New AI LeadGen Tool Identifies Email Address of Your Visitors

Did you know that you can Identify the email addresses of your anonymous website traffic?

Rather than getting only 5% of your traffic via an opt-in form, a new AI Tool, Smart Recognition, lets you target and email most of your website traffic, growing your email list and revenue faster!

How can this help? 👇

Capture email addresses of up to 40% of your anonymous traffic.

Email irresistible offers to prospects browsing your site.

Send abandoned cart emails to people who don't complete checkout.

👋 Welcome to the 248 new Founders & Finance Pro’s who joined us since last Saturday. If you haven’t subscribed, join 5,000 people getting smarter.

WELCOME TO ISSUE NO #017

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Happy Saturday! This week I’ve prepared a one big TOPIC and one freebie just for you.

TL;DR

Determine Milestones: Set clear goals for revenue, user acquisition, and product development.

Create a Financial Plan: Develop a detailed plan covering hiring, marketing, and product development costs.

Build a Financial Model: Prepare for different scenarios to anticipate changes and ensure readiness.

Understand Fundraising Needs: Calculate funding to cover 12-36 months based on your stage.

Determine Equity: Balance ownership offered to investors with your valuation and control.

Estimate Valuation: Use investor feedback, revenue multiples, and the Rule of 40 to estimate your company's worth.

Prepare a Data Room: Organize essential documents and keep them updated for investors.

Start Raising Money: Find aligned investors using tools like Crunchbase and refine your pitch with feedback.

Successful fundraising requires preparation, ongoing investor relationships, and strategic goal-setting.

👇 Watch: How Startup Fundraising Works by YC Combinator

Just a heads-up - this email’s sprinkled with affiliate links. If you fancy exploring them, it’s a great way to back this newsletter!

Partnering with the us enables you to avoid surprises, provide financial and strategic context and ensure that the company is on the right track.

