These daily stock trade alerts shouldn’t be free!

The stock market can be a rewarding opportunity to grow your wealth, but who has the time??

Full time jobs, kids, other commitments…with a packed schedule, nearly 150,000 people turn to Bullseye Trades to get free trade alerts sent directly to their phone.

World renowned trader, Jeff Bishop, dials in on his top trades, detailing his thoughts and game plan.

Instantly sent directly to your phone and email. Your access is just a click away!

WELCOME TO ISSUE NO #022

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Hey {{first_name}} 👋, in the last issue, we discussed Why AR Aging reports matter, but now, we are proceeding with Billings & Collections and today’s topic is:

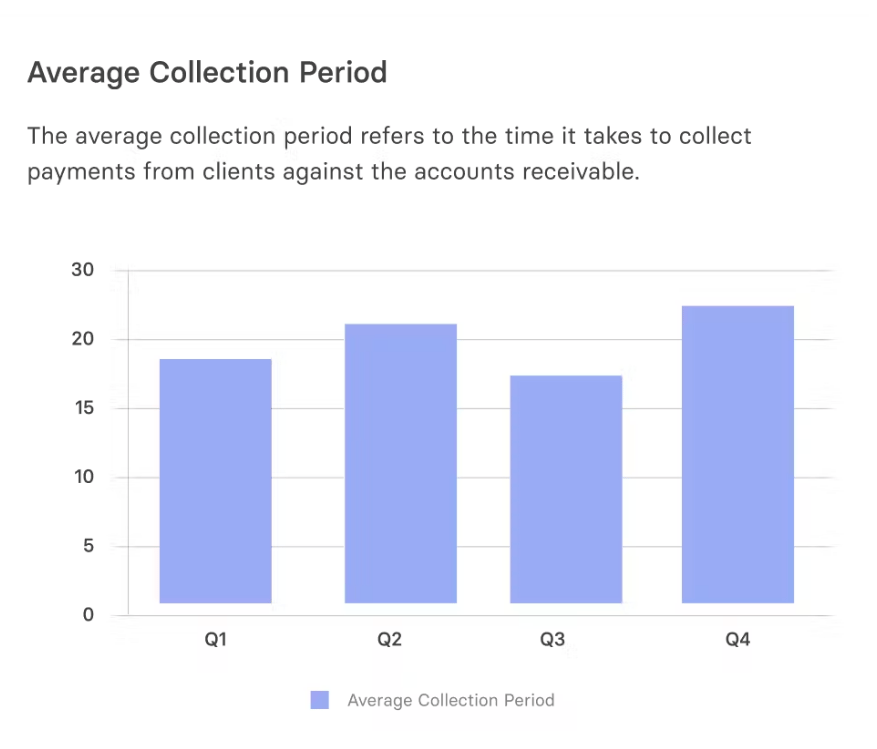

Average Collection Period

Is Your Average Collection Period Too Long? Here's How to Optimize It.

Newsletter highlights

3 reasons why tracking your average collection period matters 🤟

Average Collection Period Stat of the Week 🔢

My Tool of the Week 📊

Latest Week Content Update 🆓

3 Reasons Why Tracking Your Average Collection Period Matters

It impacts your company’s cash flow

A longer average collection period ties up your funds in receivables, making it difficult to pay vendors, employees, or reinvest in your business.

Monitoring this metric helps you spot potential cash flow issues before they become critical.

It reveals the efficiency of your credit policies

Tracking the average collection period provides insight into your credit terms and collection practices.

If it takes too long to collect payments, it might be time to tighten credit policies or adjust your billing process to ensure quicker payments.

It influences customer relationships

A prolonged collection period can indicate inefficiencies in your invoicing process or difficulties in customer payment behavior.

By improving your collection period, you strengthen your financial position and enhance relationships with clients by offering more predictable payment terms.

Average Collection Period Stat of the Week

91.25 Days

On average, it takes a company 91.25 days to collect payments after services are rendered. Tracking and optimizing this period is crucial for maintaining healthy cash flow.

This week’s shameless plug…

Just last week, I made a big announcement.

I launched The Financial Strategy Sessions!

What is it?

A flexible option to book a 60-minute power-hour session focused on your financial needs

A chance to dive deep into your business's financial strategy, forecasting, and planning

An opportunity to optimize your financial systems with personalized, expert advice

You can now book these sessions as standalone or as part of the 4-session CFO Program

Ready to elevate your financial strategy?

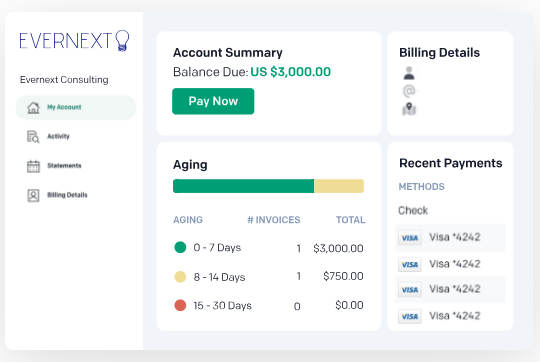

My Tool of the Week

Invoiced is an accounts receivable automation platform designed to streamline the billing process and reduce your average collection period.

It offers:

Automated Invoicing: Send out invoices automatically, reducing the time between project completion and payment requests.

Payment Reminders: Automate follow-ups and reminders to encourage prompt payments from customers.

Real-Time Tracking: Monitor payment statuses and outstanding receivables in real-time to quickly address delays.

What I like most about Invoiced is its focus on automating the entire invoicing and collection process, helping businesses shorten their average collection period and maintain a healthy cash flow.

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Here are 3 ways I can help you leverage AI in your financial processes:

Free Consultation: Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Promote yourself to 5,000+ subscribers by sponsoring my newsletter. Apply here.

Catch you in the next issue.

— Aleksandar Stojanovic