👋 Welcome to the 74 new Founders & Finance Pro’s who joined us since last Saturday. If you haven’t subscribed, join 5,000 people getting smarter.

Put your money to work in a high-yield cash account with up to $2M in FDIC† insurance through program banks.

Get started today, with as little as $10.

WELCOME TO ISSUE NO #011

Consulting | Shop | Website | Newsletter | Speaking | Training

📆 Today’s Rundown

Happy Saturday! This week I’ve prepared a one big TOPIC and one freebie just for you.

TL;DR

Quick Ratio: Short-term liquidity, assets versus liabilities, keep it 1+

CAC: Cost per customer, marketing spend divided by newbies.

CAC Payback Period: Time to recover acquisition cost, aim 12 months

CLV: Revenue from a customer, lifetime value trumps acquisition.

CAC Ratio: Lifetime value vs. acquisition cost, 3:1 is gold.

I’ve partnered with my friend David Fortin to bring you an incredible opportunity to excel your career & your business with AI. More details below.

👇 Watch: Learn how to build a Cash Runway Dashboard by Josh

Just a heads-up - this email’s sprinkled with affiliate links. If you fancy exploring them, it’s a great way to back this newsletter!

FREEBIE

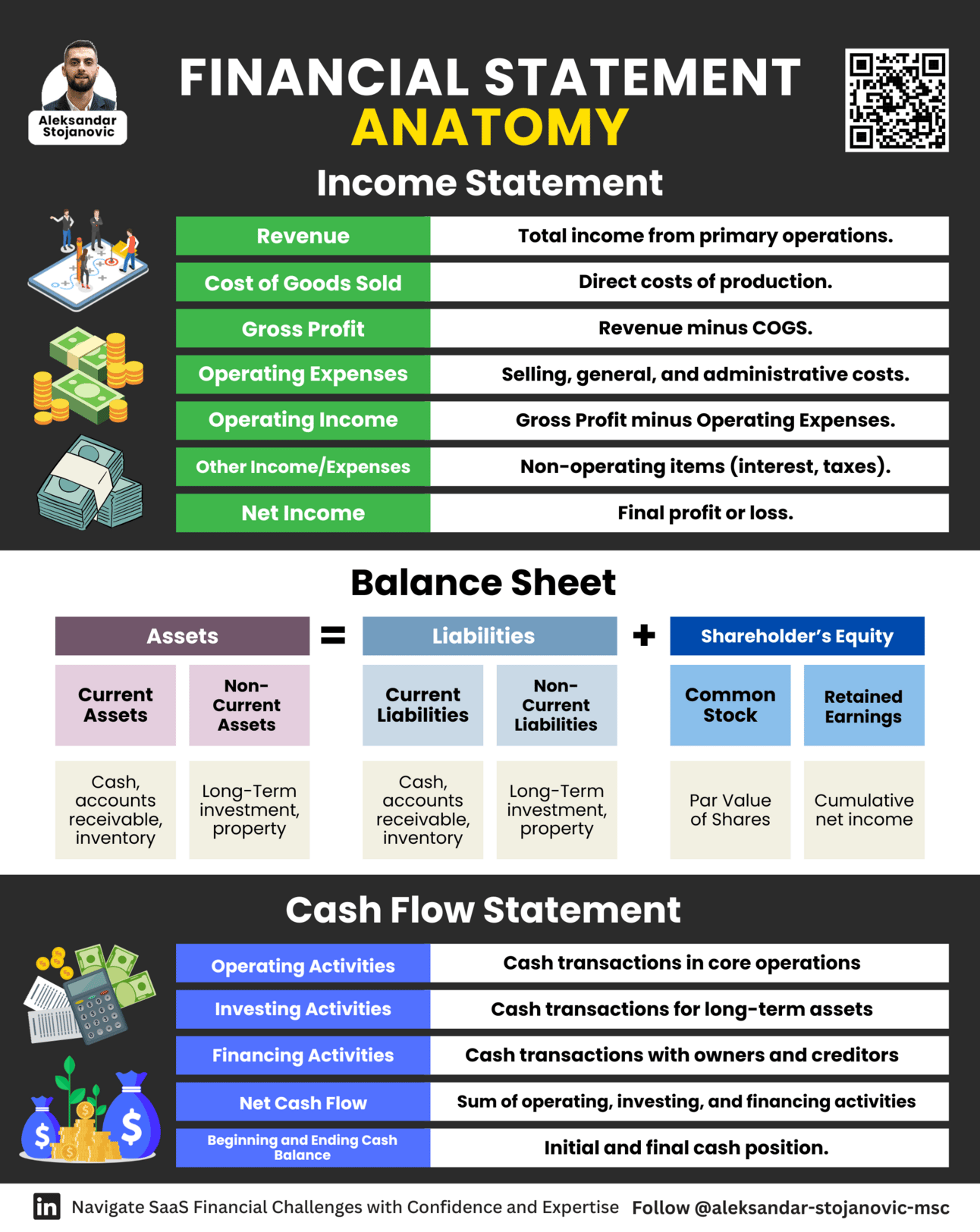