✔ Financial Model Updates and Ongoing Maintenance

✔ Board Reporting and Investor Relations

✔ Budgeting and Scenario Planning

✔ Detailed Month-End Analysis

✔ Advanced Metric Tracking

✔ Get More Clarity

✔ Save Time

FREEBIE

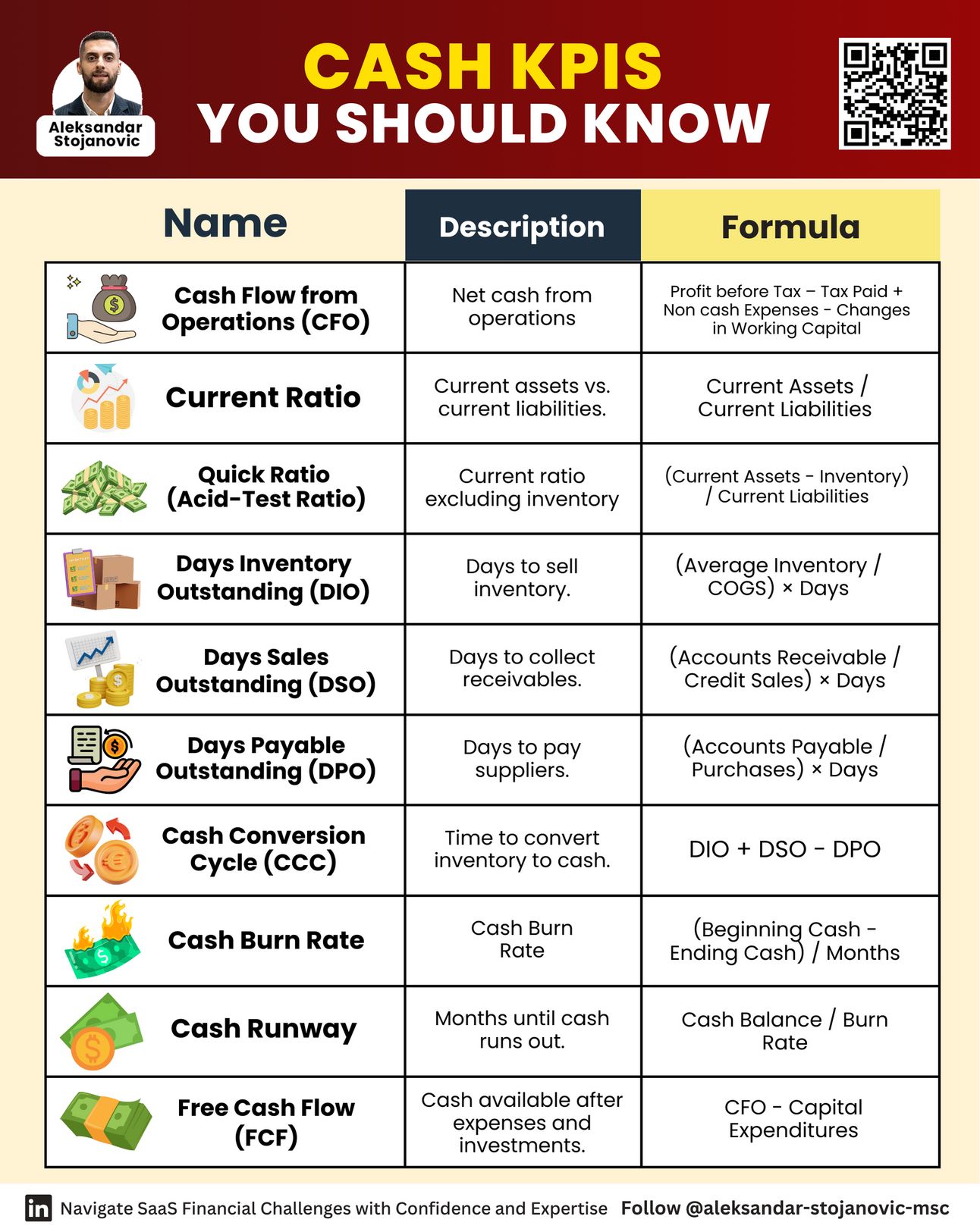

10 Cash KPIs You Should Know👇

Grab a PDF with all the information at:

Here's what you'll get....

𝗖𝗮𝘀𝗵 𝗙𝗹𝗼𝘄 𝗳𝗿𝗼𝗺 𝗢𝗽𝗲𝗿𝗮𝘁𝗶𝗼𝗻𝘀

𝗖𝘂𝗿𝗿𝗲𝗻𝘁 𝗥𝗮𝘁𝗶𝗼

𝗤𝘂𝗶𝗰𝗸 𝗥𝗮𝘁𝗶𝗼 (𝗔𝗰𝗶𝗱-𝗧𝗲𝘀𝘁 𝗥𝗮𝘁𝗶𝗼)

𝗗𝗮𝘆𝘀 𝗜𝗻𝘃𝗲𝗻𝘁𝗼𝗿𝘆 𝗢𝘂𝘁𝘀𝘁𝗮𝗻𝗱𝗶𝗻𝗴 (𝗗𝗜𝗢)

𝗗𝗮𝘆𝘀 𝗦𝗮𝗹𝗲𝘀 𝗢𝘂𝘁𝘀𝘁𝗮𝗻𝗱𝗶𝗻𝗴 (𝗗𝗦𝗢)

𝗗𝗮𝘆𝘀 𝗣𝗮𝘆𝗮𝗯𝗹𝗲 𝗢𝘂𝘁𝘀𝘁𝗮𝗻𝗱𝗶𝗻𝗴 (𝗗𝗣𝗢)

𝗖𝗮𝘀𝗵 𝗖𝗼𝗻𝘃𝗲𝗿𝘀𝗶𝗼𝗻 𝗖𝘆𝗰𝗹𝗲 (𝗖𝗖𝗖)

𝗖𝗮𝘀𝗵 𝗕𝘂𝗿𝗻 𝗥𝗮𝘁𝗲

𝗖𝗮𝘀𝗵 𝗥𝘂𝗻𝘄𝗮𝘆

𝗙𝗿𝗲𝗲 𝗖𝗮𝘀𝗵 𝗙𝗹𝗼𝘄 (𝗙𝗖𝗙)

Ever dreamt of crafting stories, sharing insights, or building a community around your passions?

Now’s the perfect time to start your own newsletter. Whether it's about tech trends, personal journeys, or niche hobbies, your voice matters.

Bring your ideas to life and join a thriving community of creators.

Who knows where your words might take you?

8 Steps to Successful Fundraising for Startups

Disclaimer: Opinions are my own. Not investment advice. Do your own research.

For many startups, fundraising is a continuous hurdle. However, with proper research and planning, founders can confidently navigate the process. Use this guide to fundraise successfully for your startup.

Introduction

Fundraising is one of the most challenging tasks for any startup. In addition to spending time developing products, marketing the brand, and reaching out to the target audience, founders must also focus heavily on securing investments.

