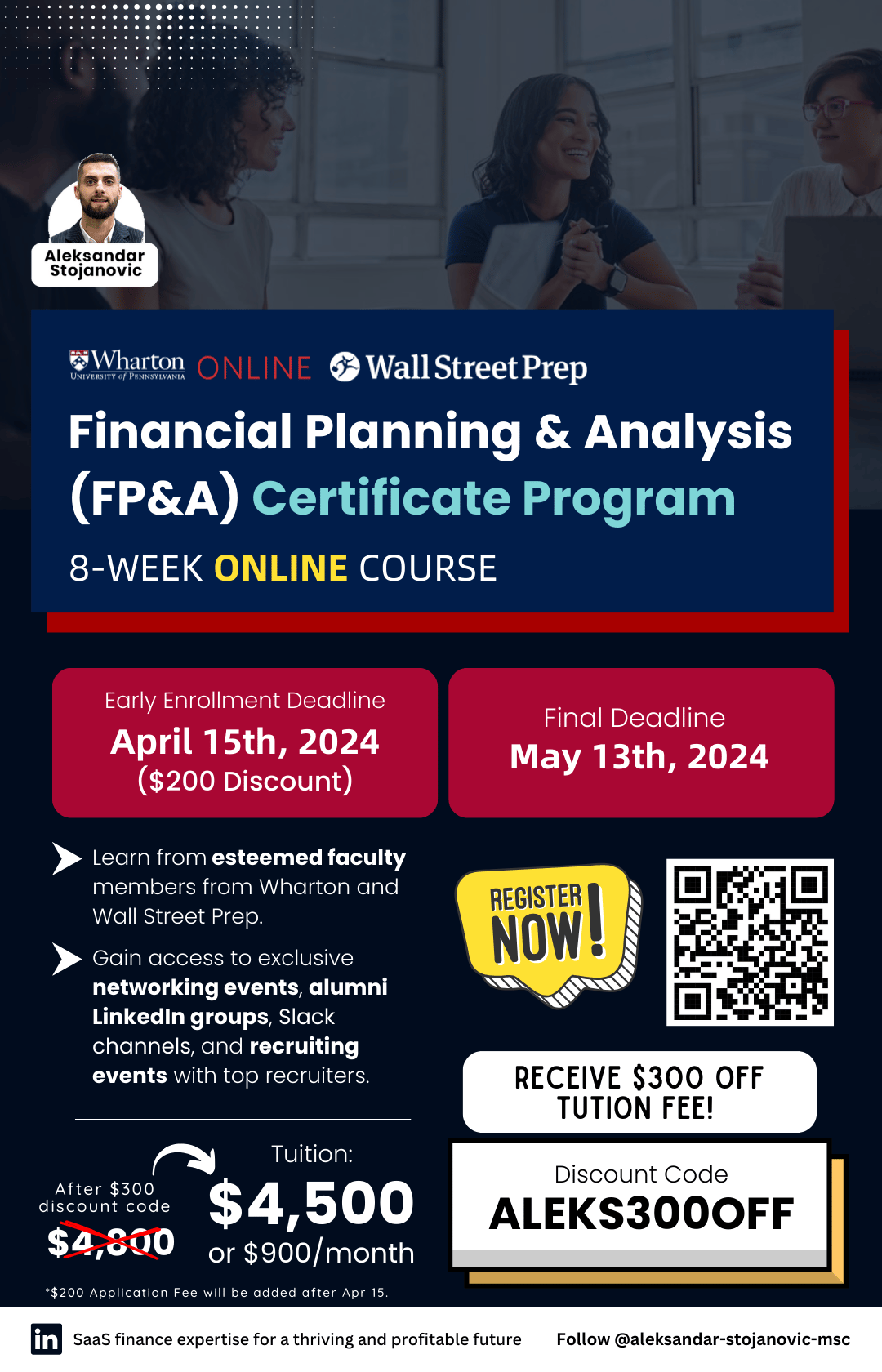

Introducing Wharton & Wall Street Prep's Exclusive FP&A Certificate Program

When: 8 Weeks May 13 - July 7, 2024 (8 weeks)

Time Commitment: 8 Hours per Week

Format: Online Self Paced with Live Office Hours

Early Registration Deadline: April 15th, 2024

Tuition: $5,000 (save $500 using my affiliate registration link)

Certificate: Issued by Wharton and Wall Street Prep

Closing Ceremony: Penn Club in NYC (Attend Live or Virtually)

Faculty: Taught jointly by Wharton & Wall Street Prep

Guest Speakers: Marcela Martin (Buzzfeed), Josette Leslie (Affinity.co), Debbie Sebastian (Eagle Family Foods Group), and more.