Financial Statements Anatomy

Most people struggle with financial statements.

But if you avoid these 5 common pitfalls,

I guarantee you'll understand better your company's financial health.

Ever dreamt of crafting stories, sharing insights, or building a community around your passions?

Now’s the perfect time to start your own newsletter. Whether it's about tech trends, personal journeys, or niche hobbies, your voice matters.

Bring your ideas to life and join a thriving community of creators.

Who knows where your words might take you?

5 Finance KPIs for SaaS Companies

Disclaimer: Opinions are my own. Not investment advice. Do your own research.

Finance KPIs measure your SaaS company’s financial performance by tracking its revenue, expenses, profits, sales, and any other financial outcomes.

Let’s get into the KPIs most relevant to your finance team.

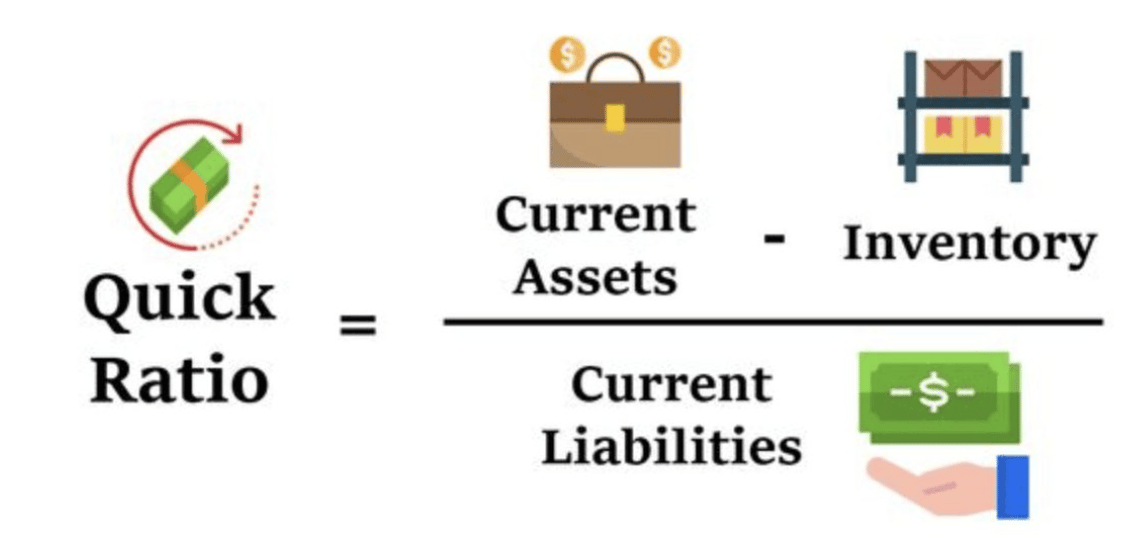

1. Quick Ratio

The Quick Ratio, also known as an acid test ratio, measures a business’ ability to pay off its short-term liabilities with assets that can be quickly converted into cash. These assets include cash, marketable securities, and any other assets that can be turned into cash in 90 days or less.