But there is good news from the VC investment funding process—you not only gain great connections and money to drive your business but also learn how to sell your vision to investors and how to be resilient and systematic.

Through these experiences, one thing becomes clear: preparation is key. Every decision, from your first financial plan to your final pitch, can determine your funding success. The more prepared you are, the smoother the ride will be.

This step-by-step guide on how to raise money for a business compiles practical tips and insights to help you prepare. Armed with this startup fundraising checklist, you will confidently navigate the complexities of the investment process.

Let’s dive in.

Step 1: Determine your milestones

Before startup fundraising, you should clearly understand your goals for additional funding. Spending two to six months on fundraising and then needing to figure out how to allocate it isn’t a wise decision.

Setting goals helps you determine how much money you need, what you aim to achieve with it, and within what timeframe.

Ideally, you should identify your key objectives for the next one to two years. If you’re not sure about your high-level goal, focus on revenue.

Some goals to consider include:

Revenue targets: What specific revenue numbers do you want to achieve? These targets should be realistic yet ambitious, demonstrating strong growth potential and a clear understanding of market opportunity.

User acquisition goals: How many users do you plan to acquire in the next month, six months, or year? User acquisition is a crucial metric for many startups, so setting attainable goals here demonstrates a solid understanding of your growth strategy.

Product development goals: What major features will you launch within the specified timeframe? Investors want to see a clear roadmap for product development, ensuring your product remains competitive and addresses user needs.

Step 2: Create a financial plan

After setting your milestones, you’ll create a detailed financial plan to achieve each goal. Think of a financial plan as the story you tell through numbers.

Here’s what you should think about:

Hiring needs: How many employees do you need to achieve your goals? Remember to factor in payroll taxes and benefits when assessing hiring costs.

Marketing budget: What resources will you use for marketing efforts to reach the targeted number of users? Ideally, you need to select a few marketing channels and break down the budget for each channel. Plan to leave more money in the budget for marketing experiments.

Product development costs: How much will it cost to build your product? This cost includes outlining the resources needed for development, such as software licenses, hardware costs, and any potential outsourcing fees. Be sure to include ongoing maintenance and development costs as well.

The main advice here is: don't guess. Research market salaries, typical marketing rates for your chosen channels, and average software development costs to ensure your budget is realistic. By including this data in your financial plan, you demonstrate that you know your numbers and show how serious you are about the investors' money.

Step 3: Make a financial model with different scenarios

Build a financial model for yourself first, then for investors.

The startup world is rarely predictable. Unexpected events can disrupt your plans, so don't shy away from analyzing both optimistic and pessimistic financial scenarios. Having a plan doesn't guarantee it will happen, but it ensures you're prepared.