Alumni Benefits including:

Exclusive Networking Events

Invites to Alumni LinkedIn Group and Slack Channels

Exclusive Recruiting events with top Recruiters

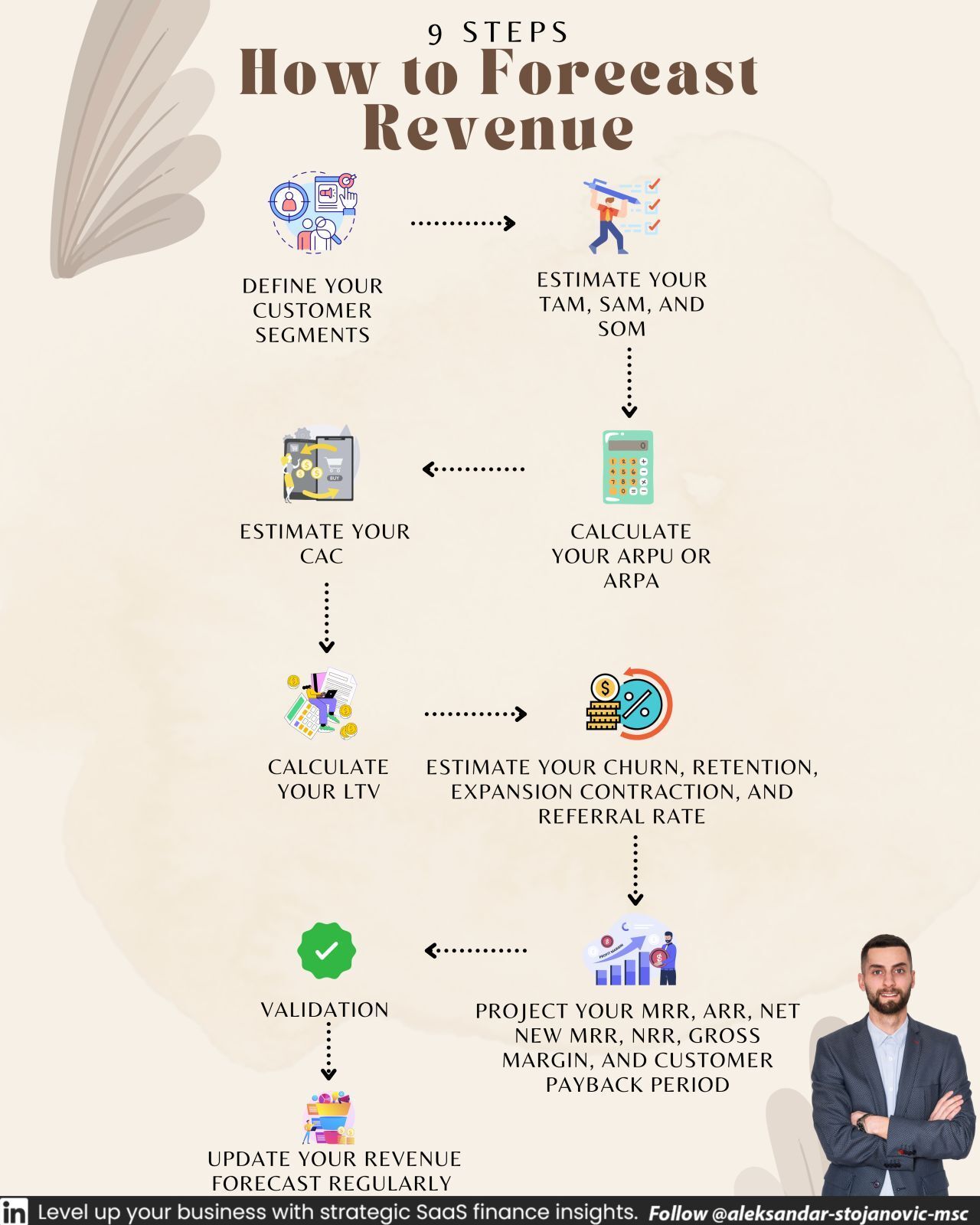

How to forecast your revenue in a SaaS business

If you're in the SaaS game, you know that forecasting revenue can be a bit of a puzzle. It's not like traditional businesses where you sell a product or service for a fixed price and call it a day. In SaaS, you're dealing with subscriptions, which means recurring revenue over time. Sounds great, but it also adds layers of complexity to your revenue forecast.