Why Should you Track Quick Ratio?

The Quick Ratio is a good indicator of your business’ short-term fiscal health and its ability to survive situations that cause temporary cash-flow problems. Tracking changes in your Quick Ratio over time can help you uncover potential problems and fix them before they escalate.

This metric also tells lenders and investors whether your company is financially stable enough to lend money.

How to Calculate Quick Ratio?

To calculate your Quick Ratio, simply divide your current assets (minus your inventory) by your current liabilities. Inventory is excluded from this calculation because it’s not as “liquid” as your other assets.

For example, say your current assets for this month are $12,000 and $2,000 of this is from inventory. Let’s also assume your liabilities for this month are $5,000. Given this information, your Quick Ratio will be:

Quick Ratio = ($12,000-2,000)/5,000= $10,000/$5,000 = 2.00

A Quick Ratio of 2 means that you have twice as many quick assets as current liabilities, which is indicative of strong financial health.

What Tools can be Used to Calculate and Track Quick Ratio?

Your balance sheet has all the information you need to find out your Quick Ratio. If you need help calculating it, consider using tools like online templates or accounting software.

Tips for Tracking and Driving Growth with this KPI

Use the Quick Ratio in conjunction with other financial metrics like the current ratio or cash ratio to get a more complete picture of your company’s liquidity.

What is a Good Quick Ratio?

A Quick Ratio equal to or greater than 1.00 indicates that your organization is safe, meaning it has enough quick assets to pay its short-term financial obligations. A business with a Quick Ratio below 1.00 may struggle to pay off its debts and have to sell off some long-term assets to meet its financial obligations.