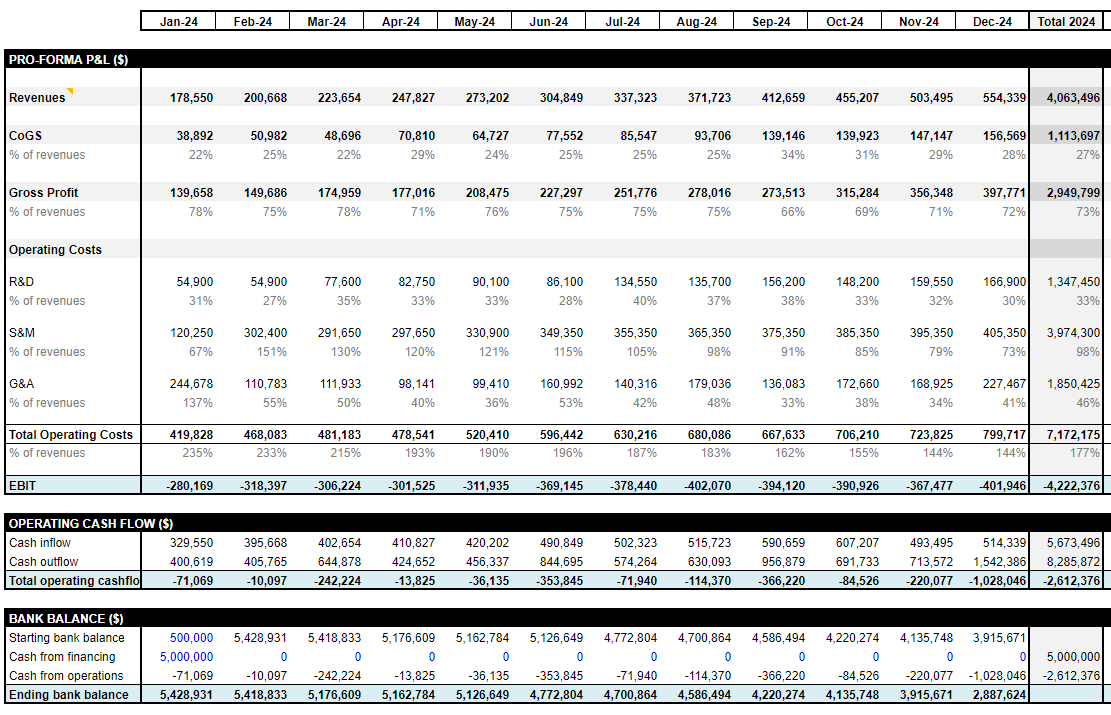

Example of the financial model

The level of detail in your financial model depends on your startup’s fundraising stage. If you are raising a Series A round, you have enough data from the previous period to build a more sophisticated model with many assumptions. But if you’re in the pre-seed stage, it will be a high-level financial model. In both cases, as a founder, you need to understand this financial model first and foremost.

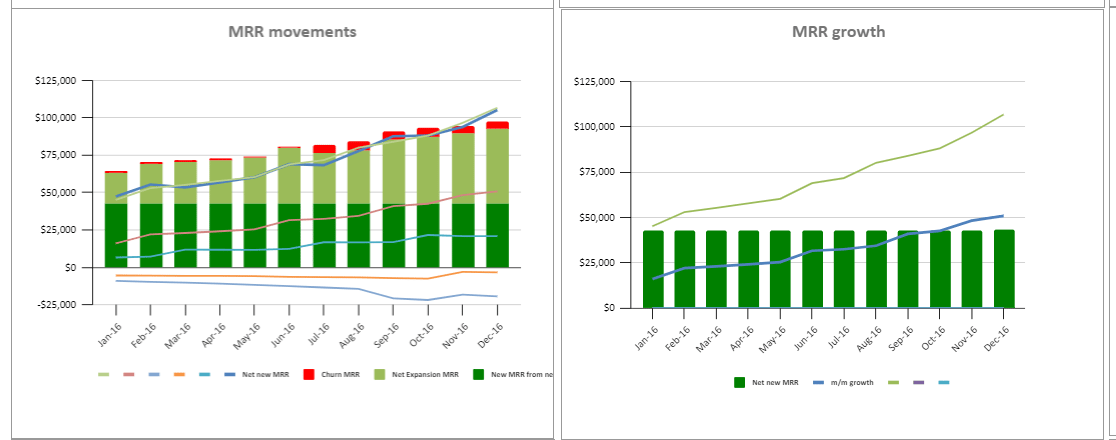

While building a financial model, focus on the key metrics that drive your revenue and expenses: leads, conversion rates, monthly recurring revenue (MRR), churn rate, new hires, marketing channels, etc. Play with different scenarios. What if you get half the revenue you expected? How will it impact your fundraising needs or hiring decisions?

Add graphs to your financial model. They will help you see significant ups or downs in revenue and expenses. You should be ready to explain such changes. Sometimes, graphs allow you to find mistakes you missed in the written financial model.

Example of graphs in the financial model

For quick and easy planning for financial reports and models, try a free financial planning product for founders, CEO’s, CFO’s and COO’s, such as this tool from Fiscallion.

Step 4: Understand your fundraising needs

The ideal amount of money to raise depends on your startup funding stage. Pre-seed funding should cover you for at least 12 months, while any other stage should aim for 24 to 36 months.

This timeframe, or the runway, allows you to achieve milestones, like product-market fit or significant user acquisition, before raising the next round.

Look at your startup financial plan and calculate the total amount of funding needed to cover your expenses for your desired runway. You can do this quickly by finding the sum of net loss for that timeframe in your profit and loss statement (P&L). Think of the money raised as buying the time needed to find a product-market fit or achieve your next milestone or target KPIs. Ask yourself if this amount and timeframe are enough to achieve these goals. If so, you’ll have more confidence in the next fundraising round. If not, you risk running out of money while trying to scale.

Step 5: Determine equity for investors

To determine your valuation, or the total worth of your company, you first need to consider how much equity (ownership percentage) you're comfortable offering to investors. Investors are essentially buying a stake in your company's future success, and the amount of equity you offer reflects their share of ownership.

