Learn how to launch and grow an affiliate program for SaaS

Launching an affiliate program for your SaaS business can be intimidating if you’re new to it, but it is pretty simple. Rewardful has boiled it down to three core principles in their free online course:

Principle 1: Make it simple for affiliates to earn money

Principle 2: Run your program like a professional

Principle 3: Build an affiliate recruitment system

By the end of the course, you'll have a clear picture of how affiliate marketing can work for your business.

WELCOME TO ISSUE NO #020

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Hey {{first_name}} 👋, in the last issue, we discussed Why tracking Burn Multiple matters, but starting from today, I am excited to announce a complete new in-depth series which will cover following building blocks:

Billings & Collections 💰

Bookings & Customers 👩👨

Cash Flow & Expense 💵

Headcount 🧑

Revenue, ARR and MRR 📈

Sales Performance 💹

To kick-off, we are starting with Billings & Collections and today’s topic is:

AR Turnover Ratio

Is Your AR Turnover Ratio Healthy? Master This Key Financial Metric.

3 reasons why tracking AR turnover matters 🤟

AR Turnover Stat of the Week 🔢

My Tool of the Week 📊

Latest Week Content Update 🆓

3 Reasons Why Tracking AR Turnover Matters

It reveals your company’s cash flow efficiency

The Accounts Receivable (AR) turnover ratio helps you understand how efficiently your company is collecting outstanding invoices.

A higher AR turnover ratio indicates that your credit sales are being converted into cash quickly, which is essential for maintaining healthy cash flow and ensuring your operations run smoothly.

It helps identify potential cash flow issues

Regularly tracking your AR turnover can help you spot inefficiencies in your collections process.

If your AR turnover is low, it might signal that your credit policies are too lenient or your collections process needs improvement, both of which can lead to cash flow problems.

It’s a valuable indicator for financial health

Investors and financial stakeholders pay close attention to AR turnover as it reflects the company’s ability to manage its receivables effectively.

A higher AR turnover ratio is often seen as a positive indicator of financial health, signaling that the company is efficiently managing its credit and collections processes.

AR Turnover Stat of the Week

12x

An AR turnover ratio of 12 means that, on average, a company collected its outstanding debts 12 times in a year, indicating efficient credit and collections processes.

My Tool of the Week

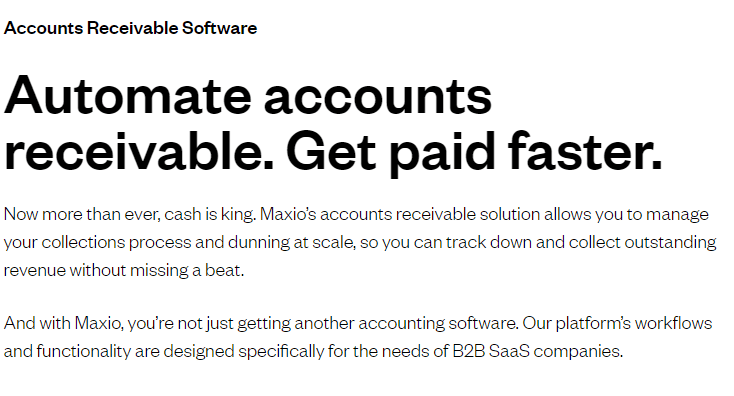

Maxio is a financial operations platform designed to help companies optimize their accounts receivable turnover ratio and improve overall financial health.

It offers:

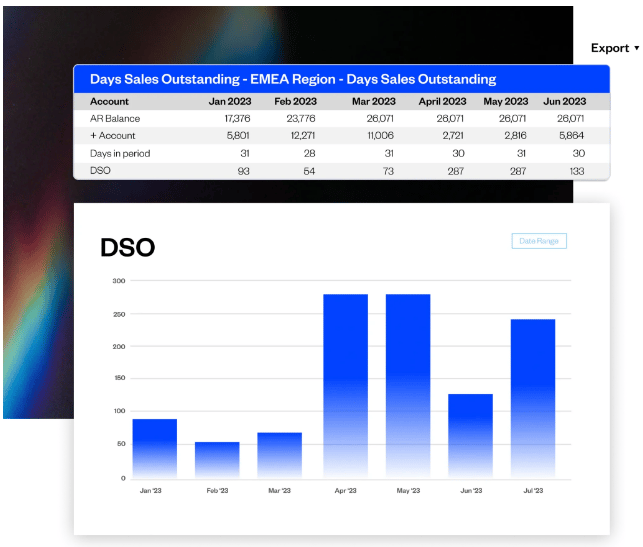

Automated Invoicing and Collections: Streamline your invoicing process and automate collections to reduce DSO (Days Sales Outstanding) and enhance AR turnover.

Real-Time AR Tracking: Monitor your AR turnover ratio and related metrics in real time, allowing for quick adjustments to your collections strategy.

Comprehensive Reporting: Generate detailed reports on AR performance, providing insights that help you optimize credit policies and improve cash flow.

What I like most about Maxio is its ability to provide a complete view of your AR processes, helping finance teams to track, manage, and optimize AR turnover efficiently.

Latest week content update

Here is the latest week content which

Earn free gifts 🎁

{{first_name}} You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

Here are 3 ways I can help you leverage AI in your financial processes:

1:1 FP&A Strategy Session: Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Promote yourself to 5,000+ subscribers by sponsoring my newsletter. Apply here.

Catch you in the next issue.

— Aleksandar Stojanovic