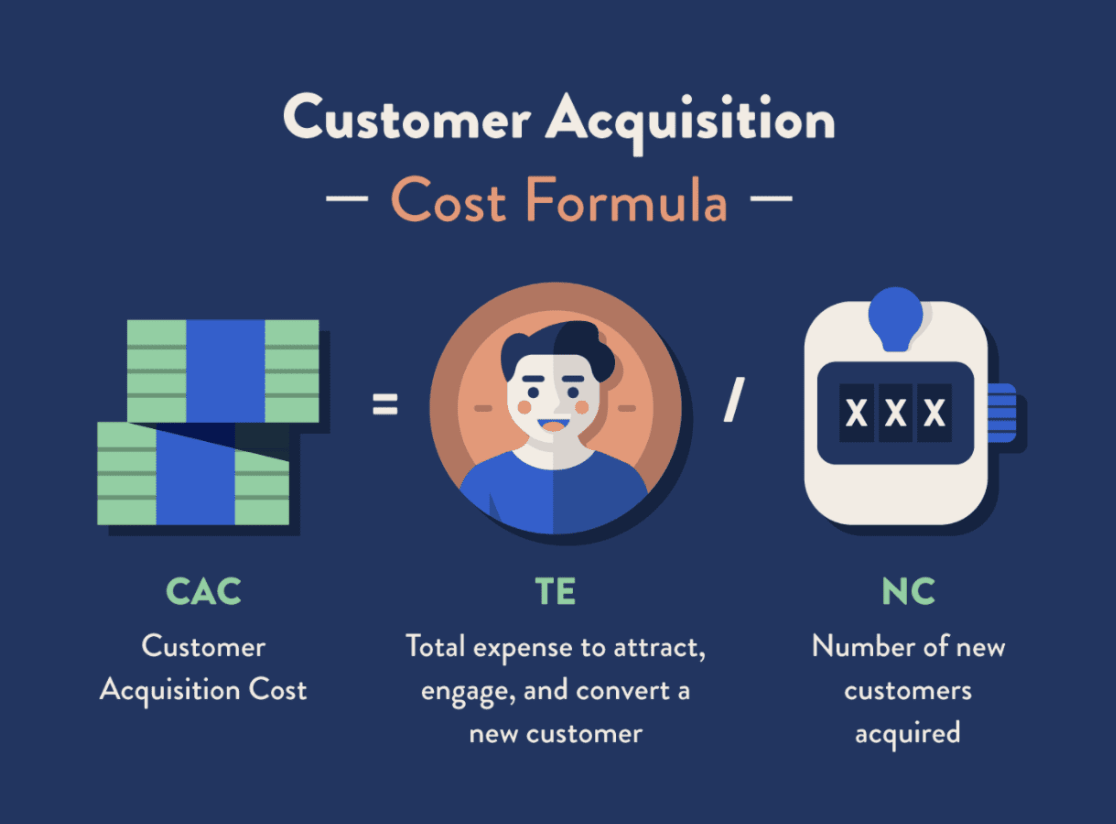

2. Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) measures how much money you need to spend to acquire a new customer.

Why Should you Track Customer Acquisition Cost?

CAC is a key metric in SaaS. By comparing how much money you spend on attracting customers against the revenue earned from that customer in their lifetime, you’re able to determine your company’s profitability and efficiency.

Knowing your CAC also helps you determine your marketing spend and drives other strategic business decisions.

How to Calculate Customer Acquisition Cost

CAC is calculated by adding up the total marketing and sales expenses for a certain period and dividing it by the number of new customers acquired during that period. These expenses are any costs you incur to attract and convert a new customer. This includes anything from PPC campaigns to the salaries of the marketing and sales team.

Suppose your sales and marketing spend to acquire new customers this quarter was $30,000. Additionally, you gained 200 new customers during this quarter. As a result, your CAC is:

CAC = $30,000/300 = $150

Your company spends $150 to acquire new customers.

Tips for Tracking and Driving Growth with this KPI

To gain more insights from your CAC, it’s useful to break it down and segment it. CAC is commonly divided into Blended and Paid:

Blended CAC accounts for all types of marketing channels

Paid CAC only accounts for paid channels.

Segregating these costs helps you figure out whether your paid channels are profitable.

CAC by itself gives you an incomplete picture. CAC should be analyzed alongside the Customer Lifetime Value (CLV), a metric we’ll look at shortly. Your CAC should never be higher than your LTV.