Let's dive into what makes SaaS revenue forecasting unique:

It's not just about the number of customers; it's also about understanding customer lifetime value (LTV), customer acquisition cost (CAC), expansion rate, retention rate, churn rate, and more.

These factors interact and vary across different customer segments, cohorts, and channels.

The SaaS market is volatile, affected by external factors like competition, regulation, economic conditions, customer behavior, and technological changes.

So, how do you forecast revenue in this ever-changing landscape? You need a bottom-up approach that starts with your customer data. Here are 9 steps to guide you:

Define Your Customer Segments: Group your customers based on characteristics, behavior, needs, and preferences.

Estimate Your Market: Calculate your total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM) for each segment.

Calculate ARPU/ARPA: Determine your average revenue per user or account for each segment.

Estimate CAC: Figure out your customer acquisition cost for each segment.

Calculate LTV: Determine your customer lifetime value for each segment.

Estimate Key Rates: Look at your churn rate, retention rate, expansion rate, contraction rate, and referral rate for each segment.

Project Your Revenue: Calculate your monthly recurring revenue (MRR), annual recurring revenue (ARR), net new MRR, net retention rate (NRR), gross margin, and customer payback period for each segment.

Validate Your Assumptions: Use historical data, benchmarks, industry trends, and customer feedback to check your assumptions.

Update Regularly: Keep your revenue forecast up-to-date based on actual performance and market changes.

Forecasting revenue in a SaaS business is challenging but crucial. It's the backbone of your financial planning and growth optimization. So, take these steps, dive into your data, and start forecasting with confidence!

Visit Fiscallion.io to learn more

Partnering with the us enables you to avoid surprises, provide financial and strategic context and ensure that the company is on the right track.