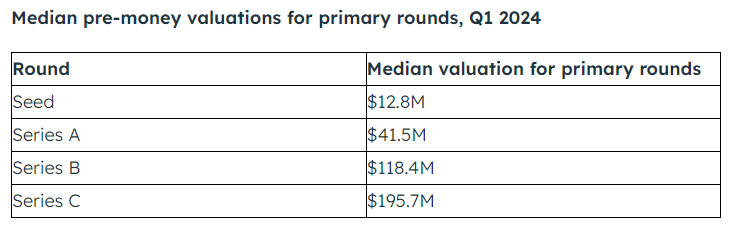

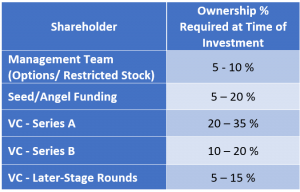

Most startup fundraising rounds involve offering investors 10% to 20% ownership. (Below is a more detailed breakdown by funding stage. Source: IPOhub.)

This is a balancing act between ownership for investors, the money you need, and your valuation. If you need to raise $2M and the maximum valuation on the market is $10M for similar startups, you can give less than 20% only if you have a higher valuation or a smaller round.

Be ready to explore different scenarios, especially after the first calls with investors. You need to offer enough equity to entice investors to support your venture. But you’ll also want to retain a significant ownership stake to maintain control over your company's direction and be the majority shareholder (which means you need to own 51% or more equity).

Step 6: Estimate your target valuation range

Investors will only hand over money if they understand the potential return on investment (ROI). So, how much is your company worth?

There's no one-size-fits-all answer. Here are some ways to estimate your valuation range.

Talk with investors

On the first five to 10 calls with investors, ask them honestly what they think is an average valuation for a company like yours. You can also talk with your current investors and fellow startup founders who have recently raised funds.

Consider revenue multiples

Look at similar startups in your sector and fundraising stage that have recently raised funding. What revenue multiples (a valuation metric based on a company's revenue) did they achieve? You can then apply a similar multiplier to your annual revenue to get your valuation.

Use the Rule of 40

The Rule of 40 is a principle proposed by venture capital firm Andreessen Horowitz (a16z) to help evaluate a company's health and valuation.

To calculate your startup's valuation using this rule, determine your annual revenue growth rate and earnings before interest, taxes, depreciation, and amortization (EBITDA) margin, then add these two metrics together to get your Rule of 40 score. A higher score typically means a higher valuation multiple. Multiply your annual revenue by this multiple to estimate your company’s valuation.

For example, suppose your growth rate is 30% and your EBITDA margin is 10%. In that case, your Rule of 40 score is 40%, which might translate to a revenue multiple of six times, giving a company with $5M in annual revenue an estimated valuation of $30M.

Remember, market conditions play a role. If the market sentiment is cautious, valuations may be lower. Use sources like Carta or OpenView, in addition to your financial projections and industry research, to define a target valuation range and track VC fundraising trends.

Step 7: Prepare your data room

Preparing a data room for fundraising is about keeping things organized and straightforward.

Make sure to keep your data room focused on the most important documents: the pitch deck, legal documents, team structure, a product demo, your cap table, and a go-to-market strategy, including sales and marketing plans and financials (actual monthly P&L for previous periods, other KPIs for your stage, unit economics, etc.)

The structure of the data room depends on your stage. Later stages have much more data. Be ready to constantly update your data room during startup fundraising, adding more documents and calculations or updating your latest financial results. Send these updates to your investors during fundraising, along with any important news about the company, about once per week.

Your financials are crucial to success, so include a simple financial model. At the seed stage, avoid overly complex models; focus on critical metrics like MRR, expenses, and net profit/loss. Adding a small dashboard with a few graphs can help visualize these metrics and highlight discrepancies.

For your understanding, maintain a more detailed financial model to explore different scenarios and answer investor questions confidently. If investors ask you to provide more details, you can always share this model with them. The goal of the data room is to present a clear and comprehensive picture of your startup’s potential.

Step 8: Start raising money

Once your materials are ready, find investors who align with your industry, stage, and investment size. Tools like Crunchbase offer some fundraising services for startups and can help with this step. Talk with other founders to help train your pitch and ask for feedback and introductions to investors.

Here’s how to find the right investors using Crunchbase:

Sign in to Crunchbase. Create an account and subscribe to Crunchbase Pro for advanced search features.

On the homepage, click “Advanced” and select “Investors” to start your search.

To narrow down the list of investors, apply filters such as location, investment preferences, funding rounds, and industries.

Click on investor profiles for detailed information, including investment history, portfolio companies, and recent activity.