3. CAC Payback Period

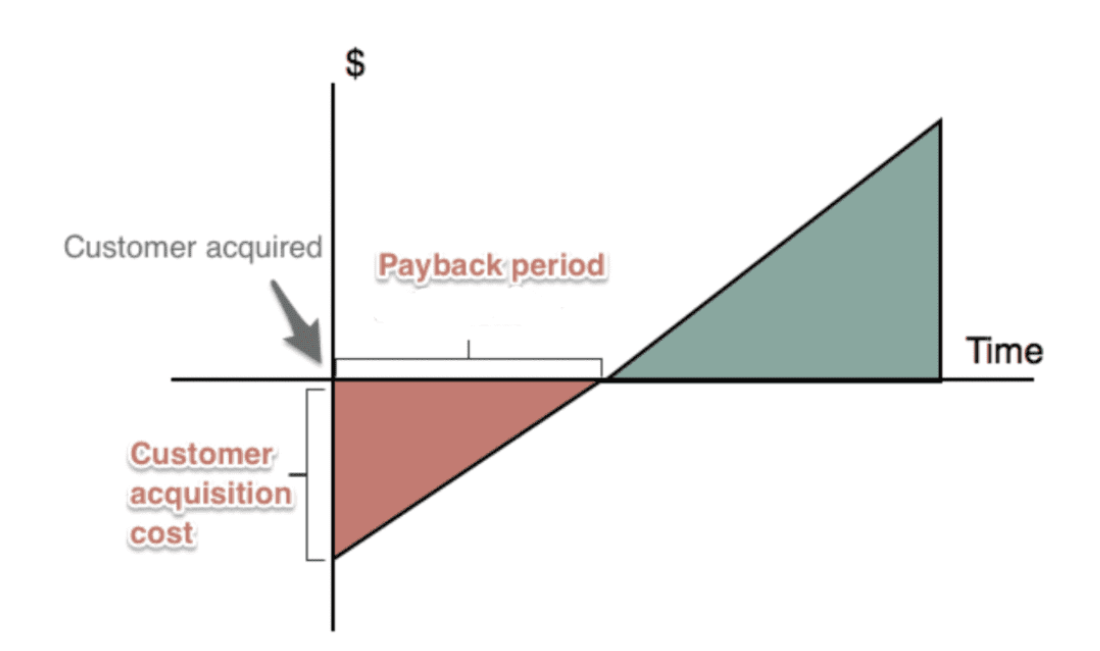

This SaaS KPI measures how much time it takes to earn back the money invested in acquiring new customers. Here’s how it works:

Over time, the customer’s subscription payments gradually pay back the initial cost until you break even. The green area is the period where the customer’s payments start contributing to the company’s growth.

Why Should you Track CAC Payback Period?

The CAC Payback Period reveals how efficient and sustainable your business’ acquisition model is. The shorter the payback period, the faster your company can recover acquisition costs and grow.

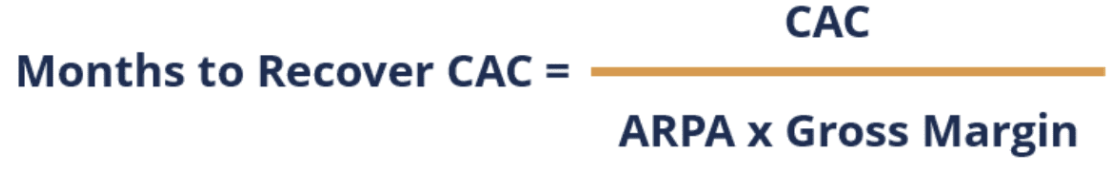

How to Calculate CAC Payback Period

To calculate your CAC Payback Period, you’ll need to know three other key metrics:

Customer Acquisition Cost (CAC)

Average Revenue Per Account (ARPA)

Gross Margin percent

The ARPA and Gross Margin give you the revenue generated from a customer over a period of time. Your payback period is then calculated as follows:

For example, let’s assume it costs you $150 to gain a new customer. This customer’s monthly subscription generates $15/month. Your CAC Payback Period is:

CAC Payback Period = $150/15 = 10 months

It will take 10 months to recover the money invested to acquire them.

The industry benchmark for SaaS startups to recover CAC is 12 months or less. The shorter your payback period, the better. High-performing SaaS companies break even in 5-6 months.

Aim to keep this metric low and focus on ways to reduce it.

What Tools Can be Used to Calculate and Track CAC Payback Period?

Our plug-n-play excel template for SaaS financial model is free, easy to use, and helps you track your CAC Payback Period. Click here for a complete walkthrough of the template.

Tips for Tracking and Driving Growth with this KPI

Similar to CAC, you can segment your CAC Payback Period to gain more actionable insights from it.

By comparing the payback period of customers acquired through different marketing channels, you can use this information to invest in your most profitable channels.

4. Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) lets you know much revenue you can generate from a customer throughout your relationship with them before they leave (churn).

Why Should you Track Customer Lifetime Value (CLV)

CLV is a key metric because it guides your company’s critical marketing and sales strategies, such as customer acquisition and retention, cross-selling, upselling, and support. For example, it helps you decide how much to spend on acquiring new customers.

