Your Personal Board of Directors is here.

Being a leader is hard. And every day, there’s a ton of things you’d love advice on, but there’s no one to ask.

Enter Sidebar. A staggering 93% of users say Sidebar has been a game-changer in their professional path. Using their matching engine and a unique vetting process, Sidebar finds your people. Think of it like a personal board of directors. Sidebar’s small groups are led by world-class facilitators, so you’re never wasting time. Get the advice you need and get back to crushing your goals.

WELCOME TO ISSUE NO #019

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Hey {{first_name}} 👋, in the last issue, we discussed Why AI is reshaping FP&A, but today, we're diving into the top Burn Multiple uses You can't afford to ignore.

3 reasons why tracking burn multiple matters 🤟

Burn Multiple Stat of the Week 🔢

CFO Tool of the Week 📊

Latest Week Content Update 🆓

3 Reasons Why Tracking Burn Multiple Matters

It reveals your startup's financial efficiency

Are you spending money wisely?

Burn multiple, calculated as net burn divided by net new ARR, provides a clear picture of how efficiently your startup is using cash to generate revenue.

A lower burn multiple indicates more efficient growth, which is crucial for sustainable business development.

It helps identify overspending

Tracking your burn multiple quarterly rather than monthly gives a more accurate view of your financial health.

It helps you spot patterns and identify if your startup is burning cash faster than it's growing, which is a red flag for both management and investors.

It’s a valuable benchmark for investors

Investors pay close attention to burn multiple.

A low burn multiple signals that your startup is capital efficient and likely has achieved product-market fit.

These are key factors that investors look for when considering funding opportunities.

Burn Multiple Stat of the Week

1.7x

The median burn multiple for SaaS companies with $1-3M in ARR is 1.7x, meaning these companies typically burn $1.70 for every $1 in new ARR generated.

CFO Tool of the Week

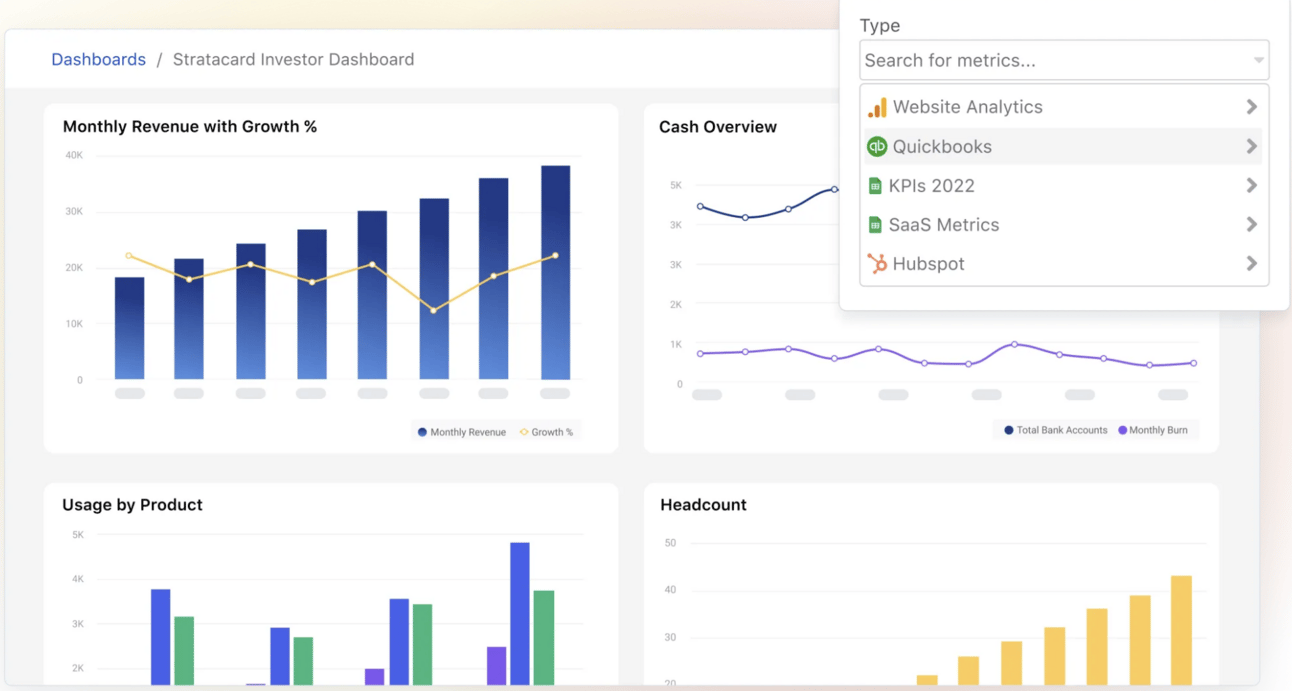

Visible is a platform designed to help startups efficiently manage investor relations by providing tools to track key metrics like burn multiple, ARR, and other financial performance indicators.

It offers:

KPI Tracking: Easily monitor important metrics like burn multiple and ARR in real time.

Investor Updates: Streamline communication with investors by sending regular updates that include key financial metrics and insights.

Custom Dashboards: Create customized dashboards to visualize your startup's financial health and share them with stakeholders.

What I like most about this tool is its ability to bring transparency and clarity to financial performance, making it easier for startups to communicate with investors and make informed decisions.

Latest week content update

Here is the latest week content which

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Here are 3 ways I can help you leverage AI in your financial processes:

1:1 FP&A Strategy Session: Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Promote yourself to 5,000+ subscribers by sponsoring my newsletter. Apply here.

Catch you in the next issue.

— Aleksandar Stojanovic