Save profiles and create a list of investors who match your criteria for easy access later.

Use the contact information provided on Crunchbase to contact investors. Tailor your message to each investor and follow up with a multistep outreach sequence.

Here’s a list of top investors for Pre-Seed, Seed, and Series A rounds (based on a Crunchbase search):

Name 👥 | Investor Type 💸 | Stages 🌱 | 2024 focus 🎯 |

New Enterprise Associates | Venture Capital | Pre-Seed, Seed, Series A, Series B, Growth Stage | All stages of health tech, technology, energy, education, and consumer startups |

Accel | Venture Capital | Pre-Seed, Seed, Series A, Series B, Growth Stage | Cybersecurity, enterprise software, and AI startups from France and the U.K., in particular. |

Sequoia Capital | Venture Capital | Pre-Seed, Seed, Series A, Series B, Growth Stage | Energy, finance, enterprise, healthcare, internet, and mobile sectors. |

Alumni Ventures | Angel Group, Micro VC, Venture Capital | Pre-Seed, Seed, Series A | AI, deep tech, growth, sports |

Bossanova Investimentos | Venture Capital | Pre-Seed, Seed, Series A | Insur-tech, financial services, health care |

Andreessen Horowitz | Venture Capital | Pre-Seed, Seed, Series A, Series B, Growth Stage | Seed to venture to growth-stage technology companies across AI, bio and healthcare, consumer, crypto, enterprise, fintech, games, infrastructure, and companies building toward American dynamism. |

IDG Capital | Private Equity Firm, Venture Capital | Pre-Seed, Series A, Series B, Growth Stage | TTM (Technology, Media, Communications), health care, consumer and entertainment, manufacturing, clean tech, energy |

SV Angel | Angel Group, Investment Bank, Venture Capital | Pre-Seed, Seed, Series A | Early-stage investments, particularly in technology and biotech startups |

FJ Labs | Micro VC, Venture Capital | Pre-Seed, Seed, Series A | Marketplaces and network-effect businesses |

Kleiner Perkins | Venture Capital | Pre-Seed, Seed, Series A, Series B, Growth Stage | AI, enterprise software, consumers, health care, fintech, and hard tech |

Bessemer Venture Partners | Venture Capital | Pre-Seed, Seed, Series A, Series B, Growth Stage | AI & ML, biotech, cloud, consumer, crypto, cybersecurity, data, deep tech, developer, fintech health care, marketplaces, vertical Software |

Conclusion

Startup fundraising is an ongoing process. Once you begin, you're indefinitely fundraising, as building connections with investors before you need funds is crucial. This continuous effort makes future rounds more strategic and, ultimately, easier. Keeping up-to-date on your milestones, fundraising needs, and data room will make the process less stressful and give you the confidence you need to secure funding.

Remember to leverage your existing network of startup founder colleagues, friends, family, and current investors to find new investors and tap into tools to help you research and connect with new investors.

Stay focused on your goals and learn from each investor interaction. The right investors aren’t just about the money; they should also share your vision and support your startup's growth. Choose investors you can work with long-term, as they will be invaluable partners in your journey.

WANT TO SECURE SUCCESSFUL FUNDING?

I CAN HELP ⬇️

I’ve developed a top-notch assessment called the Fundraising Success Accelerator.

You’ll Get:

A diagnostic of your company’s readiness across these 6 key areas critical for successful fundraising.

A roadmap to your fundraising goals with clear financial targets.

Specific recommendations you can take action on immediately to achieve results without guesswork.

A one-hour presentation with Q&A and a 40-60 page detailed report, written in an easy-to-read format designed for “non-finance people”.

To get started, send a DM to LinkedIn or an email to [email protected] with the subject “Fundraising Success Accelerator”.

Earn free gifts 🎁

You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

POLL TIME

How would you rate today's newsletter?

If you have specific suggestions or feedback, simply reply to this e-mail.

How can I help you?

Book a Growth Call: Looking to scale your company? Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Dive into 1:1 Coaching: Personalized coaching can make all the difference. Let's work together to navigate the complexities of finance and set you on the path to success. Click here to start your 1:1 coaching journey.

Sponsor an Issue of the Startup Finance: Want to reach a dedicated audience of founders & finance enthusiasts? Consider sponsoring a future issue of the Startup Finance. Contact me here for sponsorship details.

Leave a Testimonial: I would appreciate if you could leave a 5-star rating for this newsletter if you enjoyed it here.

Thanks so much for reading.

Aleksandar