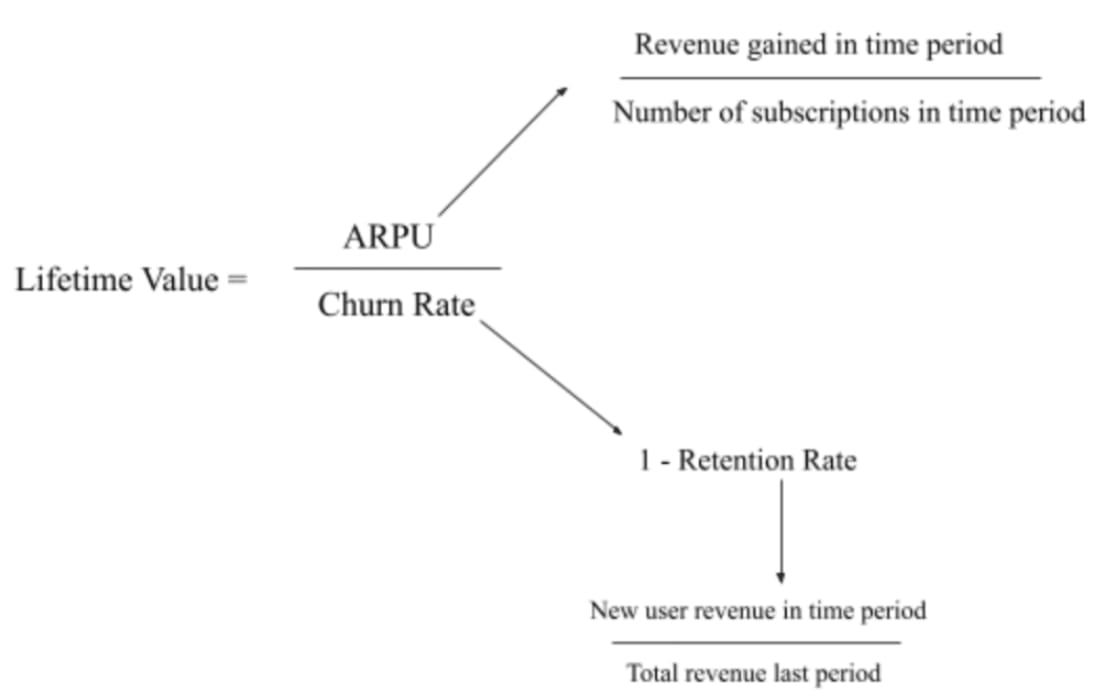

How to Calculate Customer Lifetime Value (CLV)

The formula used for calculating CLV is:

Alternatively, you can also calculate CLV using the formula LTV = ARPU*Gross Margin *Average duration of customer contracts.

Let’s look at a quick example using the churn rate:

Assume your average user pays $50/month for a subscription. This month, you lost 5 customers out of 100 so your churn rate is 5%. Given this information, the CLV is:

CLV = $50/ 0.05 = $1,000

Tips for Tracking and Driving Growth with this KPI

Use CLV insights to acquire and hold on to high-value customers, and move low-tier customers to a higher-tier plan or subscription.

Tracking CLV helps you predict future demand and inventory.

How to Interpret Customer Lifetime Value (CLV)

CLV should be looked at in relation to your CAC, as you’ll see in the next metric. According to David Skok, to ensure your SaaS business is profitable, your CLV should be 3x your CAC.