✔ Financial Model Updates and Ongoing Maintenance

✔ Board Reporting and Investor Relations

✔ Budgeting and Scenario Planning

✔ Detailed Month-End Analysis

✔ Advanced Metric Tracking

✔ Get More Clarity

✔ Save Time

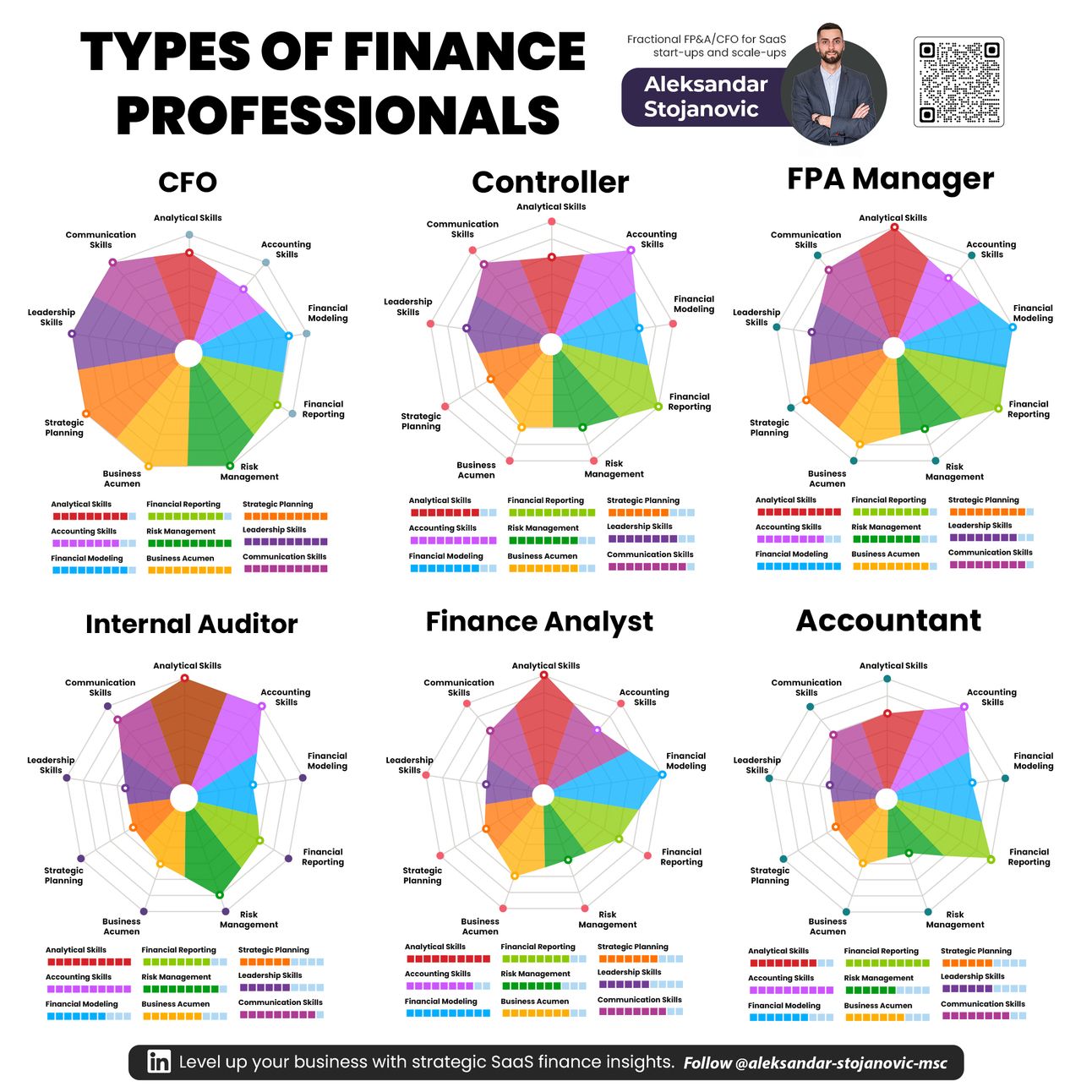

6 Types of Finance Professionals

Today, let's dive into the diverse world of finance professionals. Each role in the financial sector comes with its unique set of responsibilities and skills. Whether you're mapping out your career or assembling a top-notch finance team, it's crucial to understand where each piece fits.

Here's a quick rundown of six key finance roles:

CFOs (Chief Financial Officers): The strategic bigwigs of the finance world. They're all about leadership, strategic planning, and managing risks, with an eye on the entire financial landscape.

Controllers: The guardians of financial integrity. They're deeply involved in accounting, financial reporting, and ensuring compliance with regulations.

FP&A Managers (Financial Planning & Analysis Managers): The growth drivers. They excel in financial modeling and analysis, using their business acumen to steer the company towards growth.

Internal Auditors: The watchdogs of risk and compliance. They specialize in keeping the company in check with regulations and maintaining internal controls.

Finance Analysts: The data wizards. They're skilled in financial modeling, analytics, and reporting, aiding in data-driven decision-making.

Accountants: The meticulous record-keepers. They focus on accounting, financial reporting, and compliance, ensuring precision in financial records.

In general, CFOs and FP&A Managers are often more involved in strategic decision-making and engaging with business stakeholders. Meanwhile, Controllers and Internal Auditors are the champions of regulatory and compliance tasks. Finance Analysts and Accountants are the backbone of financial modeling and reporting.

Remember, while these titles and responsibilities can sometimes overlap depending on the job description, industry, and project, this breakdown provides a useful guide for understanding the roles within a finance department or planning your career trajectory.

If you’re looking to elevate your career, check out The Financial Modeling Course by Bojan.

This is the method that made Bojan and other students go from misunderstood analysts to respected finance leaders.

Need ONE newsletter to stay on top of everything?

Prompts daily will make you more productive at work and help you look smarter in front of your friends (seriously!)

It’s also FREE to sign up!

Earn free gifts 🎁

You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

POLL TIME

How did you enjoy this week's topics?

How would you improve the Startup Finance🚀?

Can you do me a favor? I want to know you better.

If you have specific suggestions or feedback, simply reply to this e-mail.

How can I help you?

Book a Growth Call: Looking to scale your company? Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Dive into 1:1 Coaching: Personalized coaching can make all the difference. Let's work together to navigate the complexities of finance and set you on the path to success. Click here to start your 1:1 coaching journey.

Sponsor an Issue of the Startup Finance: Want to reach a dedicated audience of founders & finance enthusiasts? Consider sponsoring a future issue of the Startup Finance. Contact me here for sponsorship details.

Thanks so much for reading.

Aleksandar