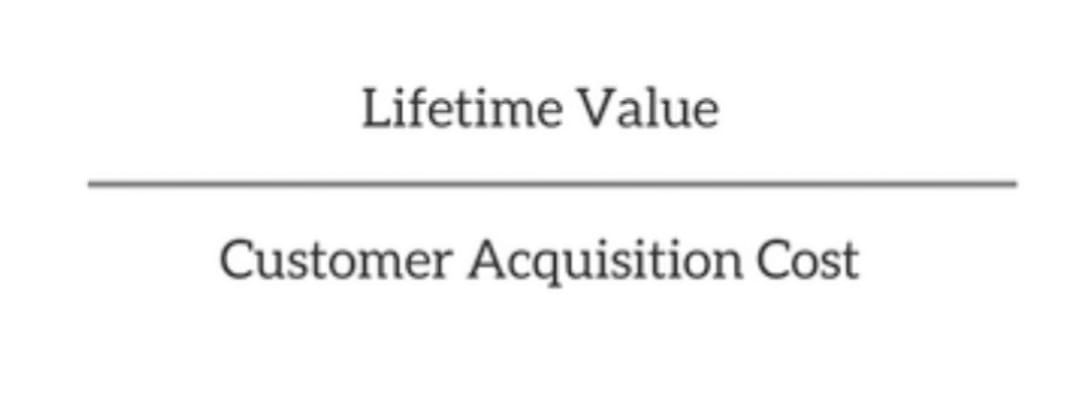

5. CAC:LTV Ratio

The CAC: LTV ratio (“Customer Acquisition Cost: Lifetime Value) measures the relationship between the value a customer brings to your business and the cost of acquiring them.

Why Should you Track CAC:LTV Ratio?

CAC:LTV is one of the most important financial SaaS metrics for several reasons:

It helps you determine how much money you should be spending on acquiring customers and what types of customers to acquire.

It’s a critical metric investors look at

It helps you measure your return on sales and marketing efforts and reveals how sustainable your business model is

How to Calculate CAC:LTV Ratio

As the name suggests, the ratio is found by dividing the lifetime value by the customer acquisition cost.

A company with a customer lifetime value of $500 that spends $100 to acquire new customers will have the following CAC:LTV ratio:

CAC:LTV Ratio = 500/100 = 5:1

A (very good) ratio of 5:1 tells us this company makes 5x of what it would spend on acquiring customers.

Tips for Tracking and Driving Growth with this KPI

The CAC:LTV Ratio indicates how valuable your company is. Optimize your ratio by:

Focusing on the right channels to attract customers

Experimenting with pricing

Reducing your sales complexity

What Is A Good CAC:LTV Ratio?

As we already touched on, a good rule of thumb for the CAC:LTV Ratio is 3:1. A high ratio means you’re keeping your customers happy for an extended time and you’re not spending much acquiring them. If your ratio is low, look for ways to reduce your CAC or increase your LTV.

Unlock Your Potential: Master Microsoft Copilot Today!

Enhance Your Skills. The course that helps business professionals go from AI beginners to AI proficient so they can enhance their productivity.

Discover tips, tricks and features you didn't even know existed. This course is designed to help complete ai rookie save hours in their professional tasks.

Earn free gifts 🎁

You can get free stuff for referring friends & family to my newsletter 👇

50 referrals - Cash Flow Models Bundle 💰

10 referrals - SaaS Financial Model 📊

{{rp_personalized_text}}

Copy & Paste this link: {{rp_refer_url}}

FEEDBACK

How would you rate today's newsletter?

If you have specific suggestions or feedback, simply reply to this e-mail.

How can I help you?

Book a Growth Call: Looking to scale your company? Book a growth call with me and let's strategize on how to propel your company to new heights. Click here to schedule your session.

Reserve me for a Keynote Speaking: Elevate your events with my keynote speaking arrangements. Whether it's a conference, seminar, webinar or corporate event, I'm here to engage and inspire your audience with insights into strategic finance. Reach out here to discuss your event.

Dive into 1:1 Coaching: Personalized coaching can make all the difference. Let's work together to navigate the complexities of finance and set you on the path to success. Click here to start your 1:1 coaching journey.

Sponsor an Issue of the Startup Finance: Want to reach a dedicated audience of founders & finance enthusiasts? Consider sponsoring a future issue of the Startup Finance. Contact me here for sponsorship details.

Leave a Testimonial: I would appreciate if you could leave a 5-star rating for this newsletter if you enjoyed it here.

Thanks so much for reading.

Aleksandar